Working Capital

Working capital is a measure of a company's liquidity, specifically its short-term financial health and whether it has the cash on hand for normal business operations.

The number is the difference between a company's current assets and current liabilities:

Working capital = current assets - current liabilities

Working capital is an important number when assessing a company's financial health, as a positive number is a good sign while a negative number can be a sign of a failing business.

Of note, working capital is also known as net working capital.

Below is an overview of working capital including how to calculate it, how it's used, working capital management and its ratios, and the factors that affect working capital.

What is working capital?

Working capital is a measure of a company's liquidity. Essentially, it assesses short-term financial health since it shows whether a company has enough cash to keep running.

For reference, liquidity refers to the conversion of assets into cash. Being liquid means that a company can cover the difference between the cash going in and the cash going out of the business, or, in other terms, the difference between its current assets and liabilities.

In accounting, the word “current” refers to assets and liabilities that can be sold or used in less than one year. This means they are considered cash or cash-like.

Below is a table with examples of current assets and liabilities:

| Cash | Debts |

| Raw materials or supplies | Accounts payable |

| Inventory or finished goods | Interest |

| Prepaid expenses | Taxes |

| Unpaid bills or accounts receivable | Accrued expenses |

| Short-term investments | Utilities and rent |

If a company's short-term assets are not enough to cover its short-term liabilities, then the company may be forced to sell a long-term asset in order to cover those liabilities. An example of a long-term asset would be machinery, buildings, etc.

In this case, the company would be considered illiquid. An illiquid company may need to raise more capital, such as by taking on more debt, or even declare bankruptcy. Companies in this position are not considered to be healthy.

This is what the working capital number helps companies assess. In short, it answers the question “how financially healthy is this business?” by determining short-term liquidity.

It's also part of a business strategy called working capital management, which employs three ratios to ensure a good balance between staying liquid and using resources efficiently. These will be covered in a later section.

Summary The working capital calculation helps companies understand the difference between their current assets and liabilities. It shows whether they have enough cash to keep running, assessing their liquidity and short-term financial health.

How is working capital calculated?

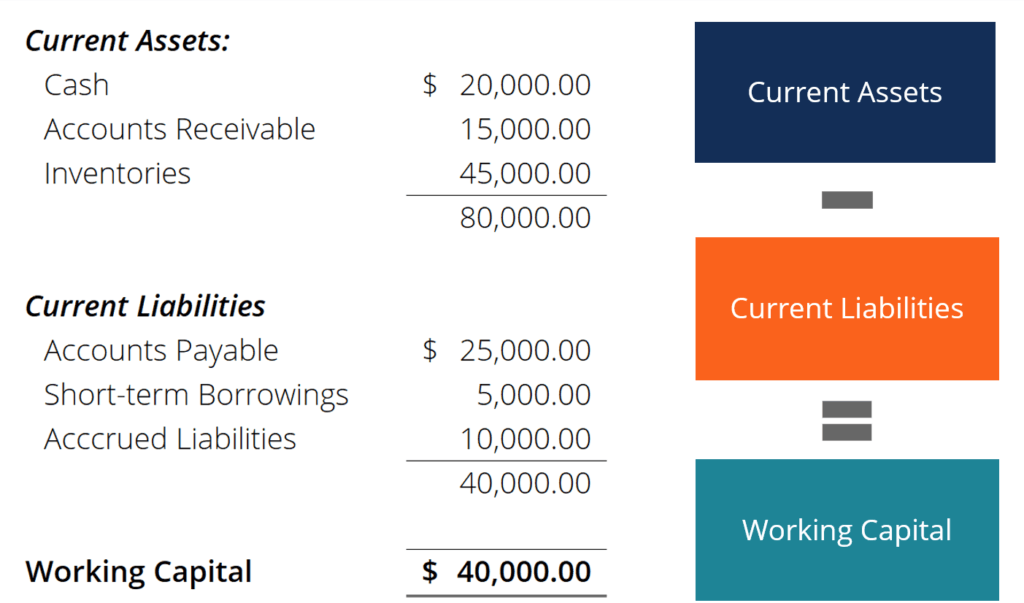

Working capital is the difference between a company's current assets and current liabilities.

Both of these numbers can be found on the balance sheet , which is listed on a company's 10-Q or 10-K filing, its investor relations page, or on financial data sites like Stock Analysis .

Here's how to calculate working capital:

Example calculation

Below is an example calculation of working capital for a clothing manufacturer.

The company has USD $500,000 in current assets, consisting of cash, fabric, and finished clothes. Its current liabilities are USD $350,000, consisting of bills and short-term debts.

Here is the calculation:

$500,000 - $350,000 = $150,000

This means the company has $150,000 available, indicating it has the ability to fund its short-term obligations. This is a sign of a healthy business.

If the numbers were reversed and the company had $500,000 in liabilities and $350,000 in assets — meaning its working capital was -$150,000 — it would fail to meet its short-term obligations and would need to seek additional financing or potentially trigger a credit default.

Working capital is a bit like having cash or savings in a short-term account versus having money tied up in a house or other asset that you wouldn't be planning to sell right away.

The more surplus a business has, the more cushion it has in times of economic uncertainty. On the other hand, too much surplus cash is not an efficient use of capital. It's a balance.

Where to find working capital listed

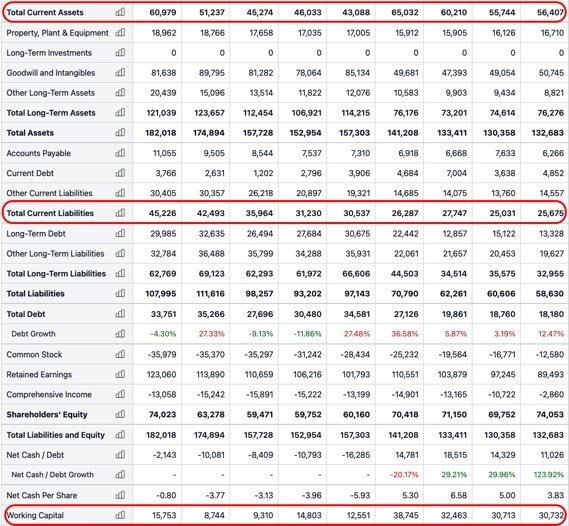

For publicly traded companies, you likely won't need to calculate working capital yourself.

For example, below is a screenshot of Johnson and Johnson's ( JNJ ) balance sheet data. Total current assets and total current liabilities are both listed, as well as working capital, which is already calculated for you.

Source: Johnson & Johnson's Balance Sheet

Summary Working capital is calculated by deducting current liabilities from current assets. The numbers needed for the calculation can be found on a company's balance sheet or on stock data websites.

Why is working capital useful?

Working capital is a number that's useful for both companies and investors to know, as it shows whether or not a company is liquid. It can also provide insights into efficiencies.

It's a measure of liquidity and financial health

If a company has a positive working capital number, this means its current assets are greater than its current liabilities. Put simply, this indicates that the company would be able to access enough cash to cover its short-term needs.

A company in this position is financially strong and well-positioned to go forward.

If, on the other hand, a company has a negative working capital number, then it does not have the capacity to cover all of its short-term debts or cash needs using its current assets.

A company in this situation would need to sell a larger asset, such as equipment or property, if they suddenly needed to pay a debt. Or, they could consider raising funds by taking on more debt. In the worst-case scenario, the company may need to declare bankruptcy.

Such companies are considered to have poor liquidity, meaning they're financially weak.

It's an indicator of operational efficiency

Working capital is also an indicator of a company's operational efficiency, as companies that have high amounts of working capital can decide to use this to grow.

This would clearly not be an option for companies with negative working capital, since they can't even cover their short-term debts.

However, keep in mind that like all financial indicators, working capital should be used alongside other metrics to get a full picture of a company's financial situation.

Summary Working capital measures short-term financial health and operational efficiency. In short, a positive working capital number is a sign of financial strength, while a negative number is a sign of poor health, though it's still important to consider the larger picture.

Working capital management and financial ratios

Working capital management is a business strategy that companies use to monitor how efficiently they are using their current assets and liabilities.

Working capital management is focused on maintaining a sufficient cash flow that can meet short-term liabilities like operating costs or debt obligations. This is done by monitoring several ratios that are designed to ensure the company is using its resources efficiently.

The basic idea is to have enough cash or cash-like assets — that is, those that can be converted into cash in fewer than 12 months — to cover any short-term liabilities.

This focus also keeps the amount of time required to convert assets to a minimum, which is known as the net operating cycle or the cash conversion cycle.

Working capital management relies on the efficient management of the cash conversion cycle, which is the relationship of key activities that can be viewed through financial ratios.

The ratios are the current ratio, the collection ratio, and the inventory turnover ratio.

Ultimately, these ratios are a measurement of how well working capital is being managed.

The current ratio

The current ratio shows how well a company is able to meet short-term debts. It's similar to the working capital calculation, as the same inputs are used, but it results in a ratio instead.

Here is the formula:

Current ratio = current assets / current liabilities

If the current ratio is below one, then it's likely a company will struggle to cover its current liabilities, such as paying its suppliers or short-term debts.

As noted earlier, this is a sign of poor financial health and means a company may need to sell a long-term asset, take on debt, or even declare bankruptcy.

Nevertheless, it's important to note that sometimes a ratio below one is normal, though further investigation is required.

Most companies aim for a ratio between 1.2–2.0 since this shows the company has good liquidity but is not wasting money by holding on to cash or cash-like instruments that are not generating revenue. Companies with ratios above two are likely to be doing just that ( 1 ).

The collection ratio

The collection ratio looks at how well a company manages to receive payments from customers using who pay with credit.

The ratio will be lower if the company is good at getting its customers to pay within the required period but higher if not.

Effectively, this ratio looks at how easily a company can turn its accounts receivable into cash.

Collection ratio = (days in accounting period x average outstanding accounts receivables) / total net credit sales in the period

The inventory turnover ratio

The inventory turnover ratio looks at how well a company manages its inventory, which is another aspect of managing cash and cash-like assets that goes into working capital.

The balance here is between having enough inventory to meet customer needs and not miss out on any sales, versus having too much money tied up in inventory.

Inventory turnover ratio = cost of goods sold / average balance sheet inventory

If a company has a low ratio relative to its peers, then it's not selling many products from its inventory and its inventory management is likely inefficient.

If the ratio is high relative to peers, then the company is running its inventory very tightly and could end up missing out on sales if it doesn't have enough products to cover demand.

Summary Working capital management is a close analysis of assets and liabilities that focuses on maintaining sufficient cash flow to cover short-term liabilities. It relies on a few key ratios: the current ratio, the collection ratio, and the inventory turnover ratio.

Factors that affect working capital

Working capital needs vary by industry and business model. Below is more information about specific sectors as well as additional factors that play a role.

Working capital norms vary by sector

Different industries have varying norms around what's considered an ideal number.

The key consideration here is the production cycle, since this is how long it will take the company to generate liquid assets from its operations.

Some sectors, like manufacturing, have longer production cycles, meaning it takes more time to generate cash from their core operations. These industries will have higher working capital requirements since they have fewer options for covering urgent liquidity needs.

Sectors with quicker turnover, such as most service industries, will not need as much working capital because they can raise short-term funds more easily due to the nature of the business.

Other factors that affect working capital needs

In understanding whether a company or sector will have higher working capital needs, it's useful to look at the business model and operating cycle.

The operating cycle is the number of days between when a company has to spend money on inventory versus when it receives money from the sale of that inventory.

How and when companies have to fund regular expenses is also relevant.

For example, consider retail. Retail tends to have long operating cycles since companies have to buy their stock long before they can sell it. This is especially true for physical stores.

Generally, stores don't sell their goods on day one of operating. Their business model, therefore, requires them to have higher working capital in the form of inventory. This is because they can't rely on making sales if they suddenly need to pay a debt.

Retail also has periods of high sales that need to be prepared for, such as holidays. During these periods, working capital will need to be even more substantial.

Contrast this with many tech industries, which may not even sell a physical product. In these cases, working capital is lower because there are no large inventories being stored.

An example of this would be an online software company where customers download the product after purchase. Sometimes, a company like this can even get away with having a negative working capital.

Additionally, if this company was small, it could likely survive for quite some time on a very small amount of working capital. This is something to keep in mind when evaluating start-ups.

As a company grows, its overhead costs will increase. Therefore, it's important to keep an eye on the numbers as a company grows larger and its working capital needs increase. Beginning a startup is one thing, but managing it through growth is another altogether.

Summary What's considered a good or normal number for working capital varies by industry, the length of the operating cycle, timelines, company size, and other factors.

The takeaway

Working capital reveals a company's financial health by assessing how liquid it is when it comes to assets and liabilities.

Companies with a positive working capital are in a good position to be able to cover their current liabilities using their current assets.

The opposite is true for companies with negative working capital, who may need to seek financing, such as by taking on debt or selling stock, or declare bankruptcy.

Additionally, companies with solid working capital are in a good position to pay unexpected short-term costs, as well as to grow their business.

What's considered a good or normal working capital number varies by industry, as it's closely related to the business model and operating cycle — that is, when cash goes in and out.

Working capital is also part of working capital management, which is a way for companies to make sure they are sufficiently liquid yet still using cash and assets wisely.

Keep in mind that while working capital is highly useful when assessing potential investments, it should always be considered in context and alongside other metrics.

To best assess a company's financials, it's important to have a well-rounded view.

Related Terms

- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

Working Capital

Step-by-Step Guide to Understanding Working Capital in Accounting

View Accounting Course

What is Working Capital?

Working Capital is a fundamental accounting metric that measures a company’s short-term financial health by subtracting current liabilities from current assets on the balance sheet.

The working capital metric is relied upon by practitioners to serve as a critical indicator of liquidity risk and operational efficiency of a particular business.

Conceptually, working capital represents the financial resources necessary to meet day-to-day obligations and maintain the operational cycle of a company (i.e. reinvestment activity).

Given a positive working capital balance, the underlying company is implied to have enough current assets to offset the burden of meeting short-term liabilities coming due within twelve months.

- Working capital is a critical measure of a company’s short-term liquidity and operational efficiency, calculated by subtracting current liabilities from current assets,

- Analyzing the historical trends in working capital and comparing them to industry benchmarks can provide critical insights into a company’s operating performance.

- A positive working capital balance indicates sufficient cash to meet short-term obligations, implying financial stability and operational flexibility.

- A negative working capital balance raises concerns about the company’s ability to meet short-term obligations, potentially signaling financial distress and the need for immediate liquidity.

- While high levels of working capital provide a safety cushion, excessive levels can indicate inefficient asset management, such as excess inventory or poor receivables collection.

- Effective working capital management is critical to maintaining financial resilience, supporting growth initiatives, and optimizing operational performance in a competitive business environment.

Table of Contents

How to Calculate Working Capital

Working capital formula, working capital example, what are the components of working capital, working capital ratio formula, how to calculate working capital ratio, what is change in working capital (nwc), how to reconcile change in nwc on cash flow statement, net working capital (nwc) formula, working capital vs. net working capital (nwc): what is the difference, what is working capital peg, how to calculate working capital cycle, working capital metrics formula chart, how to optimize working capital management, working capital calculator — excel template, working capital calculation example.

In financial accounting, working capital is a specific subset of balance sheet items and is calculated by subtracting current liabilities from current assets .

Working capital is a core component of effective financial management, which is directly tied to a company’s operational efficiency and long-term viability.

In simple terms, working capital is the net difference between a company’s current assets and current liabilities and reflects its liquidity (or the cash on hand under a hypothetical liquidation).

Therefore, working capital serves as a critical indicator of a company’s short-term liquidity position and its ability to meet immediate financial obligations.

- Current Assets ➝ Current assets can be converted into cash within one year (<12 months), such as cash and cash equivalents, marketable securities, short-term investments, accounts receivable, inventory, and prepaid expenses.

- Current Liabilities ➝ Current liabilities are short-term obligations that are due within one year (<12 months), like accounts payable, short-term loans, the current portion of long-term debt, and accrued expenses.

The working capital of a company—the difference between operating assets and operating liabilities—is used to fund day-to-day operations and meet short-term obligations.

Generally speaking, the working capital metric is a form of comparative analysis where a company’s resources with positive economic value are compared to its short-term obligations.

The management of capital is critical to the business cycle, including the acquisition of raw materials, production of goods or services, sales on credit (i.e. customer paid using credit rather than cash ), and collection of the owed payment in cash.

In the event of any unexpected occurrence that disrupts the workflow cycle, such as the unanticipated need to produce more inventory in excess of the original plan—or the delay in the issuance of an owed payment of invoices beyond 30 days—an increase in working capital can be required to sustain its operating activities.

The formula to calculate working capital—at its simplest—equals the difference between current assets and current liabilities.

- Current Assets ➝ Current assets are converted into cash within a year (<12 months).

- Current Liabilities ➝ Current liabilities are near-term obligations due within a year (<12 months)

The current assets and current liabilities are each recorded on the balance sheet of a company, as illustrated by the 10-Q filing of Alphabet, Inc (Q1-24).

The current assets section is listed in order of liquidity, whereby the most liquid assets are recorded at the top of the section.

On the other hand, the current liabilities section is listed in order of the due date, in which the near-term obligations that must be met sooner are recorded first — albeit, not all publicly-traded companies abide by that reporting convention.

Note, only the operating current assets and operating current liabilities are highlighted in the screenshot, which we’ll soon elaborate on.

Working Capital on Balance Sheet Example (Source: Alphabet Q1-2024 )

Working capital is composed of current assets and current liabilities.

- Current Assets ➝ Current assets are expected to be converted into cash within twelve months (or one year), which is the time frame deemed the standard operating cycle.

- Current Liabilities ➝ Likewise, current liabilities are anticipated to be paid within a company’s twelve months.

The most common examples of current assets on the balance sheet are each defined in the subsequent table:

| Current Assets | Description |

|---|---|

On the other hand, the most common current liabilities are described in the following chart:

| Current Liabilities | Description |

|---|---|

The working capital ratio is a method of analyzing the financial state of a company by measuring its current assets as a proportion of its current liabilities rather than as an integer.

The formula to calculate the working capital ratio divides a company’s current assets by its current liabilities.

- Positive Working Capital Ratio ➝ Therefore, if a company exhibits a working capital ratio in excess of 1.0x, that implies net positive working capital.

- Negative Working Capital Ratio ➝ Conversely, the company has net negative working capital if the working capital ratio is below 1.0x.

One common financial ratio used to measure working capital is the current ratio , a metric designed to provide a measure of a company’s liquidity risk.

The current ratio is calculated by dividing a company’s current assets by its current liabilities.

The current ratio is of limited utility without context. Still, a general rule of thumb is that a current ratio of > 1.0x implies a company is more liquid because it has liquid assets that can presumably be converted into cash and will more than cover the upcoming short-term liabilities.

The quick ratio—or “acid test ratio”—is a closely related metric that isolates only the most liquid assets, such as cash and receivables , to gauge liquidity risk.

Why? The benefit of neglecting inventory and other non-current assets is that liquidating inventory may not be simple or desirable, so the quick ratio ignores those as a source of short-term liquidity.

On the subject of modeling working capital in a financial model , the primary challenge is determining the operating drivers that must be attached to each working capital line item.

The working capital items are fundamentally tied to the core operating performance, and forecasting working capital is simply a process of mechanically linking these relationships on the three financial statements (e.g. income statement , cash flow statement, and balance sheet).

The balance sheet organizes assets and liabilities in order of liquidity (i.e. current vs long-term), making it easy to identify and calculate working capital (current assets less current liabilities).

The change in net working capital (NWC) is tracked on the cash from operations (CFO) section of the cash flow statement (CFS)—or statement of cash flows—which reconciles net income for non-cash items like depreciation and amortization (D&A) and changes in working capital.

The cash flow from operating activities section aims to identify the cash impact of all assets and liabilities tied to operations, not solely current assets and liabilities.

To further complicate matters, the changes in working capital section of the cash flow statement (CFS) commingles current and long-term operating assets and liabilities.

Therefore, the section boxed in red on the statement of cash flows of Alphabet (NASDAQ: GOOGL) could contain changes in long-term operating assets and liabilities.

Change in Working Capital Section on Cash Flow Statement (Source: Alphabet Q1-24 )

The balance sheet organizes items based on liquidity, but the cash flow statement organizes items based on their nature.

The three sections of a cash flow statement under the indirect method are as follows.

- Cash from Operating Activities (CFO) ➝ Net Income, Depreciation and Amortization (D&A), Change in Working Capital

- Cash from Investing Activities (CFI) ➝ Capital Expenditure (Capex), Sale of PP&E

- Cash from Financing Activities (CFF) ➝ Debt Issuance, Equity Issuance

As it so happens, most current assets and liabilities are related to operating activities (inventory, accounts receivable, accounts payable, accrued expenses, etc.).

Those line items are thus consolidated in the operating activities section of the cash flow statement (CFS) under “changes in operating assets and liabilities.”

Because most of the working capital items are clustered in operating activities, finance professionals generally refer to the “changes in operating assets and liabilities” section of the cash flow statement as the “changes in working capital” section.

However, this can be confusing since not all current assets and liabilities are tied to operations. For example, items such as marketable securities and short-term debt are not tied to operations and are included in investing and financing activities instead.

In practice, cash and other short-term investments, such as treasury bills (T-Bills), marketable securities, commercial paper, and any interest-bearing debt, like loans and corporate bonds , are excluded when calculating net working capital (NWC).

Why? Cash and cash equivalents, as well as debt and interest-bearing securities, are non-operational items that do not directly contribute toward generating revenue (i.e. not part of the core operations of a company’s business model).

The net working capital (NWC) calculation only includes operating current assets like accounts receivable (A/R) and inventory, as well as operating current liabilities such as accounts payable and accrued expenses.

The net working capital (NWC) metric is different from the traditional working capital metric because non-operating current assets and current liabilities are excluded from the calculation.

- Cash and Cash Equivalents ➝ The net working capital (NWC) metric must omit cash and cash equivalents, such as marketable securities and short-term investments. Cash and cash equivalents are not part of the core operations of a company’s revenue model and are closer to investing activities (i.e. interest income).

- Short-Term Debt and Interest-Bearing Securities ➝ The net working capital (NWC) metric must exclude short-term borrowings, the portion of long-term debt due within twelve months (<12), and any interest-bearing securities. Likewise, debt and interest-bearing securities are also excluded from net working capital (NWC) because such instruments are closer to financing activities (i.e. interest expense).

The difference between working capital and net working capital (NWC) are as follows:

One nuance to calculating the net working capital (NWC) of a particular company is the minimum cash balance—or required cash—which ties into the working capital peg in the context of mergers and acquisitions ( M&A ).

In short, the working capital peg is the minimum baseline amount of working capital required in order for a business to continue operating per usual post-closing of the transaction, agreed upon by the buyer and seller in an M&A transaction.

There is much negotiation that occurs between the buyer and seller in M&A, including conditional clauses, surrounding the topic of the working capital peg (or “target”).

In fact, certain practitioners include the minimum cash balance in the net working capital (NWC) metric, based on the notion that the company must retain some cash on hand to continue running its business, which is referred to as “required cash.”

Therefore, the working capital peg is set based on the implied cash on hand required to run a business post-closing and projected as a percentage of revenue (or the sum of a fixed amount of cash).

Cash, accounts receivable, inventories, and accounts payable are often discussed together because they represent the moving parts involved in a company’s operating cycle (a fancy term that describes the time it takes, from start to finish, to buy or producing inventory, selling it, and collecting cash for it).

For example, if it takes an appliance retailer 35 days on average to sell inventory and another 28 days on average to collect the cash post-sale, the operating cycle is 63 days.

- Operating Cycle = 35 days + 28 days = 63 days

In other words, there are 63 days between when cash was invested in the process and when cash was returned to the company.

Conceptually, the operating cycle is the number of days that it takes between when a company initially puts up cash to get (or make) stuff and getting the cash back out after you sell the stuff.

Since companies often purchase inventory on credit, a related concept is the working capital cycle—often referred to as the “net operating cycle” or “cash conversion cycle”—which factors in credit purchases.

The working capital cycle formula is days inventory outstanding (DIO) plus days sales outstanding (DSO) , subtracted by days payable outstanding (DPO) .

In our example, if the retailer purchased the inventory on credit with 30-day terms, it had to put up the cash 33 days before it was collected. Here, the cash conversion cycle is 33 days, which is pretty straightforward.

- Cash Conversion Cycle (CCC) = 35 days + 28 days – 30 days = 33 days

The following chart lists the most common working capital metrics:

| Working Capital Metric | Formula |

|---|---|

For many firms, the analysis and management of the operating cycle is the key to healthy operations.

For example, imagine the appliance retailer ordered too much inventory – its cash will be tied up and unavailable for spending on other things (such as fixed assets and salaries). Moreover, it will need larger warehouses, will have to pay for unnecessary storage, and will have no space to house other inventory.

Imagine that in addition to buying too much inventory, the retailer is lenient with payment terms to its own customers (perhaps to stand out from the competition). This extends the time cash is tied up and adds a layer of uncertainty and risk around collection.

Suppose an appliance retailer mitigates these issues by paying for the inventory on credit (often necessary as the retailer only gets cash once it sells the inventory).

Cash is no longer tied up, but effective working capital management is even more important since the retailer may be forced to discount more aggressively (lowering margins or even taking a loss) to move inventory to meet vendor payments and escape facing penalties.

Taken together, this process represents the operating cycle (also called the cash conversion cycle).

Companies with significant working capital considerations must carefully and actively manage working capital to avoid inefficiencies and possible liquidity problems.

In our example, a perfect storm could look like this:

- Poor Working Capital Management ➝ Retailer bought a lot of inventory on credit with short repayment terms

- Economic Downturn ➝ The economy is contracting, and economic growth is slowing down, so customers are not paying as quickly as expected.

- Fluctuations in Market Demand ➝ The demand for the retailer’s product offerings changes, and some inventory flies off the shelves while other inventory isn’t selling.

In this perfect storm, the retailer doesn’t have the funds to replenish the inventory flying off the shelves because it hasn’t collected enough cash from customers.

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Excel Template | File Download Form

By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

While our hypothetical appliance retailer appears to require significant working capital investments (translation: It has cash tied up in inventory and receivables for 33 days on average), Noodles & Co, for example, has a very short operating cycle.

We can see that Noodles & Co has a short cash conversion cycle (<3 days).

On average, Noodles needs approximately 30 days to convert inventory to cash, and Noodles buys inventory on credit and has about 30 days to pay.

Hence, the company exhibits a negative working capital balance with a relatively limited need for short-term liquidity.

The suppliers, who haven’t yet been paid, are unwilling to provide additional credit or demand even less favorable terms.

In this case, the retailer may draw on their revolver, tap other debt, or even be forced to liquidate assets. The risk is that when working capital is sufficiently mismanaged, seeking last-minute sources of liquidity may be costly, deleterious to the business, or, in the worst-case scenario, undoable.

While each component—inventory, accounts receivable, and accounts payable—is important individually, collectively, the items comprise the operating cycle for a business and thus must be analyzed both together and individually.

Working capital as a ratio is meaningful when compared alongside activity ratios, the operating cycle, and the cash conversion cycle over time and against a company’s peers.

Put together, managers and investors can gain critical insights into a business’s short-term liquidity and operations.

In closing, we’ll summarize the key takeaways we’ve described from the presentation of working capital on the financial statements:

- While the textbook definition of working capital is current assets less current liabilities, finance professionals refer to the subset of working capital tied to operating activities as simply working capital.

- The balance sheet working capital items include operating and non-operating assets and liabilities, whereas the “changes in working capital” section of the cash flow statement only includes operating assets and liabilities.

- The cash flow statement, informally named the “changes in working capital” section, will include some non-current assets and liabilities (and thus excluded from the textbook definition of working capital) as long as they are associated with operations.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

- Google+

- 100+ Excel Financial Modeling Shortcuts You Need to Know

- The Ultimate Guide to Financial Modeling Best Practices and Conventions

- What is Investment Banking?

- Essential Reading for your Investment Banking Interview

Oh and in the second footnote: is it “$2.95mm/60 months” or “$2.95mm/59 months” ? Because you write “divided by 59 months”, but you divide by 60 months in your calculation. Maybe there is something I did not grasp?

Many thanks

Yohann: The text should read $2.95 million / 60 days. This is simply an accrual accounting quirk (an arcane quirk but simple accrual accounting). The company would recognize $49,167 ($2.95 million divided by 60 months) even though it will only pay for 59 months (since the first month’s rent is … Read more »

This is great adivce!

This is a very good article. Thank you for sharing. I look forward to publishing more such works. There are not many such articles in this field.

Hey I think I’ve spotted 3 typos: (1) “The benefit of ignoring inventory and other *non-current* assets is that liquidating inventory may not be simple or desirable…” –> should read: “and other *current* assets” ? (2) “Adding to the confusion is that the ‘changes in operating *activities* and liabilities’…” –> … Read more »

1. Yes, this should read other “current” assets. 2. Yes, this should read operating “assets” not activities. 3. Yes, this applies to my response to your second question above.

how do we record working capital in the financial statements e.g I borrowed 200,000.00 Short term long to pay salaries and other expenses.

Hi, Khumo, In that case, your short term debt would be credited (increase by) $200K, and your cash debited (increase by) $200K. Then your cash would be credited (decrease by) $200K, and your retained earnings debited (decrease by) $200K by way of expense, which lowers net income and thus lowers … Read more »

You article is very valuable for me. Hoping to read more. Thank you.

Thanks for your feedback, Oliver, and we are glad it was helpful!

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO.

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- Search Search Please fill out this field.

What Is Working Capital?

Understanding working capital.

- Limitations

Special Considerations

The bottom line.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Working Capital: Formula, Components, and Limitations

Learn about company liquidity, operational efficiency, and short-term health

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

Working capital, also known as net working capital (NWC), is the difference between a company’s current assets —like cash, accounts receivable/customers’ unpaid bills, and inventories of raw materials and finished goods—and its current liabilities , such as accounts payable and debts. It's a commonly used measurement to gauge the short-term financial health and efficiency of an organization.

Key Takeaways

- Working capital, also called net working capital (NWC), is the difference between a company’s current assets and current liabilities.

- It measures a company’s liquidity and short-term financial health, indicating the ability to fund operations and respond to financial stress or opportunities.

- Negative working capital occurs when current liabilities exceed current assets, suggesting potential liquidity issues.

- Positive working capital shows a company can support ongoing operations and invest in future growth.

- High working capital isn’t always a good thing. It might indicate that the business has too much inventory, is not investing its excess cash, or is not taking advantage of low-cost debt opportunities.

Investopedia / Yurle Villegas

Working capital is calculated from the assets and liabilities on a corporate balance sheet , focusing on immediate debts and the most liquid assets. Calculating working capital provides insight into a company's short-term liquidity and efficiency. A company with positive working capital generally has the potential to invest in growth and expansion. But if current assets don't exceed current liabilities, the company has negative working capital, and may face difficulties in growth, paying back creditors, or even avoiding bankruptcy.

In corporate finance, "current" refers to a time period of one year or less. Current assets are those that can be converted into cash within 12 months, while current liabilities are obligations that must be paid within the same timeframe.

The amount of working capital needed varies by industry, company size, and risk profile. Industries with longer production cycles require higher working capital due to slower inventory turnover. Alternatively, bigger retail companies interacting with numerous customers daily, can generate short-term funds quickly and often need lower working capital.

Working Capital Formula

To calculate working capital , subtract a company's current liabilities from its current assets. Both figures can be found in public companies' publicly disclosed financial statements, though this information may not be readily available for private companies.

Working Capital = Current Assets – Current Liabilities

Working capital is often expressed as a dollar figure. For example, if a company has $100,000 in current assets and $30,000 in current liabilities, it has $70,000 of working capital. This means the company has $70,000 at its disposal in the short term if it needs to raise money for any reason.

A business can either have positive or negative working capital:

- Positive working capital : When this calculation is positive, it indicates that the company's current assets exceed its current liabilities, as in the above example. The company has more than enough resources to cover its short-term debt and some leftover cash if all current assets are liquidated to pay this debt.

- Negative working capital : When the calculation is negative, the company's current assets are insufficient to cover its current liabilities. This is a warning sign that the company has more short-term debt than short-term resources. It typically indicates poor short-term health, low liquidity, and potential problems in paying its debt obligations.

It's worth noting that while negative working capital isn't always bad and can depend on the specific business and its lifecycle stage, prolonged negative working capital can be problematic.

Components of Working Capital

Working capital consists of current assets and current liabilities. A company's balance sheet contains all working capital components, though it may not need all the elements discussed below. For example, a service company that doesn't carry inventory will simply not factor inventory into its working capital calculation.

Current Assets

Current assets are economic benefits that the company expects to receive within the next 12 months. The company has a claim or right to receive the financial benefit, and calculating working capital poses the hypothetical situation of liquidating all items below into cash.

- Cash and cash equivalents : All of the company's money on hand, including foreign investments and low-risk, short-term investments like money market accounts

- Inventory : Unsold goods, including raw materials, work-in-progress, and finished goods not yet sold

- Accounts receivable : Claims to cash for items sold on credit, net of any allowance for doubtful payments

- Notes receivable : Claims to cash from other agreements, usually documented with a signed agreement

- Prepaid expenses : The value for expenses paid in advance, which, while hard to liquidate, still carry short-term value

- Others : Any other short-term asset. For example, some companies may recognize a short-term deferred tax asset that reduces a future liability.

Current Liabilities

Current liabilities encompass all debts a company owes or will owe within the next 12 months. The overarching goal of working capital is to understand whether a company can cover all of these debts with the short-term assets it already has on hand.

- Accounts payable : Unpaid vendor invoices for supplies, raw materials, utilities, property taxes, rent, or any other operating expense owed. Credit terms on invoices are often net 30 days, capturing nearly all invoices.

- Wages payable : Unpaid salaries and wages for staff members. Depending on payroll timing, this typically accrues up to one month's worth of wages.

- Current portion of long-term debt : Short-term payments related to long-term debt. Only the upcoming 12 months' payments are included in working capital calculations.

- Accrued tax payable : Obligations to government bodies, including accruals for tax obligations not due for months but payable within the next 12 months

- Dividend payable : Authorized payments to shareholders. While a company may decline future dividend payments, it must fulfill obligations on already authorized dividends.

- Unearned revenue : Capital received in advance of completing work. If a company fails to complete a job, it may need to return this capital to the client.

Theresa Chiechi © Investopedia, 2019

Limitations of Working Capital

Working capital can be very insightful in determining a company's short-term health. However, some downsides to the calculation can make the metric sometimes misleading. Here are four limitations of working capital:

- Changing values : Working capital is always changing. If a company is fully operating, several—if not most—current asset and current liability accounts will likely change. Therefore, by the time financial information is accumulated, it's likely that the company's working capital position has already changed.

- Nature of assets : Working capital fails to consider the specific types of underlying accounts. For example, a company with positive working capital but whose current assets are entirely in accounts receivable may face liquidity issues if customers delay payments.

- Asset devaluation : On a similar note, assets can quickly become devalued. This may happen due to factors beyond the company's control, such as customer bankruptcy affecting accounts receivable or inventory becoming obsolete or stolen. Physical cash is also at risk of theft, impacting working capital.

- Unknown debt : Working capital calculations assume all debt obligations are accounted for. In fast-paced environments or during mergers, missed agreements or incorrectly processed invoices can skew the accuracy of working capital figures.

Most major new projects, like expanding production or entering into new markets, often require an upfront investment , reducing immediate cash flow. Therefore, companies needing extra capital or using working capital inefficiently can boost cash flow by negotiating better terms with suppliers and customers.

Companies can forecast future working capital by predicting sales, manufacturing, and operations. Forecasting helps estimate how these elements will impact current assets and liabilities.

On the other hand, high working capital isn’t always a good thing . It might indicate that the business has too much inventory or isn't investing excess cash. Alternatively, it could mean a company fails to leverage the benefits of low-interest or no-interest loans .

Another financial metric, the current ratio , measures the ratio of current assets to current liabilities. Unlike working capital, it uses different accounts in its calculation and reports the relationship as a percentage rather than a dollar amount.

Example of Working Capital

As of March 2024, Microsoft (MSFT) reported $147 billion of total current assets, which included cash, cash equivalents, short-term investments, accounts receivable, inventory, and other current assets.

The company also reported $118.5 billion of current liabilities, which comprise accounts payable, current portions of long-term debts, accrued compensation, short-term income taxes, short-term unearned revenue , and other current liabilities.

Therefore, as of March 2024, Microsoft's working capital metric was approximately $28.5 billion. If Microsoft were to liquidate all short-term assets and extinguish all short-term debts, it would have almost $30 billion remaining cash.

How Do You Calculate Working Capital?

Working capital is calculated by taking a company’s current assets and deducting current liabilities. For instance, if a company has current assets of $100,000 and current liabilities of $80,000, then its working capital would be $20,000. Common examples of current assets include cash, accounts receivable, and inventory . Examples of current liabilities include accounts payable, short-term debt payments, or the current portion of deferred revenue .

Why Is Working Capital Important?

Working capital is crucial for businesses to remain solvent. Even a profitable business can face bankruptcy if it lacks the cash to pay its bills. For example, if a company has $1 million in cash from retained earnings and invests it all at once, it might not have enough current assets to cover its current liabilities.

Is Negative Working Capital Bad?

Generally, yes, if a company's current liabilities exceed its current assets. This indicates the company lacks the short-term resources to pay its debts and must find ways to meet its short-term obligations. However, a short period of negative working capital may not be an issue depending on the company's stage in its business life cycle and its ability to generate cash quickly.

How Can a Company Improve Its Working Capital?

A company can improve its working capital by increasing current assets and reducing short-term debts. To boost current assets, it can save cash, build inventory reserves, prepay expenses for discounts, and carefully extend credit to minimize bad debts. To reduce short-term debts, a company can avoid unnecessary debt, secure favorable credit terms, and manage spending efficiently.

Working capital is critical to gauge a company's short-term health, liquidity, and operational efficiency. You calculate working capital by subtracting current liabilities from current assets, providing insight into a company's ability to meet its short-term obligations and fund ongoing operations.

Positive working capital generally means a company has enough resources to pay its short-term debts and invest in growth and expansion. Conversely, negative working capital indicates potential cash flow problems, which might require creative financial solutions to meet obligations.

Working capital is a useful measure to track. Still, it's important to look at the types of assets and liabilities and the company's industry and business stage to get a more complete picture of its finances.

Purdue University. " Working Capital: What Is It and Do You Have Enough? "

Cornell Law School, Legal Information Institute. " Current Asset ."

Microsoft. " Earnings Release FY 24 Q3 ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-923217650-fc950a3a87ee4f4d88bddcaf949f617c.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Working Capital Formula

Working capital is equal to current assets minus current liabilities.

What is the Working Capital Formula?

The working capital formula is:

Working Capital = Current Assets – Current Liabilities

The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. It is a measure of a company’s short-term liquidity and is important for performing financial analysis, financial modeling , and managing cash flow .

Below is an example balance sheet used to calculate working capital.

Example calculation with the working capital formula

A company can increase its working capital by selling more of its products. If the price per unit of the product is $1000 and the cost per unit in inventory is $600, then the company’s working capital will increase by $400 for every unit sold, because either cash or accounts receivable will increase.

Comparing the working capital of a company against its competitors in the same industry can indicate its competitive position. If Company A has working capital of $40,000, while Companies B and C have $15,000 and $10,000, respectively, then Company A can spend more money to grow its business faster than its two competitors.

What is working capital?

Working capital is the difference between a company’s current assets and current liabilities . It is a financial measure, which calculates whether a company has enough liquid assets to pay its bills that will be due within a year. When a company has excess current assets, that amount can then be used to spend on its day-to-day operations.

Current assets , such as cash and equivalents , inventory, accounts receivable, and marketable securities, are resources a company owns that can be used up or converted into cash within a year.

Current liabilities are the amount of money a company owes, such as accounts payable , short-term loans, and accrued expenses, that are due for payment within a year.

Positive vs negative working capital

Having positive working capital can be a good sign of the short-term financial health of a company because it has enough liquid assets remaining to pay off short-term bills and to internally finance the growth of its business. With a working capital deficit, a company may have to borrow additional funds from a bank or turn to investment bankers to raise more money.

Negative working capital means assets aren’t being used effectively and a company may face a liquidity crisis. Even if a company has a lot invested in fixed assets, it will face financial and operating challenges if liabilities are due. This may lead to more borrowing, late payments to creditors and suppliers, and, as a result, a lower corporate credit rating for the company.

When negative working capital is ok

Depending on the type of business, companies can have negative working capital and still do well. Examples are grocery stores like Walmart or fast-food chains like McDonald’s that can generate cash very quickly due to high inventory turnover rates and by receiving payment from customers in a matter of a few days. These companies need little working capital being kept on hand, as they can generate more in short order.

Products that are bought from suppliers are immediately sold to customers before the company has to pay the vendor or supplier. In contrast, capital-intensive companies that manufacture heavy equipment and machinery usually can’t raise cash quickly, as they sell their products on a long-term payment basis. If they can’t sell fast enough, cash won’t be available immediately during tough financial times, so having adequate working capital is essential.

Learn more about a company’s Working Capital Cycle , and the timing of when cash comes in and out of the business.

Adjustments to the working capital formula

While the above formula and example are the most standard definition of working capital, there are other more focused definitions.

Examples of alternative formulas:

- Current Assets – Cash – Current Liabilities (excludes cash)

- Accounts Receivable + Inventory – Accounts Payable (this represents only the “core” accounts that make up working capital in the day-to-day operations of the business)

Download the free template

Enter your name and email in the form below and download the free template now!

Working Capital Template

Download the free Excel template now to advance your finance knowledge!

- First Name *

Working capital in financial modeling

We hope this guide to the working capital formula has been helpful. If you’d like more detail on how to calculate working capital in a financial model, please see our additional resources below.

- Free Fundamentals of Credit Course

- Financial Modeling Courses

- Financial Modeling Guide

- DCF Model Training

- How to Be a Great Financial Analyst

- See all financial modeling resources

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation . CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification . CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

- Careers

- CFI’s Most Popular Courses

- All CFI Resources

- Finance Terms

The Financial Modeling Certification

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- ACCA apprenticeships

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member communities

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Working capital management

- Study resources

- Financial Management (FM)

- Technical articles and topic explainers

This article covers the following syllabus areas:

- C1 – the nature, importance and elements of working capital

- C2a – explain the cash operating cycle and the role of accounts payable and accounts receivable’ and

- C2b – explain and apply relevant accounting ratios.

Working capital management is a core area of the syllabus and can form part, or the whole of, a 20-mark question in the exam, as well as being examined by objective test questions. It is, however, essential to study the whole syllabus and not only the specific areas covered in this article.

Importance of working capital management

Working capital represents the net current assets available for day-to-day operating activities. It is defined as current assets less current liabilities and, in exam questions, the components are usually inventory and trade receivables, trade payables and bank overdraft.

Many businesses that appear profitable are forced to cease trading due to an inability to meet short-term obligations when they fall due. Successful management of working capital is essential to remaining in business.

Working capital management requires great care due to potential interactions between its components. For example, extending the credit period offered to customers can lead to additional sales. However, the company’s cash position will fall due to the longer wait for customers to pay, potentially leading to the need for a bank overdraft. Interest on the overdraft may even exceed the profit arising from the additional sales, particularly if there is also an increase in the incidence of bad debts.

Working capital management is central to the effective management of a business because:

- current assets comprise the majority of the total assets of some companies

- shareholder wealth is more closely related to cash generation than accounting profits

- failure to control working capital, and hence to manage liquidity, is a major cause of corporate collapse.

Objectives of working capital management

One of the two key objectives of working capital management is to ensure liquidity. A business with insufficient working capital will be unable to meet obligations as they fall due, leading to late payments to employees, suppliers and other providers of credit. Late payments can result in lost employee loyalty, lost supplier discounts and a damaged credit rating. Non-payment (default) can lead to the compulsory liquidation of assets to repay creditors.

The other key objective is profitability. Funds tied up in working capital tend to earn little, or no, return. Hence, a company with a high level of working capital may fail to achieve the return on capital employed (Operating profit ÷ (Total equity and long-term liabilities)) expected by its investors.

Therefore, when determining the appropriate level of working capital there is a trade-off between liquidity and profitability:

The trade-off is perhaps most obvious with regards to the holding of cash. Although cash obviously provides liquidity it generates little return, even if held in the form of cash equivalents such as treasury bills. This is particularly true in an era of low interest rates (for example, in November 2016 the annualised yield on three-month US dollar treasury bills was approximately 0.4%).

Although an optimal level of working capital may exist it may not be achievable due to factors beyond management’s control, such as an unreliable supply chain influencing inventory levels. However businesses must at least avoid the extremes:

- Overtrading – insufficient working capital to support the level of business activities. This can also be described as under-capitalisation and is characterised by a high and rising proportion of short-term finance to long-term finance

- Over-capitalisation – an excessive level of working capital, leading to inefficiency.

Liquidity ratios

If the current ratio falls below 1 this may indicate problems in meeting obligations as they fall due. Even if the current ratio is above 1 this does not guarantee liquidity, particularly if inventory is slow moving. On the other hand a very high current ratio is not to be encouraged as it may indicate inefficient use of resources (for example, excessive cash balances).

The level of a firm’s current ratio is heavily influenced by the nature if its business for example:

- Traditional manufacturing industries require significant working capital investment in inventory (comprising raw materials, work in progress and finished goods) and trade receivables (as their business customers expect to be offered generous credit terms). Therefore companies operating in such industries may reasonably be expected to have current ratios of 2 or more.

- Modern manufacturing companies may use just-in-time management techniques to reduce the level of buffer inventory and hence reduce their current ratios to some extent.

- In some industries, a current ratio of less than 1 might be considered acceptable. This is especially true of the retail sector which is often dominated by ‘giants’ such as Wal-Mart (in the US) and Tesco (in the UK). Such retailers are able to negotiate long credit periods with suppliers while offering little credit to customers leading to higher trade payables as compared with trade receivables. These retailers are also able to keep their inventory levels to a minimum through efficient supply chain management.

The quick ratio is particularly relevant where inventory is slow moving.

Efficiency ratios

This shows how quickly inventory is sold; higher turnover reflects faster-moving inventory.

However, working capital ratios are often easier to interpret if they are expressed in ‘days’ as opposed to ‘turnover’:

Note that exam questions may tell you to assume there are 360 days in the year. Furthermore, many exam questions only provide information about inventory as at the year-end, in which case this must be used as a proxy for the average inventory level.

Inventory days estimates the time taken for inventory to be sold. Everything else being equal a business would prefer lower inventory days.

In exam questions you may have to assume that:

(i) year-end receivables are representative of the average figure; and (ii) all sales are made on credit.

Receivables days estimates the time taken for customers to pay. Everything else being equal a business would prefer lower receivables days.

- Year-end payables are representative of the average figure

- Cost of sales approximates annual credit purchases

- All purchases are made on credit.

Payables days estimates the time taken to pay suppliers. A business would prefer to increase its payables days, unless this proves expensive in terms of lost settlement discounts or leads to other problems such as a damaged reputation – a ‘good corporate citizen’ is expected to pay promptly.

In this ratio working capital is defined as the level of investment in inventory and receivables less payables. In exam questions you may have to assume that year-end working capital is representative of the average figure over the year.

The sales to working capital ratio indicates how efficiently working capital is being used to generate sales. Everything else being equal the business would prefer this ratio to rise.

Cash operating cycle

The cash operating cycle (also known as the working capital cycle or the cash conversion cycle) is the number of days between paying suppliers and receiving cash from sales.

Cash operating cycle = Inventory days + Receivables days – Payables days.

In the manufacturing sector inventory days has three components:

(i) raw materials days (ii) work-in-progress days (the length of the production process), and (iii) finished goods days.

However, exam questions tend to be based in the retail sector where no such sub-analysis is required.

The longer the operating cycle the greater the level of resources ‘tied up’ in working capital. Although it is desirable to have as short a cycle as possible, there may be external factors which restrict management’s ability to achieve this:

- Nature of the business – a supermarket chain may have low inventory days (fresh food), low receivables days (perhaps just one to two days to receive settlement from credit card companies) and significant payables days (taking credit from farmers). In this case the operating cycle could be negative (ie cash is received from sales before suppliers are paid). On the other hand a construction company may have a very long operating cycle due to the high levels of work-in-progress.

- Industry norms – if key competitors offer long periods of credit to their customers it may be difficult to reduce receivables days without losing business.

- Power of suppliers – an attempt to delay payments could lead to the supplier demanding ‘cash on delivery’ in future (ie causing payables days to actually fall to zero rather than rising).

Interpretation of ratios

For a meaningful evaluation to be made of a firm’s working capital management it is necessary to identify:

- Trends – the change in a ratio over time. If an exam question provides two, or more, years of financial statements then appropriate ratios should be calculated for each year.

- External benchmarks – industry average (sector) ratios are commonly published by business schools or consultancies. If an exam question provides industry average data then you are expected to use this to benchmark the performance of the firm in the scenario. However do not assume that the only relevant ratios are those for which industry average data is available.

The following table is provided for reference purposes:

Topple Co has the following forecast figures for its first year of trading:

Sales $3,600,000

Purchases expense $3,000,000

Average receivables $306,000

Average inventory $495,000

Average payables $230,000

Average overdraft $500,000

Gross profit margin 25%

Industry average data:

Inventory days 53

Receivables days 23

Payables days 47

Current ratio 1.43

Assume there are 365 days in the year.

REQUIRED: Calculate and comment on Topple Co’s cash operating cycle, current ratio, quick ratio and sales to working capital ratio.

The length of the cash operating cycle indicates that there will be 70 days between Topple Co receiving cash from sales and paying cash to suppliers. This is significantly longer than the industry average of 29 days (53 + 23 – 47) and likely to lead to liquidity problems, as evidenced by the size of the overdraft.

Topple Co expects to take approximately the same credit period from its suppliers as is taken by its own customers, whereas the industry norm is to take a significantly longer credit period from suppliers (47 days) than is taken by customers (23 days). Therefore, slow inventory turnover is the main cause of Topple Co’s long working capital cycle. This may be inevitable in the first year of trading but is it important that systems are implemented to ensure efficient inventory management. The extent of future reductions in inventory days may be limited by the nature of the business as the industry average is 53 days.

It is perhaps unsurprising that Topple Co’s receivables days is also above the industry average as the firm may have been forced to offer generous terms of trade in order to attract customers away from its more established competitors, In addition Topple Co may still be in the process of establishing and implementing credit control procedures.

On the other hand Topple Co is paying its own suppliers much more quickly than the industry norm. Although this puts pressure on liquidity, Topple Co may be taking advantage of settlement discounts offered by suppliers or, as a new firm without an established trading history, it may simply not be offered extended credit periods by suppliers.

The above comparisons to sector data must be treated with caution as working capital management may be poor across the sector, leading to benchmarks which Topple Co should not endeavour to replicate. As a long-term target Topple Co should benchmark its performance against the leader in the sector.

The current ratio indicates that, over the year, there will be $1.10 of current assets per $1 of current liabilities, which does not compare favourably with the industry average of 1.43 and may not be sufficient as Topple Co’s inventory appears to be slow moving. More relevant, therefore, is the quick ratio which indicates only $0.42 of liquid assets per $1 of current liabilities, although no industry average data is available to benchmark this figure.

The overdraft would need to be continuously monitored to ensure it remains within any agreed limit, and contingency plans put into place for refinancing. However if Topple Co is started up with an appropriate level of long-term finance then an overdraft may be avoided entirely.

Each $1 invested in working capital is expected to generate $6.30 of revenue. Although this may not appear to be a particularly efficient use of resources, the first year’s trading may not be representative. Once Topple Co becomes more established it should benchmark its sales to working capital ratio against sector data if available.

This article has covered the foundations of working capital management, focusing on the analysis of current assets and current liabilities. The Financial Management syllabus also demands detailed knowledge of specific models and techniques for each component of working capital – cash, inventory, receivables and payables – and a well-prepared candidate must also be competent in using these.

References: PwC Global Working Capital Survey 2015

Mike Ashworth, a subject matter expert in financial management

Related Links

- Student Accountant hub

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

Working Capital Management

Explore ‘Working Capital Management’ to grasp the critical aspects of managing short-term financial decisions effectively. Learn about optimizing cash flow, managing inventories, and balancing receivables and payables. Understand how to maintain liquidity while ensuring operational efficiency and financial stability in a business.

1 Conceptual Framework

Definition of Working Capital

Constituents of working capital, types of working capital, cyclical flow and characteristics of working capital.

- Planning for Working Capital Working Capital and Inflation

Trends in Working Capital

2 Operating Environment of Working Capital

Monetary and Credit Policies

Financial markets.

- Economic Liberalisation and Industry

3 Determination of Working Capital

- Determination of Working Capital Needs: Different Approaches

- Factors Influencing Determination

Tandon Committee Norms

Present policy of banks.

4 Management of Receivables

- Credit Policy

- Credit Evaluation Models

Monitoring Receivables

Collecting receivables, strategic issues in receivables management.

5 Management of Cash

- Motives of holding cash