Crafting the Perfect Business Plan for an Accounting Firm: Step-by-Step

Accounting Firm Bundle 2025

Launching a successful accounting firm requires meticulous planning and preparation. Before diving into the business plan, entrepreneurs must tackle a comprehensive 9-step checklist to ensure their venture is well-positioned for growth and profitability. From in-depth market research to assembling a skilled team, this introductory guide outlines the critical steps that lay the groundwork for a thriving accounting practice.

Steps Prior To Business Plan Writing

Conduct thorough market research and competitive analysis.

Embarking on the journey of establishing an accounting firm requires a meticulous examination of the market landscape. The first critical step in crafting a comprehensive business plan for your accounting firm is to conduct a thorough market research and competitive analysis . This foundational step will provide invaluable insights into the industry, your target audience, and the competitive environment, ultimately shaping the strategic direction of your firm.

Begin by gathering data on the current state of the accounting industry in your geographic region. Analyze key market trends, growth patterns, and the evolving needs of small to medium-sized businesses and startups. Understand the size of the potential client pool , their pain points, and the services they currently seek from accounting firms.

- Leverage industry reports, market research studies, and online resources to gather comprehensive data on the accounting industry in your target market.

- Conduct surveys or interviews with existing and potential clients to gain first-hand insights into their unique accounting needs and preferences.

Next, conduct a detailed competitive analysis to assess the landscape of existing accounting firms in your market. Identify your direct and indirect competitors, their service offerings, pricing structures, and unique value propositions. Understand their strengths, weaknesses, and the strategies they employ to attract and retain clients.

By analyzing the competitive landscape, you can identify unmet needs in the market and pinpoint opportunities to differentiate your accounting firm. This analysis will also help you determine your unique selling points and develop a compelling value proposition that resonates with your target audience.

- Gather information on your competitors' client base, service quality, and customer satisfaction levels through online reviews, industry publications, and networking.

- Analyze the pricing structures and billing models of your competitors to inform your own pricing strategy.

According to a recent industry report, the global accounting services market is expected to grow at a CAGR of 5.2% from 2021 to 2028 , reaching a market size of $715.4 billion by 2028 . This growth is driven by the increasing demand for specialized accounting services from small and medium-sized businesses, as well as the need for strategic financial management in a rapidly evolving business landscape.

By conducting a thorough market research and competitive analysis, you will gain a deep understanding of the accounting industry, your target market, and the competitive environment. This foundational knowledge will enable you to develop a robust business plan that aligns with the unique needs of your clients and sets your accounting firm up for long-term success.

Determine the Target Audience and Their Unique Needs

Identifying the target audience and understanding their unique needs is a crucial step in developing a comprehensive business plan for an accounting firm. By honing in on the specific pain points and requirements of your potential clients, you can tailor your services, pricing, and overall value proposition to better serve their needs.

For LedgerLogic Accounting Services, the target audience is primarily small to medium-sized businesses and startups. These organizations often lack the resources and expertise to manage their finances effectively, making them prime candidates for the personalized accounting services offered by LedgerLogic.

To better understand the needs of this target audience, it is essential to conduct thorough market research. This may involve analyzing industry trends, surveying potential clients, and identifying the common challenges faced by small and medium-sized businesses in the accounting and financial management domain.

Some key considerations when determining the target audience and their unique needs include:

- Industry-Specific Requirements: Different industries may have unique accounting and reporting needs, such as specific tax regulations or financial reporting standards. LedgerLogic should be prepared to tailor its services to address these industry-specific requirements.

- Growth Stage and Lifecycle: The accounting needs of a startup may differ significantly from those of an established small business. LedgerLogic should be equipped to provide tailored solutions based on the client's growth stage and lifecycle.

- Financial Literacy and Sophistication: Some small business owners may have limited financial expertise, requiring more hands-on support and guidance from the accounting firm. LedgerLogic should be prepared to offer educational resources and personalized advisory services.

- Compliance and Regulatory Requirements: Small businesses must navigate a complex web of tax laws, reporting obligations, and regulatory compliance. LedgerLogic should be well-versed in these requirements and able to provide comprehensive support to ensure clients remain compliant.

- Conduct in-depth interviews and focus groups with potential clients to gain a deeper understanding of their unique pain points and accounting needs.

- Analyze industry benchmarks and financial data to identify common challenges and opportunities faced by small to medium-sized businesses in your target market.

- Leverage customer segmentation techniques to create detailed buyer personas that can guide your service offerings, pricing, and marketing strategies.

By thoroughly understanding the target audience and their unique needs, LedgerLogic can position itself as a trusted partner that provides tailored, high-value accounting services to small and medium-sized businesses. This strategic focus will be a key competitive advantage in the crowded accounting services market.

Identify Your Unique Value Proposition and Competitive Advantages

In the highly competitive accounting services market, it is crucial for your firm to differentiate itself by identifying a unique value proposition and showcasing its competitive advantages. This step is essential in crafting a compelling business plan that will attract potential clients and set your accounting firm apart from the competition.

To develop a strong value proposition, start by conducting a thorough analysis of the local accounting market. Examine the services offered by competing firms, their pricing structures, and the level of customer satisfaction. Identify the gaps in the market that your firm can fill and the specific needs of your target audience that your services can address.

- Analyze the strengths and weaknesses of your competitors to uncover opportunities for your firm to stand out.

- Gather feedback from potential clients to understand their pain points and expectations from an accounting service provider.

- Leverage your team's expertise and industry experience to develop unique service offerings or specialized expertise.

Once you have a clear understanding of the market and your target audience, you can begin to craft your unique value proposition. This should be a concise statement that highlights the key benefits your firm offers, such as personalized attention, industry-specific expertise, or innovative financial management strategies. Your value proposition should be prominently featured in your business plan and used to guide your marketing and sales efforts.

Alongside your value proposition, it is essential to identify your firm's competitive advantages. These may include your team's credentials, specialized services, or a proven track record of client satisfaction. Emphasize these advantages in your business plan and use them to position your firm as the preferred choice for potential clients.

- Leverage industry awards, certifications, or accolades to demonstrate your firm's expertise and credibility.

- Highlight your firm's unique service offerings or innovative approaches to financial management.

- Showcase client testimonials and case studies to provide social proof of your firm's capabilities.

By clearly defining your unique value proposition and competitive advantages, you can create a compelling business plan that sets your accounting firm apart in the market. This will not only help you attract and retain clients but also position your firm for long-term success in the dynamic accounting services industry.

Develop a clear understanding of the accounting services to offer

Developing a clear understanding of the accounting services to offer is a critical step in crafting a comprehensive business plan for your accounting firm. By thoroughly assessing the market demand and your firm's unique capabilities, you can create a tailored service portfolio that sets you apart from the competition and aligns with the specific needs of your target clientele.

Start by conducting in-depth market research to identify the key accounting services that small to medium-sized businesses and startups in your local area are seeking. Analyze industry trends, review competitor offerings, and gather insights from potential clients through surveys or interviews. This will help you pinpoint the services that are in high demand and where your firm can provide the most value.

Next, evaluate your firm's core competencies and expertise. Determine the specific accounting services your team is best equipped to deliver, such as tax preparation, financial reporting, payroll management, or advisory services. Carefully consider the resources, skills, and certifications required to offer each service and ensure that your service portfolio aligns with your firm's capabilities.

- Tip: Prioritize services that offer the highest profit margins and have the potential for recurring revenue, as these will be crucial for the long-term sustainability of your accounting firm.

Once you have identified the accounting services to offer, develop detailed service descriptions that outline the scope of each offering, the key deliverables, and the expected timeline for completion. This will not only help you communicate the value proposition to potential clients but also ensure that your team is aligned on the service delivery process.

Furthermore, consider the pricing structure for each service, taking into account factors such as the complexity of the work, the time required, and the market rates in your local area. Establish a clear and transparent pricing model that balances the value you provide with the financial needs of your clients.

By developing a comprehensive understanding of the accounting services to offer, you can create a strong foundation for your business plan and position your accounting firm for success in the competitive market.

Assess the financial requirements and potential revenue streams

Establishing a solid financial foundation is crucial for the success of any accounting firm. When starting an accounting firm, it's essential to carefully assess the financial requirements and identify potential revenue streams to ensure the long-term viability of the business. This step involves a thorough analysis of the startup costs, ongoing operational expenses, and the anticipated revenue generation.

The startup costs for an accounting firm can vary widely, depending on factors such as the location, office space, equipment, and technology requirements. Typically, the initial investment can range from $50,000 to $100,000 or more, depending on the scale and scope of the operations. This includes expenses for office setup, software licenses, professional certifications, and any necessary legal and regulatory compliance.

In addition to the startup costs, it's crucial to estimate the ongoing operational expenses that the accounting firm will incur. These may include rent, utilities, employee salaries and benefits, professional development, marketing and advertising, and other administrative costs. Accurately forecasting these expenses will help you determine the minimum revenue required to sustain the business and achieve profitability.

When assessing the potential revenue streams, it's important to consider the range of accounting services the firm will offer, the target clientele , and the pricing structure for those services. Accounting firms typically generate revenue from a combination of services, such as tax preparation, bookkeeping, financial reporting, auditing, and consulting. Analyzing the market demand, competition, and the firm's unique value proposition will help you determine the appropriate pricing for these services.

- Leverage industry benchmarks and data to estimate startup costs and ongoing expenses accurately.

- Diversify revenue streams by offering a comprehensive suite of accounting services to meet the varying needs of your target clients.

- Regularly review and adjust your pricing structure to remain competitive and ensure profitability.

By carefully assessing the financial requirements and potential revenue streams, you can develop a solid financial plan that will guide the growth and sustainability of your accounting firm. This step lays the foundation for a robust business plan that can attract investors, secure financing, and ensure the long-term success of your venture.

Establish a Well-Defined Pricing Structure and Billing Model

Establishing a well-defined pricing structure and billing model is a crucial step in developing a successful accounting firm business plan. Pricing and billing are not only essential for generating revenue but also for projecting financial viability, communicating value to clients, and maintaining a competitive edge in the market.

When determining the pricing structure for your accounting firm, it's important to consider a range of factors, including the local market rates, the complexity of the services offered, the expected time and resources required, and the overall value proposition of your firm. A common approach is to offer a combination of hourly rates, flat fees, and package pricing, allowing you to cater to the diverse needs and preferences of your target clients.

- Conduct thorough market research to benchmark pricing in your local area and industry.

- Carefully calculate your operational costs and desired profit margins to set competitive yet sustainable rates.

- Consider offering package pricing for common services to provide value and simplicity for clients.

In addition to pricing, it's essential to establish a clear and transparent billing model. This can include options such as monthly retainers, project-based billing, or a hybrid approach that combines both. Implementing an efficient invoicing system, providing clients with detailed statements, and offering flexible payment options can further enhance the client experience and improve cash flow management.

- Implement a user-friendly invoicing system that provides clients with detailed, itemized statements.

- Offer a range of payment options, including online payments, direct bank transfers, and credit card processing.

- Consider offering discounts or incentives for prompt payment or long-term retainer agreements.

According to a recent industry survey, 58% of accounting firms reported that their pricing and billing models were the most significant factor in maintaining client satisfaction and retention . By carefully designing your pricing structure and billing model, you can not only generate sustainable revenue but also differentiate your accounting firm and build long-term, mutually beneficial relationships with your clients.

Evaluate the necessary licenses, certifications, and legal considerations

Before establishing an accounting firm, it's essential to ensure that you have the necessary licenses, certifications, and legal considerations in place. This step is crucial to ensure compliance with industry regulations and to protect your business from potential legal issues.

In the United States, accounting firms must obtain a Certified Public Accountant (CPA) license to provide accounting services. The CPA license is granted by the state board of accountancy and typically requires passing the Uniform CPA Examination, meeting education and experience requirements, and adhering to ongoing continuing education standards.

Additionally, your accounting firm may need to obtain various business licenses and permits depending on your location and the specific services you plan to offer. These may include a general business license, a sales tax permit, a professional services license, or any other licenses required by your state or local government.

It's also important to consider the legal structure of your accounting firm, such as a sole proprietorship, partnership, or limited liability company (LLC). Each structure has its own legal and tax implications, so it's advisable to consult with a legal professional to determine the best option for your business.

Furthermore, accounting firms must comply with industry-specific regulations and standards, such as the Sarbanes-Oxley Act, which imposes stricter financial reporting and internal control requirements for publicly traded companies. Ensuring compliance with these regulations is essential to maintain the integrity of your accounting services and avoid potential legal and financial penalties.

- Familiarize yourself with the licensing and certification requirements in your state or local jurisdiction to ensure your accounting firm is operating legally.

- Consider consulting with a business attorney or accountant to ensure you have the appropriate legal structure and have addressed all necessary legal and compliance considerations.

- Stay up-to-date with changes in industry regulations and standards to maintain compliance and protect your firm's reputation.

By thoroughly evaluating the necessary licenses, certifications, and legal considerations, you can ensure that your accounting firm is positioned for success while operating within the bounds of the law. This step lays the foundation for a strong and compliant business that can serve its clients with confidence.

Build a Network of Strategic Partnerships and Referral Sources

Establishing a strong network of strategic partnerships and referral sources is a crucial step in building a successful accounting firm. By collaborating with other businesses and professionals, you can expand your reach, access new client pools, and leverage complementary expertise to provide a more comprehensive suite of services to your clients.

One of the key strategies for building these partnerships is to identify complementary businesses and service providers in your local market. This could include law firms, financial advisors, insurance providers, or even other accounting firms that specialize in different areas. By developing mutually beneficial relationships, you can cross-refer clients and offer a more holistic approach to their financial needs.

- Attend local business events, networking groups, and industry conferences to connect with potential partners and build relationships.

- Offer to provide educational workshops or webinars to other businesses, showcasing your expertise and building trust.

- Explore opportunities for co-marketing initiatives, such as joint promotions or co-branded content, to increase visibility and reach.

In addition to formal partnerships, cultivating a network of referral sources is also crucial for the growth of your accounting firm. This could include local business owners, entrepreneurs, and even individual clients who are satisfied with your services and are willing to recommend you to their networks.

To effectively build and manage your referral network, consider implementing a structured referral program. This might include offering incentives or rewards for successful referrals, as well as regularly communicating with your referral sources to maintain strong relationships and stay top-of-mind.

- Develop a clear and consistent process for managing referrals, including tracking, follow-up, and feedback.

- Regularly review and refine your referral program to ensure it remains effective and attractive to potential referral sources.

- Foster a culture of gratitude and appreciation within your firm, acknowledging and rewarding team members who contribute to building your referral network.

By building a robust network of strategic partnerships and referral sources, you can significantly expand your client base, diversify your service offerings, and position your accounting firm as a trusted and respected player in the local business community. According to a 2021 study by the National Association of Accountants, 62% of accounting firms that had a structured referral program in place saw an average increase of 18% in new client acquisitions over a three-year period.

Assemble a Skilled and Experienced Team of Accounting Professionals

Building a talented and well-rounded team of accounting professionals is a crucial step in establishing a successful accounting firm. The caliber of your team will directly impact the quality of services you can provide, your firm's reputation, and its long-term growth potential.

When assembling your accounting team, it's essential to seek out individuals with a diverse range of skills and expertise. This may include certified public accountants (CPAs), enrolled agents, bookkeepers, and tax specialists, each bringing unique strengths to the table. According to the Bureau of Labor Statistics, the employment of accountants and auditors in the United States is projected to grow by 4% from 2019 to 2029 , faster than the average for all occupations.

In addition to technical proficiency, it's important to prioritize soft skills such as effective communication, problem-solving, attention to detail, and a customer-centric approach. These attributes will enable your team to build strong relationships with clients, provide exceptional service, and contribute to the overall success of your accounting firm.

- Establish clear job descriptions and requirements for each role within your accounting firm to ensure you attract the right talent.

- Offer competitive compensation and benefits packages to attract and retain top-tier accounting professionals.

- Invest in ongoing training and professional development opportunities to keep your team's skills and knowledge up-to-date.

When building your accounting team, it's also essential to consider the scalability of your firm. As your client base grows, you'll need to ensure that your team can handle the increased workload and complexity. According to a survey by the AICPA, 58% of accounting firms reported that finding and retaining qualified staff was their top challenge in 2021.

By assembling a skilled and experienced team of accounting professionals, you'll be well-positioned to deliver high-quality services, build a strong reputation, and achieve sustainable growth for your accounting firm.

Related Blogs

- What Are The Top 9 Business Benefits Of Starting A Accounting Firm Business?

- What Are The Nine Best Ways To Boost A Accounting Firm Business?

- What Are Nine Methods To Effectively Brand A Accounting Firm Business?

- Master the Art of Acquiring Accounting Firms: Your Essential Checklist

- What Are The Reasons For The Failure Of Accounting Firm Businesses?

- How To Fund Or Get Money To Start A Accounting Firm Business?

- How To Name A Accounting Firm Business?

- Accounting Firm Owner Earnings: A Comprehensive Guide

- How to Launch a Successful Accounting Firm: Planning and Execution

- 7 Key KPIs for Tracking Accounting Firm Success

- Essential Costs for Running an Accounting Firm

- What Are The Top Nine Pain Points Of Running A Accounting Firm Business?

- How to Enhance Your Accounting Firm's Profitability in 2023

- What Are Nine Strategies To Effectively Promote And Advertise A Accounting Firm Business?

- What Are The Best Nine Strategies For Scaling And Growing A Accounting Firm Business?

- How To Sell Accounting Firm Business in 9 Steps: Checklist

- Key Startup Expenses For Your New Accounting Firm

- What Are The Key Factors For Success In A Accounting Firm Business?

- Starting an Accounting Firm Without Money: A Comprehensive Guide

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

- Paragraph Generator

- Cover Letter

- Authorization Letter

- Application Letter

- Letter of Intent

- Letter of Recommendation

- Business Plan

- Incident Report

- Reference Letter

- Minutes of Meeting

- Letter of Resignation

- Excuse Letter

- Research Proposal

- Job Application

- Acknowledgement

- Employment Letter

- Promissory Note

- Business Proposal

- Statement of Purpose

- Offer Letter

- Deed of Sale

- Letter of Interest

- Power of Attorney

- Solicitation Letter

3+ SAMPLE Accountancy Firm Business Plan in PDF

Accountancy firm business plan, 3+ sample accountancy firm business plan, an accountancy firm business plan, benefits of hiring an accounting firm, tips for increasing your accounting firm’s efficiency, types of accounting, how to create an accountancy firm business plan, how is an accounting business structured, what is the purpose of an accounting firm, is there a demand for accountants.

Accountancy Firm and Tax Services Business Plan

Sample Accountancy Firm Business Plan

Simple Accountancy Firm Business Plan

Accountancy Firm Business Plan Example

What is an accountancy firm business plan, 1. financial accounting, 2. managerial accounting, 3. cost accounting, 4. auditing, 5. accounting information systems, 6. forensic accounting, 7. governmental accounting, 1. create a concise executive summary., 2. conduct a market analysis of your industry., 3. describe management and operations in detail., 4. provide financial data about your business., share this post on your network, you may also like these articles, agriculture business plan.

An Agriculture Business Plan serves as a roadmap for setting up, managing, and expanding an agricultural venture. It outlines the objectives, strategies, and resources needed for a successful operation.…

Workout Plan

A workout plan is a structured schedule designed to guide your exercise routines, helping you achieve specific fitness goals such as weight loss, muscle gain, or improved endurance. It…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their accounting firms.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an accounting business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

How to Write a Business Plan for an Accounting Firm

If you want to start an accounting business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your accounting business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of accounting business you are running and the status. For example, are you a startup, do you have an accounting business that you would like to grow, or are you operating an established accounting business you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the accounting industry.

- Discuss the type of accounting business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Finish Your Business Plan Today!

Company Overview

In your company overview, you will detail the type of accounting business you are operating.

For example, you might specialize in one of the following types of accounting firms:

- Full Service Accounting Firm: Offers a wide range of accounting services.

- Bookkeeping Firm: Typically serves small business clients by maintaining their company finances.

- Tax Firm: Offers tax accounting services for businesses and individuals.

- Audit Firm: Offers auditing services for companies, organizations, and individuals.

In addition to explaining the type of accounting business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, or the amount of revenue earned.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Accounting Firm Company Overview Example

Accurate Accounting Solutions is a new Accounting Firm/Services serving customers in Portland, OR. We are a local accounting firm, poised to fill the gap in the market for high-quality local accounting services. Our presence in Portland is not just about offering accounting solutions; it’s about establishing a firm that prides itself on precision, reliability, and customized service for each client. The realization that there are no high-quality local accounting firms in the area motivated us to launch our services, aiming to be the go-to solution for individuals and businesses alike.

At Accurate Accounting Solutions, we offer a comprehensive suite of accounting services tailored to meet the needs of both individuals and businesses. Our offerings encompass bookkeeping, payroll, tax preparation, and more, designed to streamline financial management and compliance for our clients. Our approach is rooted in understanding the unique needs of each client, ensuring that we provide solutions that are not just accurate, but also strategically aligned with their goals. Whether you’re a small startup looking for bookkeeping support or a growing enterprise in need of comprehensive accounting strategies, we’re here to help.

Based in the vibrant city of Portland, Oregon, Accurate Accounting Solutions is strategically located to serve customers within the Portland area. Our choice of location is deliberate, allowing us to tap into the local market and build strong, face-to-face relationships with our clients. This local presence is crucial for us, as it enables us to offer personalized service and support that’s just a phone call or a short drive away.

Our firm is uniquely qualified to succeed for several reasons. Firstly, our founder brings invaluable experience from previously running a successful accounting firm. This background provides us with a deep understanding of the industry, as well as insights into best practices and innovative solutions. Secondly, we are committed to offering higher quality accounting services compared to what’s currently available in the market. This dedication to excellence is evident in every aspect of our operations, from the services we offer to the personalized attention we provide each client.

Accurate Accounting Solutions was officially founded on 2024-09-02. Structured as a Sole Proprietorship, our firm has made significant strides since its inception. Our accomplishments to date include the development of our brand identity, evidenced by our professionally designed logo and the strategic selection of our company name. Additionally, we’ve secured a prime location for our operations, ensuring that we’re accessible to our target market. These milestones mark the beginning of our journey, laying a solid foundation for the future growth and success of Accurate Accounting Solutions.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the accounting industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the accounting industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your accounting business plan:

- How big is the accounting industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your accounting business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Accounting Firm Industry Analysis Example

The Accounting Firm/Services industry in the United States is a significant market with an estimated size of approximately $160 billion. This industry encompasses a wide range of services, including auditing, tax preparation, payroll processing, and financial consulting. With the increasing complexity of financial regulations and reporting requirements, the demand for accounting services continues to grow.

Market research indicates that the Accounting Firm/Services industry is expected to experience steady growth in the coming years. The market is projected to expand at a compound annual growth rate of around 4% over the next five years. This growth can be attributed to factors such as the increasing number of businesses seeking professional accounting assistance, the rise in outsourcing of finance and accounting functions, and the growing complexity of tax laws.

Accurate Accounting Solutions, as a new Accounting Firm/Services serving customers in Portland, OR, is well-positioned to capitalize on the positive trends in the industry. With a focus on providing high-quality and reliable accounting services to businesses in the region, Accurate Accounting Solutions can benefit from the growing demand for professional accounting assistance. By staying abreast of industry trends and offering tailored solutions to meet the needs of clients, the firm can establish itself as a trusted partner for businesses seeking financial expertise.

Customer Analysis

The customer analysis section of your accounting business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, organizations, government entities, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of accounting business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Accounting Firm Customer Analysis Example

Target Customers

We will target a broad spectrum of customers in Portland, OR, with a focus on local small to medium-sized businesses. These businesses often require comprehensive accounting services, including bookkeeping, tax preparation, and financial planning, to effectively manage their finances and remain compliant with regulations. Our personalized approach will address the unique needs of each business, ensuring they receive tailored solutions that promote growth and sustainability.

Local residents will also form a significant portion of our customer base, particularly those who need assistance with personal tax preparation and financial planning. Individuals seeking to optimize their tax returns and manage their personal finances more efficiently will find value in our services. We will offer guidance on budgeting, retirement planning, and investment strategies to help residents achieve their financial goals.

In addition to businesses and individual residents, we will target start-ups and entrepreneurs who require support in setting up robust financial systems from the onset. By providing expertise in financial forecasting and strategic planning, we will empower these clients to make informed decisions that foster long-term success. Our services will include assistance with business formation, funding strategies, and financial projections to ensure a solid financial foundation.

We will also engage with nonprofit organizations, understanding their unique accounting needs such as fund accounting and grant management. Our services will help these organizations maintain transparency and accountability in their financial reporting, which is crucial for maintaining donor trust and securing future funding. By supporting nonprofits in achieving their mission-driven goals, we will contribute to the broader community impact in Portland.

Customer Needs

Accurate Accounting Solutions fulfills the pressing need for high-quality accounting services among individuals and businesses. Clients can expect precise and timely financial reporting, which is crucial for informed decision-making and strategic planning. By offering expert advice and comprehensive financial analysis, the firm empowers clients to optimize their financial health and achieve their financial goals.

Businesses in Portland often struggle with complex tax regulations and compliance issues, and Accurate Accounting Solutions provides clarity and guidance in these areas. The firm offers tailored tax planning and preparation services, reducing the risk of errors and ensuring clients take advantage of applicable tax benefits. This personalized approach helps businesses maintain compliance while maximizing their financial outcomes.

In addition to tax services, Accurate Accounting Solutions addresses the growing demand for efficient bookkeeping and payroll management. Clients benefit from streamlined operations, allowing them to focus on core business activities without the distractions of financial administration. The firm’s dedication to accuracy and confidentiality builds trust with clients, fostering long-term partnerships.

Furthermore, Accurate Accounting Solutions understands the need for ongoing support and accessibility. Clients have access to knowledgeable professionals who can provide insights and solutions at any stage of their financial journey. Through consistent communication and a commitment to excellence, the firm enhances client satisfaction and loyalty.

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other accounting firms.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes CPAs, other accounting service providers, or bookkeeping firms. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of accounting business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

Concerning the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide options for multiple customer segments?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Finish Your Accounting Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an accounting business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of accounting company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide auditing services, tax accounting, bookkeeping, or risk accounting services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your accounting company. Document where your company is situated and mention how the site will impact your success. For example, is your accounting business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your accounting marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your accounting business, including answering calls, scheduling meetings with clients, billing and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your accounting business to a new city.

Accounting Firm Operations Plan Example

Key Operational Processes

To ensure the success of Accurate Accounting Solutions, there are several key day-to-day operational processes that we will perform:

- Maintain accurate and up-to-date client financial records using advanced accounting software to ensure efficient service delivery.

- Perform regular financial analysis and generate reports to offer clients insights into their financial health and areas for improvement.

- Conduct bookkeeping tasks, including managing accounts payable and receivable, reconciling bank statements, and maintaining the general ledger.

- Ensure compliance with local, state, and federal tax regulations by staying informed of changes in tax laws and preparing tax documents accurately and on time.

- Engage in consistent communication with clients to understand their financial needs and provide tailored accounting solutions.

- Develop and maintain internal accounting processes and controls to ensure data accuracy and financial integrity.

- Offer financial planning and budgeting services to help clients achieve their financial objectives and manage cash flow effectively.

- Provide payroll services, including calculating employee wages, withholding taxes, and ensuring timely salary disbursement.

- Engage in continuous professional development to stay updated on industry trends and best practices in accounting and finance.

- Utilize cloud-based accounting tools and technology to enhance the efficiency, security, and accessibility of financial information for clients.

- Encourage client feedback and implement improvements to enhance service quality and customer satisfaction.

- Foster a collaborative team environment where staff members can share knowledge and skills to improve overall service offerings.

Accurate Accounting Solutions expects to complete the following milestones in the coming months to ensure its success:

- Launch Our Accounting Firm: Officially open the firm by securing a physical or virtual office space, setting up essential technology infrastructure, and establishing an online presence through a website and social media.

- Obtain Required Licenses and Certifications: Ensure compliance with state and federal regulations by obtaining necessary licenses and certifications, such as CPA licenses for staff and any business operating permits.

- Establish a Client Acquisition Strategy: Develop and implement a marketing and sales strategy focusing on networking, partnerships, and digital marketing to attract and retain clients.

- Hire and Train Key Personnel: Recruit qualified accountants and administrative staff, providing them with comprehensive training to ensure high-quality service delivery and client satisfaction.

- Achieve Initial Revenue Milestone: Reach $15,000 in monthly revenue by securing a steady client base and delivering exceptional accounting services.

- Implement Robust Financial Controls and Reporting: Establish internal financial controls and regular reporting mechanisms to monitor the firm’s financial health and make informed business decisions.

- Build Strategic Partnerships: Form alliances with complementary businesses or organizations, such as local banks or business associations, to enhance service offerings and expand the client base.

- Develop and Offer Specialized Services: Identify niche areas or industries where the firm can offer specialized accounting services, thereby diversifying revenue streams and differentiating from competitors.

- Enhance Client Satisfaction and Retention: Implement feedback systems and client relationship management tools to continuously improve service quality and maintain long-term client relationships.

- Evaluate and Optimize Operations: Regularly assess the firm’s operational efficiency and make necessary adjustments to processes, technology, and staffing to ensure scalability and sustainability.

Management Team

To demonstrate your accounting business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing accounting businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an accounting business or bookkeeping firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer discounts for referrals? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your accounting business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a accounting business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of your most prominent clients. Writing a business plan for your accounting business is a worthwhile endeavor. If you follow the accounting business plan example above, by the time you are done, you will truly be an expert. You will understand the accounting industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful accounting business.

What Is an Accounting Business Plan?

A business plan provides a snapshot of your accounting business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Accounting Firm

If you’re looking to start an accounting firm or grow your existing accounting business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your accounting business to improve your chances of success. Your accounting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Accounting Firms

With regard to funding, the main sources of funding for an accounting firm are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for accounting firms.

Don’t you wish there was a faster, easier way to finish your Accounting business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

See how a Growthink business plan writer can create your business plan for you.

Other Helpful Business Plan Articles & Templates

- Sample Business Plans

Accounting Firm Business Plan

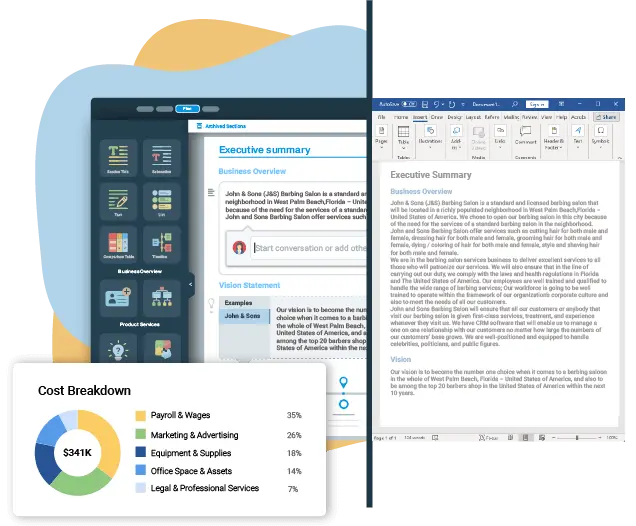

If you are planning to start a new accounting firm, the first thing you will need is a business plan. Use our sample accounting firm business plan created using Upmetrics business plan software to start writing your business plan in no time.

Before you start writing your business plan for your new accounting firm, spend as much time as you can reading through some examples of service-related business plans .

Reading sample business plans will give you a good idea of your aim. It will also show you the different sections that different entrepreneurs include and the language they use to write about themselves and their business plans.

We have created this sample accounting firm business plan for you to get a good idea about how a perfect business plan should look and what details you will need to include in your stunning business plan.

Accounting Firm Business Plan Outline

This is the standard accounting firm business plan outline which will cover all important sections that you should include in your business plan.

- Product and Services

- Vision Statement

- Mission Statement

- Business Structure

- Chief Executive Officer

- Accounting and Tax Consultants

- Admin and HR Manager

- Marketing and Sales Executive

- Client Service Executive / Front Desk Officer

- SWOT Analysis

- Market Trends

- Target Market

- Competitive Advantage

- Sources of Income

- No. of Clients v/s Revenue Chart

- Payment Options

- Publicity and Advertising Strategy

- Financial Projections and Costing

- Generating Funds/Startup Capital

- Sustainability and Expansion Strategy

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

After getting started with upmetrics , you can copy this sample business plan into your business plan and modify the required information and download your accounting firm business plan pdf and doc file. It’s the fastest and easiest way to start writing your business plan.

Download a sample accounting firm business plan

Need help writing your business plan from scratch? Here you go; download our free accounting firm business plan pdf to start.

It’s a modern business plan template specifically designed for your accounting firm business. Use the example business plan as a guide for writing your own.

Related Posts

Bookkeeping Business Plan

Counseling Private Practice Business Plan

Common Business Plan Mistakes To Avoid

Top Business Planning Tools

Business Plan for Bank Loan

Pro Forma Business Plan

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

All articles

How to create an effective business plan for an accounting firm, filter by category.

Thinking of starting your own accounting firm? That's great! Getting success in the high-demand finance industry needs persistence, hard work, and proper planning.

Yes, a detailed accounting firm business plan! Whether you are preparing to raise funding, applying for loans, or want to expand the company—a business plan is the key to all.

But do you know how to write one? Worry not, you are at the right place. This guide on writing an accounting business plan effectively will help you get started.

Why do you need a business plan for your accounting firm?

If you're planning to launch a new accounting firm or thinking of expanding the existing one, a well-crafted business plan is essential. It does not only act as a roadmap for your firm's growth, but it also improves your chances of securing funding if required.

It also outlines the goals and strategies of the company, allowing you to make strong decisions that align with its long-term goals.

How to write an accounting firm business plan?

Writing an effective business plan is critical for the success of your accounting firm. It acts as a roadmap for your business. But writing it includes many steps—if you need help you can use any business planning software for support. Various steps to include in the plan are:

1. Executive summary

An executive summary is a brief overview of the entire business plan. It acts as a hook to engage readers, motivating them to further explore your business plan.

This section should include important details such as mission, goals, services briefs, marketing & sales strategies, and financial goals.

The executive summary should be concise yet comprehensive, giving readers a clear understanding of your firm's potential and value proposition.

2. Company description

Now, this is the section where you give a detailed description of your accounting firm.

Start the section by mentioning the legal structure of your accounting firm, whether it's a sole proprietorship, partnership, limited liability company (LLC) , or corporation.

Also, highlight your firm's mission, values, long-term vision of the firm, location of your business, and business history (if any). You should also mention the owners of the business along with their experience and educational qualifications.

3. Market analysis

Before you start writing your business plan, conduct market research . Identify the size and scope of the market, including the number of accounting firms.

First, define your target market based on your research. Understand all their pain points and accounting needs, so you can customize your services accordingly.

After that, do the competitive analysis. Identify your direct and indirect competitors, and conduct a SWOT analysis to understand your unique selling propositions.

Mention any industry trends. You can adapt your strategies by staying informed about all the trends.

Finally, add the legal regulations you need to follow to run the accounting business in a particular location. Mention about all the licenses or permits your business needs.

4. Accounting services

This is the section, where you highlight all the services and mention how you are the best in providing them.

Give a detailed description of each service you provide. It can be about tax preparation, auditing, bookkeeping, or consulting. You can also mention the specialized services if you provide any such as business valuation, acquisition support, or anything else.

Mention if you use any special software or technology to provide such services. For example, any accounting software, client portal software , communication tools, etc.

5. Marketing and sales strategies

After mentioning your services, you need to highlight sales and marketing strategies to show how will you reach the customers.

Here, you need to identify the types of customers you are going to serve. For example, individuals, firms, small businesses, startups, or NPOs. Once you know the target audience, describe your strategies to attract them. Not only attract them but also retain the existing customers.

Some strategies your accounting firm can use are networking events, social media marketing, SEO, content marketing, email marketing, etc.

6. Operational plan

The main essence of an operational plan is to showcase how you work daily. Here explain the procedure of the services you provide.

For example, a client needs to register first, then schedule a meeting with the accountant, and then that particular accountant will be in the touch with client throughout.

With the procedure, you need to mention the timeline too, in which you will provide the services. Along with all these, mention in detail all the technologies or software you plan to purchase like project management tool , bookkeeping & accounting software, file sharing software , or some other.

7. Management team

Introduce your accounting firm's key members along with their roles, experience, and educational qualifications. This will build trust for your audience about who is behind the firm and how reliable they are.

Include brief biographies or resumes of each key team member to show their expertise. You also need to give details about the CEO or the owners of the firm.

Additionally, showcase the organizational structure of your team members and who will report to whom. Do not forget to include any advisory board or third-party consultants, if you have hired any.

8. Financial plan

Here, you have to show the financial health of your accounting firm. You need to present the financial forecasts of the firm for at least three to five years.

The financial forecasts should include profit & loss statements, cash flow statements, balance sheets, and cash flow tools .

With one view of the financial plan, your audience should get to know how much profit your business will make in the future. They should also get to know about the break-even point of the business.

9. Funding request

In the funding request section, mention the financial ask you need for your business. For that, you need to calculate the startup costs first and be clear about your requirements from investors or bankers.

Provide a breakdown of the funding required for various purposes, such as office rent, staff salaries, marketing, technology, and equipment.

Highlight the potential return on investment for investors, including projected revenue growth and profitability. If you are not writing the accounting firm's business plan for funding then you can skip this section.

10. Appendix

An appendix is kind of your supporting section, which has all the documents that support the main content of the whole business plan.

This might include resumes of the team members, detailed financial projections, customer feedback, legal documents, or any other additional information that you feel like to be added.

Including all this additional information can help provide a wider view of your accounting firm and support your business plan.

How Clinked Can Help You

Starting the adventure of managing an accounting firm can be significantly smoother with the right technological partners. Clinked is here to supercharge your firm’s operational capabilities and client interactions.

Here’s how Clinked can be a game-changer for your business:

- Secure Client Portal: Imagine a world where your clients have continuous access to a secure, branded client portal for your accounting firm . Here, they can view their financial documents, share necessary files, and communicate effortlessly with your team. This transparency not only boosts client satisfaction but also enhances client retention.

- Effortless Real-Time Collaboration: With Clinked, gone are the days of back-and-forth emails and disconnected workflows. Your team can now edit business documents simultaneously, streamline processes, and ensure that every financial statement or tax filing is perfect the first time around.

- Streamlined Task Management: Keep your projects on track with Clinked’s intuitive task management tools. Assign tasks, set deadlines, and monitor progress in a way that ensures your team is always productive and no client query goes unanswered.

- Uncompromised Security and Compliance: In the realm of accounting, securing sensitive information is paramount. Clinked fortifies your client data with state-of-the-art security measures and ensures compliance with the latest financial regulations, thereby nurturing trust and maintaining your firm’s esteemed reputation.

- Mobile Accessibility: In today’s fast-paced world, access to information on the go is not just a luxury—it’s a necessity. With Clinked’s mobile app, your team and clients can remain connected and operational from anywhere, at any time, facilitating unparalleled flexibility and responsiveness.

By integrating Clinked into your daily operations, you not only streamline complex processes but also enhance your firm’s overall productivity and client service capabilities. With Clinked, you’re not just surviving in the competitive accounting industry; you’re thriving.

So that's it! That is how you write an effective accounting firm business plan. If you are still confused about how to write one, then in this AI phase, you can use an AI business plan generator to write your plan or free business plan template.

Using an AI business plan generator can save you time and effort, allowing you to focus on other aspects of your business. Therefore, using these tools can be beneficial for business owners, entrepreneurs, and individuals.

Alongside AI tools, integrating platforms like Clinked can further enhance your business operations and client interactions. Clinked offers a secure, customizable client portal, real-time collaboration tools, and mobile access to manage your business effectively from anywhere. These features ensure that your accounting firm not only meets but exceeds client expectations, setting you apart in a competitive industry. Embrace these technological solutions, and propel your firm towards a successful future.

- How To Start An Accounting Firm

- 8 Best Project Management Software for Accounting Firms

- Virtual Accounting Firm: How To Make It A Success

- 8 Best Accounting Practice Management Software in 2024

- Client Accounting Services (CAS): Benefits, Trends & Solutions

Let Us Know What You Thought about this Post.

Put your Comment Below.

Related articles

Find out how Clinked can help you achieve your goal

- Client Portal

- Partner Portal

- Secure File Sharing

- Collaboration Software

- Communication Software

- Intranet Software

- Project Management Software

- Virtual Data Room

- White Label Software

- SharePoint Alternative

- Accounting Client Portal

- Financial Services Client Portal

- Legal Services Client Portal

- Help & Learning Center

- Clinked Blog

- Case Studies

- About Clinked

- Career Hiring!

- Partner with Clinked

- Security and Compliance

- Service Status

- Submit a Ticket

Subscribe to our newsletter

The latest Clinked news, articles, and resources, sent straight to your inbox every month.

- Terms of use

- Privacy Policy

- Clinked EU Data Processing Agreement

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Accounting & Bookkeeping Business Plan

Start your own accounting & bookkeeping business plan

The Sorcerer's Accountant

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

The Sorcerer’s Accountant is a small, successful, one-person accounting and tax preparation service owned and run by Max Greenwood, CPA in Chicago, Illinois. The firm offers tax accounting, management accounting, and QuickBooks set-up and training for small business clients. To move beyond a one person model, the business will expand its services to include bookkeeping services for small businesses. This will require an investment in marketing and staff to grow the business to include this complementary line of business. This business plan organizes the strategy and tactics for the business expansion and set objectives for growth over the next three years.

The business will offer clients bookkeeping services with the oversight of a CPA at a price they can afford. To do this involves hiring undergraduate student bookkeepers and a graduate student manager, keeping fixed costs as low as possible, and continuing to define the expertise of Sorcerer’s Accountant through its website resources. The effect will be sales more than doubling over three years as 8 part-time bookkeepers are deployed to client businesses as needed, and salary and dividends to Greenwood increase substantially.

The Sorcerer’s Accountant seeks to launch a new line of services – small business bookkeeping – which will be offered to the same ongoing clients as Sorcerer’s Accountant currently seeks.

Sorcerer’s Accountant has set the following objectives:

- To launch the bookkeeping services slowly, beginning with two part-time bookkeepers

- To achieve bookkeeping service annual revenues equal or greater to the current total revenues within three years (effectively doubling revenue)

- To achieve net profit of $60,000 in three years

- To employ 8 part-time bookkeepers in three years

The Sorcerer’s Accountant seeks to provide a full suite of tax and management accounting services for small businesses in Chicago, Illinois, allowing business owners to not only save money over in-house accounting and ensure their compliance with tax laws, but to make valuable management decisions from their numbers.

Keys to Success

The keys to success for the accounting business include:

- Building trust with clients

- Maintaining up-to-date CPA certification and education on accounting practices and laws

- Going beyond saving clients money to proposing how they can increase their revenues

- Legal and ethical practices when it comes to transparency, reporting, and taxes

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

The Sorcerer’s Accountant, established in 2006 by Max Greenwood, is a one-person CPA firm which provides tax services, management and cost consulting services, and QuickBooks sales and added services. Sorcerer’s Accountant serves small businesses (under $5 million in revenue) in the Chicago, IL area, primarily in service industries. The Sorcerer’s Accountant plans to add bookkeeping services to its suite of services to better serve its current and future clients.

Company Ownership

Max Greenwood is founder and 100% owner of The Sorcerer’s Accountant, a sole proprietorship.

Company History

Founded with $10,000 of start-up capital by Max Greenwood, CPA in 2006, The Sorcerer’s Accountant has become a full-time endeavor for Greenwood. At first focused entirely on tax services, Greenwood added management and cost accounting services in 2007 and then QuickBooks reselling and services to small businesses and startups in 2008, after becoming a certified QuickBooks Pro Advisor. This has allowed Sorcerer’s Accountant to provide a wide range of services to small businesses over its lifetime from launch through expansion and growth.

The Sorcerer’s Accountant has grown significantly in past years to $175,000 in total annual revenue, but has had difficulty taking on additional work due to the limits on Greenwood’s time. Client retention has been a positive factor, with 75% of 2008 clients repeating service in 2009.

The business operates out of a small rented office which has enough room for one additional employee. The office is not used for client meetings – they are held entirely at client offices.

Current services offered by The Sorcerer’s Accountant include:

Tax Services:

- Tax preparation

- Tax planning

- Addressing tax problems (audit representation, back taxes owed, payroll tax problems, IRS issues, bankruptcy)

Management/Cost Accountant Services:

- Cost and Margin Analysis

- Financial Projection

- Setup for credit card processing

QuickBooks Services

- QuickBooks sales and setup

- QuickBooks training

- QuickBooks tips (via website)

- QuickBooks “quicktune” service (audit and fix of QuickBooks files)

Current services are either provided entirely by Max Greenwood or available through resources on the The Sorcerer’s Accountant website. Greenwood will provide referrals to credit card processing companies or some speciality consultants when the need calls for it, but focuses his work on general small business services of use to the widest variety of businesses.

The Sorcerer’s Accountant intends to add the following bookkeeping services :

- Payroll processing

- Accounts payable (entry, bill paying)

- Accounts receivable (entry, invoicing, deposits, collection)

- Sales tax processing

- Bank reconciliations

- Inventory management

- Financial statement preparation

- Other financial reporting

These bookkeeping services will be at a rate of $30 per hour/per bookkeeper for clients. Clients would pay $20 -$25, once benefits and taxes are factored in, for an in-house, part-time bookkeeper, and would still be responsible for training, oversight, and management in that case. The Sorcerer’s Accountant’s rate is very economical once this is taken into account.

The new services will be performed by part-time student bookkeepers who are current undergraduate accounting majors with up to 20 hours per week free to work. Each business will have a consistent bookkeeper assigned to it. The bookkeepers will be trained by Max Greenwood directly in proper techniques. They will all be students in the top 20% of their class with at least one professional recommendation and one educational (professor) recommendation. This is a business model which has been successful in other cities where there is ample student labor, such as New York City.

To add additional value, the bookkeeping manager, a graduate student pursuing an MBA in accounting, will supervise and audit the work of the bookkeepers, answering their questions when questions arise, and providing quality assurance. The bookkeeping manager will review the QuickBooks files and reports created by the bookkeepers to ensure that they follow proper formats and are prepared correctly.

Market Analysis Summary how to do a market analysis for your business plan.">

The small business accounting market consists of virtually every small business in the United States. As businesses grow larger than one person sole proprietorships, they generally require expert help with at least their tax preparation, and often with additional bookkeeping and accounting services. Even many non-employer sole proprietorships will use accounting help at some point. While some small businesses hire bookkeepers or CFOs directly, many successfully outsource these types of services.

The accounting service market as a whole includes the following:

- Corporate accounting and auditing firms: The “Big Four” (PricewaterhouseCoopers, Ernst & Young, Deloitte Touche Tohmatsu, and KPMG) and their competitors

- Small business accounting

- Personal accounting (by H & R Block and the like)

Market Segmentation

The market of small businesses in Chicago for The Sorcerer’s Accountant represents approximately 85,000 businesses in 2010. It has been divided into three groups:

Non-employer firms: Without employees, these firms do not have many of the concerns of larger businesses. However, the owners must be vigilant to protect their own tax liability and sort out how their personal and business tax returns intersect. These firms are generally buyers of QuickBooks services and tax preparation services. As they grow, this group becomes ripe for outsourced bookkeeping services before they can hire an full-time in-house bookkeeper.

Very small businesses: Made up of businesses that are designed to stay small and those which are growing through a phase, these businesses require payroll services, bookkeeping, and tax preparation. They are concerned about losing control, but can generally be convinced of using outsourced accounting and bookkeeping with cost analysis. With the stakes higher, these businesses can make greater use of management accounting services, especially as most cannot afford a dedicated CFO. Many do not need a full-time bookkeeper, but can make do with part-time help, which limits their hiring options.