The Ultimate Guide to Writing a Nonprofit Business Plan

A business plan can be an invaluable tool for your nonprofit. Even a short business plan pushes you to do research, crystalize your purpose, and polish your messaging. This blog shares what it is and why you need it, ten steps to help you write one, and the dos and don’ts of creating a nonprofit business plan.

Nonprofit business plans are dead — or are they?

For many nonprofit organizations, business plans represent outdated and cumbersome documents that get created “just for the sake of it” or because donors demand it.

But these plans are vital to organizing your nonprofit and making your dreams a reality! Furthermore, without a nonprofit business plan, you’ll have a harder time obtaining loans and grants , attracting corporate donors, meeting qualified board members, and keeping your nonprofit on track.

Even excellent ideas can be totally useless if you cannot formulate, execute, and implement a strategic plan to make your idea work. In this article, we share exactly what your plan needs and provide a nonprofit business plan template to help you create one of your own.

What is a Nonprofit Business Plan?

A nonprofit business plan describes your nonprofit as it currently is and sets up a roadmap for the next three to five years. It also lays out your goals and plans for meeting your goals. Your nonprofit business plan is a living document that should be updated frequently to reflect your evolving goals and circumstances.

A business plan is the foundation of your organization — the who, what, when, where, and how you’re going to make a positive impact.

The best nonprofit business plans aren’t unnecessarily long. They include only as much information as necessary. They may be as short as seven pages long, one for each of the essential sections you will read about below and see in our template, or up to 30 pages long if your organization grows.

Why do we need a Nonprofit Business Plan?

Regardless of whether your nonprofit is small and barely making it or if your nonprofit has been successfully running for years, you need a nonprofit business plan. Why?

When you create a nonprofit business plan, you are effectively creating a blueprint for how your nonprofit will be run, who will be responsible for what, and how you plan to achieve your goals.

Your nonprofit organization also needs a business plan if you plan to secure support of any kind, be it monetary, in-kind , or even just support from volunteers. You need a business plan to convey your nonprofit’s purpose and goals.

It sometimes also happens that the board, or the administration under which a nonprofit operates, requires a nonprofit business plan.

To sum it all up, write a nonprofit business plan to:

- Layout your goals and establish milestones.

- Better understand your beneficiaries, partners, and other stakeholders.

- Assess the feasibility of your nonprofit and document your fundraising/financing model.

- Attract investment and prove that you’re serious about your nonprofit.

- Attract a board and volunteers.

- Position your nonprofit and get clear about your message.

- Force you to research and uncover new opportunities.

- Iron out all the kinks in your plan and hold yourself accountable.

Before starting your nonprofit business plan, it is important to consider the following:

- Who is your audience? E.g. If you are interested in fundraising, donors will be your audience. If you are interested in partnerships, potential partners will be your audience.

- What do you want their response to be? Depending on your target audience, you should focus on the key message you want them to receive to get the response that you want.

10-Step Guide on Writing a Business Plan for Nonprofits

Note: Steps 1, 2, and 3 are in preparation for writing your nonprofit business plan.

Step 1: Data Collection

Before even getting started with the writing, collect financial, operating, and other relevant data. If your nonprofit is already in operation, this should at the very least include financial statements detailing operating expense reports and a spreadsheet that indicates funding sources.

If your nonprofit is new, compile materials related to any secured funding sources and operational funding projections, including anticipated costs.

Step 2: Heart of the Matter

You are a nonprofit after all! Your nonprofit business plan should start with an articulation of the core values and your mission statement . Outline your vision, your guiding philosophy, and any other principles that provide the purpose behind the work. This will help you to refine and communicate your nonprofit message clearly.

Your nonprofit mission statement can also help establish your milestones, the problems your organization seeks to solve, who your organization serves, and its future goals.

Check out these great mission statement examples for some inspiration. For help writing your statement, download our free Mission & Vision Statements Worksheet .

Step 3: Outline

Create an outline of your nonprofit business plan. Write out everything you want your plan to include (e.g. sections such as marketing, fundraising, human resources, and budgets).

An outline helps you focus your attention. It gives you a roadmap from the start, through the middle, and to the end. Outlining actually helps us write more quickly and more effectively.

An outline will help you understand what you need to tell your audience, whether it’s in the right order, and whether the right amount of emphasis is placed on each topic.

Pro tip: Use our Nonprofit Business Plan Outline to help with this step! More on that later.

Step 4: Products, Programs, and Services

In this section, provide more information on exactly what your nonprofit organization does.

- What products, programs, or services do you provide?

- How does your nonprofit benefit the community?

- What need does your nonprofit meet and what are your plans for meeting that need?

E.g. The American Red Cross carries out its mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.

Don’t skimp out on program details, including the functions and beneficiaries. This is generally what most readers will care most about.

However, don’t overload the reader with technical jargon. Try to present some clear examples. Include photographs, brochures, and other promotional materials.

Step 5: Marketing Plan

A marketing plan is essential for a nonprofit to reach its goals. If your nonprofit is already in operation, describe in detail all current marketing activities: any outreach activities, campaigns, and other initiatives. Be specific about outcomes, activities, and costs.

If your nonprofit is new, outline projections based on specific data you gathered about your market.

This will frequently be your most detailed section because it spells out precisely how you intend to carry out your business plan.

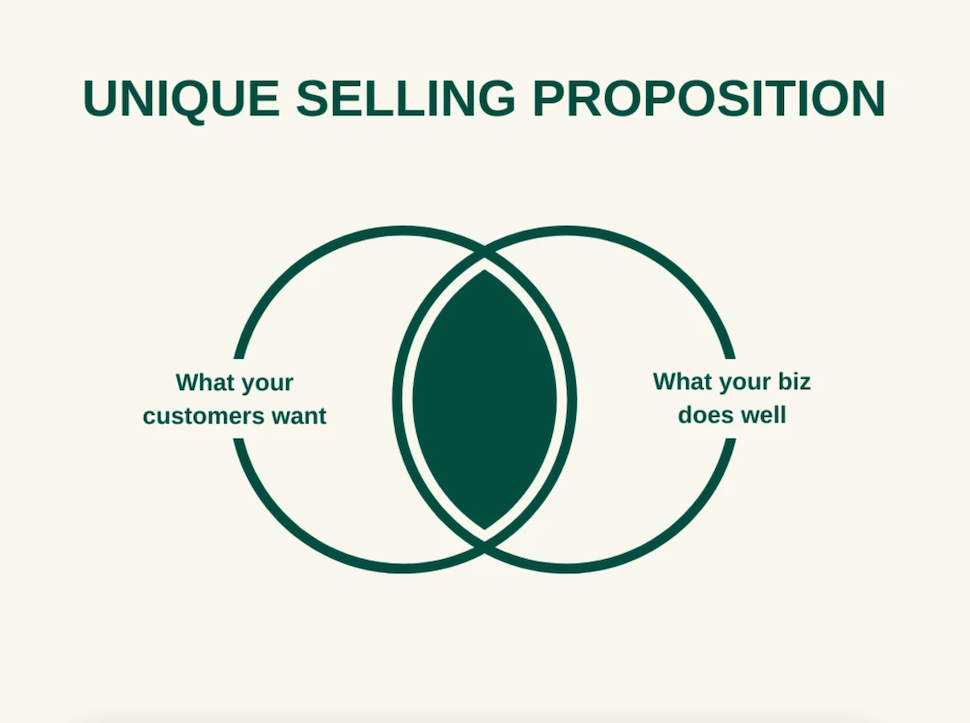

- Describe your market. This includes your target audience, competitors, beneficiaries, donors, and potential partners.

- Include any market analyses and tests you’ve done.

- Outline your plan for reaching your beneficiaries.

- Outline your marketing activities, highlighting specific outcomes.

Step 6: Operational Plan

An operational plan describes how your nonprofit plans to deliver activities. In the operational plan, it is important to explain how you plan to maintain your operations and how you will evaluate the impact of your programs.

The operational plan should give an overview of the day-to-day operations of your organization such as the people and organizations you work with (e.g. partners and suppliers), any legal requirements that your organization needs to meet (e.g. if you distribute food, you’ll need appropriate licenses and certifications), any insurance you have or will need, etc.

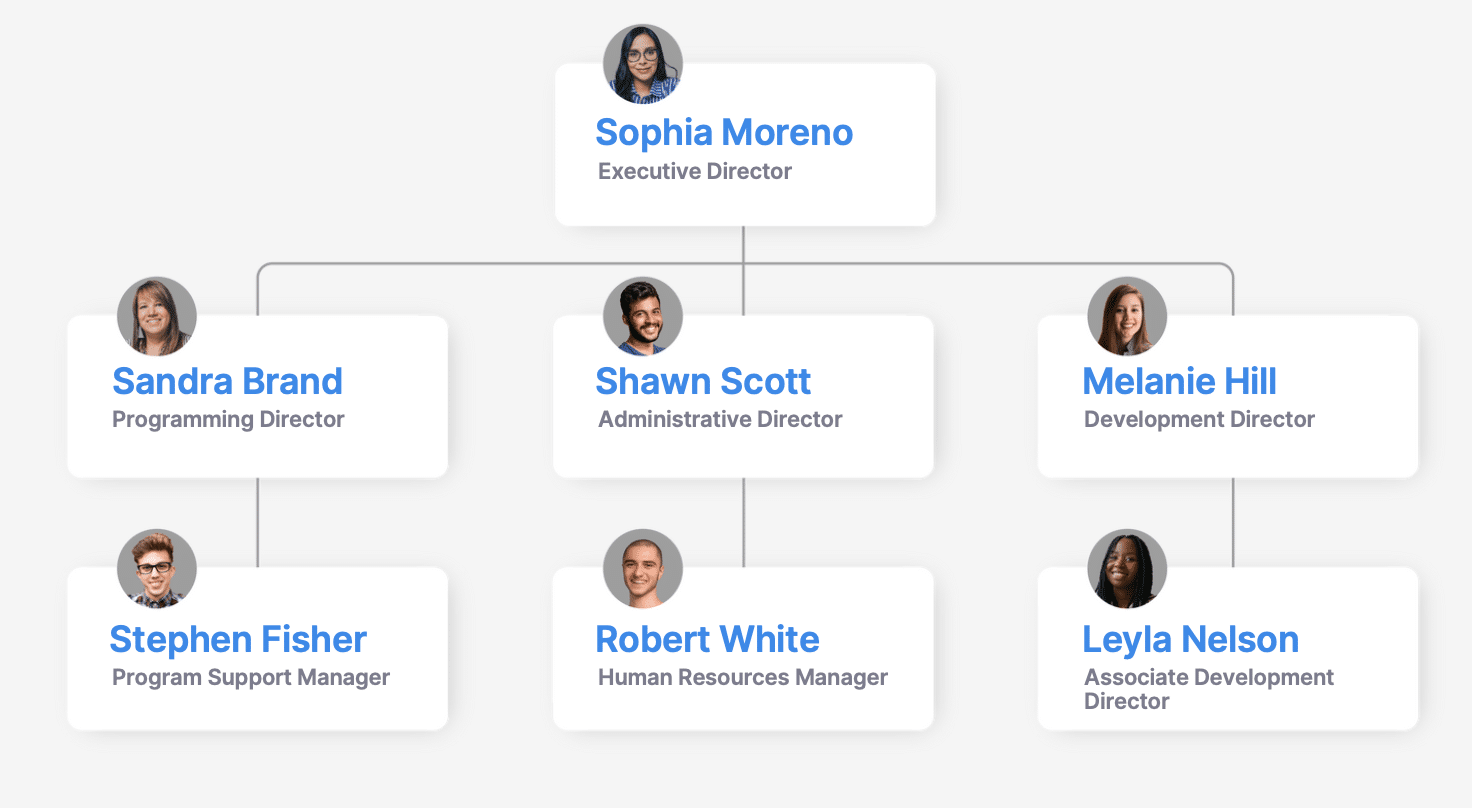

In the operational plan, also include a section on the people or your team. Describe the people who are crucial to your organization and any staff changes you plan as part of your business plan.

Pro tip: If you have an organizational chart, you can include it in the appendix to help illustrate how your organization operates. Learn more about the six types of nonprofit organizational charts and see them in action in this free e-book .

Step 7: Impact Plan

For a nonprofit, an impact plan is as important as a financial plan. A nonprofit seeks to create social change and a social return on investment, not just a financial return on investment.

Your impact plan should be precise about how your nonprofit will achieve this step. It should include details on what change you’re seeking to make, how you’re going to make it, and how you’re going to measure it.

This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives.

These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.

Answer these in the impact plan section of your business plan:

- What goals are most meaningful to the people you serve or the cause you’re fighting for?

- How can you best achieve those goals through a series of specific objectives?

E.g. “Finding jobs for an additional 200 unemployed people in the coming year.”

Step 8: Financial Plan

This is one of the most important parts of your nonprofit business plan. Creating a financial plan will allow you to make sure that your nonprofit has its basic financial needs covered.

Every nonprofit needs a certain level of funding to stay operational, so it’s essential to make sure your organization will meet at least that threshold.

To craft your financial plan:

- Outline your nonprofit’s current and projected financial status.

- Include an income statement, balance sheet , cash flow statement, and financial projections.

- List any grants you’ve received, significant contributions, and in-kind support.

- Include your fundraising plan .

- Identify gaps in your funding, and how you will manage them.

- Plan for what will be done with a potential surplus.

- Include startup costs, if necessary.

If your nonprofit is already operational, use established accounting records to complete this section of the business plan.

Knowing the financial details of your organization is incredibly important in a world where the public demands transparency about where their donations are going.

Pro tip : Leverage startup accelerators dedicated to nonprofits that can help you with funding, sponsorship, networking, and much more.

Step 9: Executive Summary

Normally written last but placed first in your business plan, your nonprofit executive summary provides an introduction to your entire business plan. The first page should describe your non-profit’s mission and purpose, summarize your market analysis that proves an identifiable need, and explain how your non-profit will meet that need.

The Executive Summary is where you sell your nonprofit and its ideas. Here you need to describe your organization clearly and concisely.

Make sure to customize your executive summary depending on your audience (i.e. your executive summary page will look different if your main goal is to win a grant or hire a board member).

Step 10: Appendix

Include extra documents in the section that are pertinent to your nonprofit: organizational chart , current fiscal year budget, a list of the board of directors, your IRS status letter, balance sheets, and so forth.

The appendix contains helpful additional information that might not be suitable for the format of your business plan (i.e. it might unnecessarily make it less readable or more lengthy).

Do’s and Dont’s of Nonprofit Business Plans – Tips

- Write clearly, using simple and easy-to-understand language.

- Get to the point, support it with facts, and then move on.

- Include relevant graphs and program descriptions.

- Include an executive summary.

- Provide sufficient financial information.

- Customize your business plan to different audiences.

- Stay authentic and show enthusiasm.

- Make the business plan too long.

- Use too much technical jargon.

- Overload the plan with text.

- Rush the process of writing, but don’t drag it either.

- Gush about the cause without providing a clear understanding of how you will help the cause through your activities.

- Keep your formatting consistent.

- Use standard 1-inch margins.

- Use a reasonable font size for the body.

- For print, use a serif font like Times New Roman or Courier. For digital, use sans serifs like Verdana or Arial.

- Start a new page before each section.

- Don’t allow your plan to print and leave a single line on an otherwise blank page.

- Have several people read over the plan before it is printed to make sure it’s free of errors.

Nonprofit Business Plan Template

To help you get started we’ve created a nonprofit business plan outline. This business plan outline will work as a framework regardless of your nonprofit’s area of focus. With it, you’ll have a better idea of how to lay out your nonprofit business plan and what to include. We have also provided several questions and examples to help you create a detailed nonprofit business plan.

Download Your Free Outline

At Donorbox, we strive to make your nonprofit experience as productive as possible, whether through our donation software or through our advice and guides on the Nonprofit Blog . Find more free, downloadable resources in our Library .

Many nonprofits start with passion and enthusiasm but without a proper business plan. It’s a common misconception that just because an organization is labeled a “nonprofit,” it does not need to operate in any way like a business.

However, a nonprofit is a type of business, and many of the same rules that apply to a for-profit company also apply to a nonprofit organization.

As outlined above, your nonprofit business plan is a combination of your marketing plan , strategic plan, operational plan, impact plan, and financial plan. Remember, you don’t have to work from scratch. Be sure to use the nonprofit business plan outline we’ve provided to help create one of your own.

It’s important to note that your nonprofit should not be set in stone—it can and should change and evolve. It’s a living organism. While your vision, values, and mission will likely remain the same, your nonprofit business plan may need to be revised from time to time. Keep your audience in mind and adjust your plan as needed.

Finally, don’t let your plan gather dust on a shelf! Print it out, put up posters on your office walls, and read from it during your team meetings. Use all the research, data, and ideas you’ve gathered and put them into action!

If you want more help with nonprofit management tips and fundraising resources, visit our Nonprofit Blog . We also have dedicated articles for starting a nonprofit in different states in the U.S., including Texas , Minnesota , Oregon , Arizona , Illinois , and more.

Learn about our all-in-one online fundraising tool, Donorbox, and its simple-to-use features on the website here .

Raviraj heads the sales and marketing team at Donorbox. His growth-hacking abilities have helped Donorbox boost fundraising efforts for thousands of nonprofit organizations.

Join the fundraising movement!

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, how to write a nonprofit business plan.

A nonprofit business plan ensures your organization’s fundraising and activities align with your core mission.

Every nonprofit needs a mission statement that demonstrates how the organization will support a social cause and provide a public benefit. A nonprofit business plan fleshes out this mission statement in greater detail. These plans include many of the same elements as a for-profit business plan, with a focus on fundraising, creating a board of directors, raising awareness, and staying compliant with IRS regulations. A nonprofit business plan can be instrumental in getting your organization off the ground successfully.

Start with your mission statement

The mission statement is foundational for your nonprofit organization. The IRS will review your mission statement in determining whether to grant you tax-exempt status. This statement also helps you recruit volunteers and staff, fundraise, and plan activities for the year.

[Read more: Writing a Mission Statement: A Step-by-Step Guide ]

Therefore, you should start your business plan with a clear mission statement in the executive summary. The executive summary can also cover, at a high level, the goals, vision, and unique strengths of your nonprofit organization. Keep this section brief, since you will be going into greater detail in later sections.

Identify a board of directors

Many business plans include a section identifying the people behind the operation: your key leaders, volunteers, and full-time employees. For nonprofits, it’s also important to identify your board of directors. The board of directors is ultimately responsible for hiring and managing the CEO of your nonprofit.

“Board members are the fiduciaries who steer the organization towards a sustainable future by adopting sound, ethical, and legal governance and financial management policies, as well as by making sure the nonprofit has adequate resources to advance its mission,” wrote the Council of Nonprofits.

As such, identify members of your board in your business plan to give potential donors confidence in the management of your nonprofit.

Be as realistic as possible about the impact you can make with the funding you hope to gain.

Describe your organization’s activities

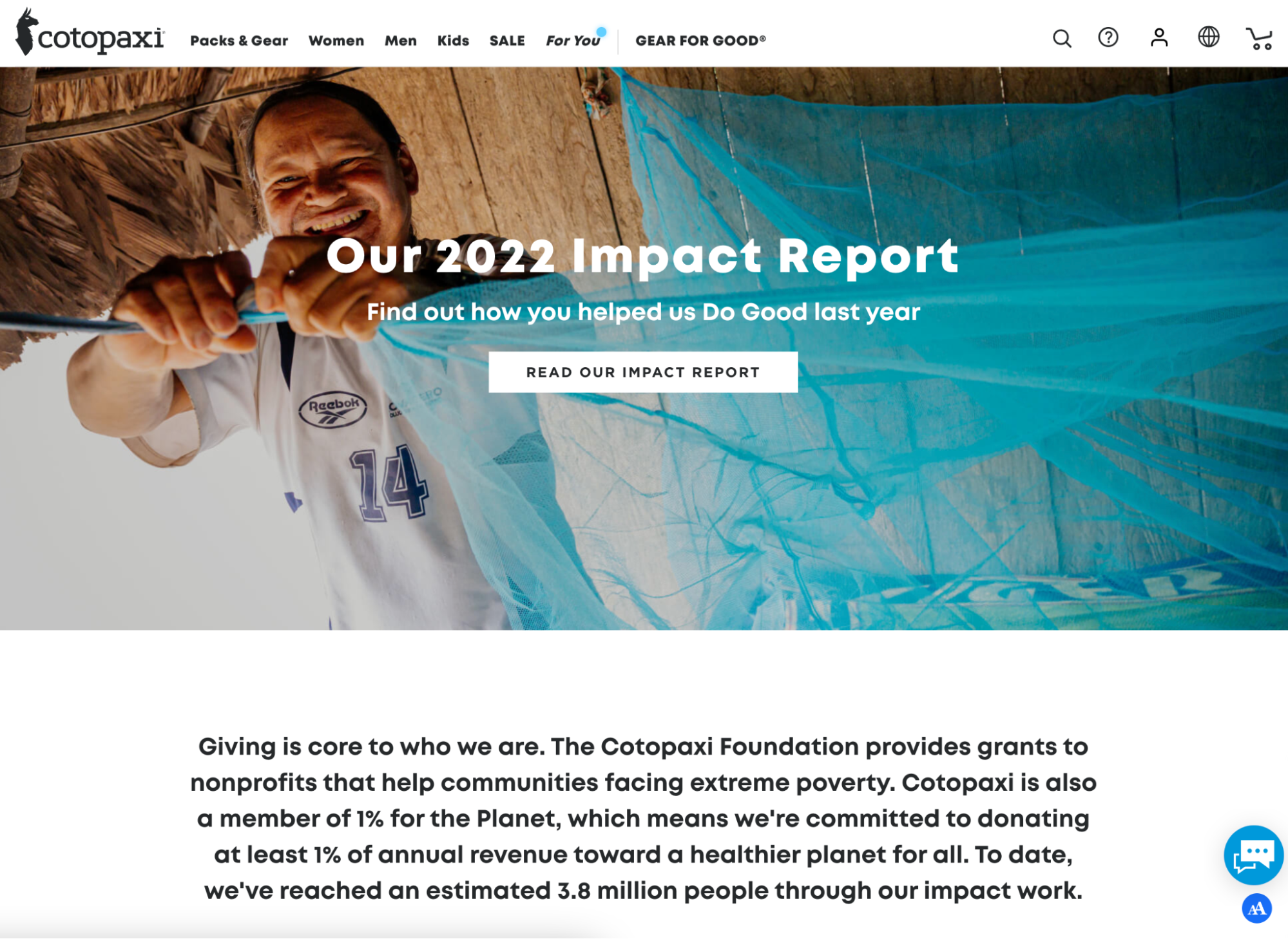

In this section, provide more information about what your nonprofit does on a day-to-day basis. What products, training, education, or other services do you provide? What does your organization do to benefit the constituents identified in your mission statement? Here’s an example from the American Red Cross, courtesy of DonorBox :

“The American Red Cross carries out their mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.”

This section should be detailed and get into the operational weeds of how your business delivers on its mission statement. Explain the strategies your team will take to service clients, including outreach and marketing, inventory and equipment needs, a hiring plan, and other key elements.

Write a fundraising plan

This part is the most important element of your business plan. In addition to providing required financial statements (e.g., the income statement, balance sheet, and cash flow statement), identify potential sources of funding for your nonprofit. These may include individual donors, corporate donors, grants, or in-kind support. If you are planning to host a fundraising event, put together a budget for that event and demonstrate the anticipated impact that event will have on your budget.

Create an impact plan

An impact plan ties everything together. It demonstrates how your fundraising and day-to-day activities will further your mission. For potential donors, it can make a very convincing case for why they should invest in your nonprofit.

“This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives,” wrote DonorBox . “These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.”

Be as realistic as possible about the impact you can make with the funding you hope to gain. Revisit your business plan as your organization grows to make sure the goals you’ve set both align with your mission and continue to be within reach.

[Read more: 8 Signs It's Time to Update Your Business Plan ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

How to build a manufacturing business plan, what 'feature creep' teaches small businesses about marketing messaging, sole proprietorship vs. llc: which structure should you choose.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Raise More & Grow Your Nonprofit.

The complete guide to writing a nonprofit business plan.

August 14, 2019

Leadership & Management

July 7, 2022

TABLE OF CONTENTS

Statistics from the National Center for Charitable Statistics (NCCS) show that there are over 1.5 million nonprofit organizations currently operating in the U.S. alone. Many of these organizations are hard at work helping people in need and addressing the great issues of our time. However, doing good work doesn’t necessarily translate into long-term success and financial stability. Other information has shown that around 12% of non-profits don’t make it past the 5-year mark, and this number expands to 17% at the 10-year mark.

12% of non-profits don’t make it past the 5-year mark and 17% at the 10-year mark

There are a variety of challenges behind these sobering statistics. In many cases, a nonprofit can be sunk before it starts due to a lack of a strong nonprofit business plan. Below is a complete guide to understanding why a nonprofit needs a business plan in place, and how to construct one, piece by piece.

The purpose of a nonprofit business plan

A business plan for a nonprofit is similar to that of a for-profit business plan, in that you want it to serve as a clear, complete roadmap for your organization. When your plan is complete, questions such as "what goals are we trying to accomplish?" or "what is the true purpose of our organization?" should be clear and simple to answer.

Your nonprofit business plan should provide answers to the following questions:

1. What activities do you plan to pursue in order to meet the organization’s high level goals?

2. What's your plan on getting revenue to fund these activities?

3. What are your operating costs and specifically how do these break down?

Note that there’s a difference between a business plan and a strategic plan, though there may be some overlap. A strategic plan is more conceptual, with different ideas you have in place to try and meet the organization’s greater vision (such as fighting homelessness or raising climate change awareness). A business plan serves as an action plan because it provides, in as much detail as possible, the specifics on how you’re going to execute your strategy.

More Reading

- What is the Difference Between a Business Plan and a Strategic Plan?

- Business Planning for Nonprofits

Creating a nonprofit business plan

With this in mind, it’s important to discuss the individual sections of a nonprofit business plan. Having a proper plan in a recognizable format is essential for a variety of reasons. On your business’s end, it makes sure that as many issues or questions you may encounter are addressed up front. For outside entities, such as potential volunteers or donors, it shows that their time and energy will be managed well and put to good use. So, how do you go from conceptual to concrete?

Step 1: Write a mission statement

Having a mission statement is essential for any company, but even more so for nonprofits. Your markers of success are not just how the organization performs financially, but the impact it makes for your cause.

One of the easiest ways to do this is by creating a mission statement. A strong mission statement clarifies why your organization exists and determines the direction of activities.

At the head of their ethics page , NPR has a mission statement that clearly and concisely explains why they exist. From this you learn:

- The key point of their mission: creating a more informed public that understands new ideas and cultures

- Their mechanism of executing that vision: providing and reporting news/info that meets top journalistic standards

- Other essential details: their partnership with their membership statement

You should aim for the same level of clarity and brevity in your own mission statement.

The goal of a mission statement isn’t just about being able to showcase things externally, but also giving your internal team something to realign them if they get off track.

For example, if you're considering a new program or services, you can always check the idea against the mission statement. Does it align with your higher level goal and what your organization is ultimately trying to achieve? A mission statement is a compass to guide your team and keep the organization aligned and focused.

Step 2: Collect the data

You can’t prepare for the future without some data from the past and present. This can range from financial data if you’re already in operation to secured funding if you’re getting ready to start.

Data related to operations and finances (such as revenue, expenses, taxes, etc.) is crucial for budgeting and organizational decisions.

You'll also want to collect data about your target donor. Who are they in terms of their income, demographics, location, etc. and what is the best way to reach them? Every business needs to market, and answering these demographic questions are crucial to targeting the right audience in a marketing campaign. You'll also need data about marketing costs collected from your fundraising, marketing, and CRM software and tools. This data can be extremely important for demonstrating the effectiveness of a given fundraising campaign or the organization as a whole.

Then there is data that nonprofits collect from third-party sources as to how to effectively address their cause, such as shared data from other nonprofits and data from governments.

By properly collecting and interpreting the above data, you can build your nonprofit to not only make an impact, but also ensure the organization is financially sustainable.

Step 3: Create an outline

Before you begin writing your plan, it’s important to have an outline of the sections of your plan. Just like an academic essay, it’s easier to make sure all the points are addressed by taking inventory of high level topics first. If you create an outline and find you don’t have all the materials you need to fill it, you may need to go back to the data collection stage.

Writing an outline gives you something simple to read that can easily be circulated to your team for input. Maybe some of your partners will want to emphasize an area that you missed or an area that needs more substance.

Having an outline makes it easier for you to create an organized, well-flowing piece. Each section needs to be clear on its own, but you also don’t want to be overly repetitive.

As a side-note, one area where a lot of business novices stall in terms of getting their plans off the ground is not knowing what format to choose or start with. The good news is there are a lot of resources available online for you to draw templates for from your plan, or just inspire one of your own.

Using a business plan template

You may want to use a template as a starting point for your business plan. The major benefit here is that a lot of the outlining work that we mentioned is already done for you. However, you may not want to follow the template word for word. A nonprofit business plan may require additional sections or parts that aren’t included in a conventional business plan template.

The best way to go about this is to try and focus less on copying the template, and more about copying the spirit of the template. For example, if you see a template that you like, you can keep the outline, but you may want to change the color scheme and font to better reflect your brand. And of course, all your text should be unique.

When it comes to adding a new section to a business plan template, for the most part, you can use your judgment. We will get into specific sections in a bit, but generally, you just want to pair your new section with the existing section that makes the most sense. For example, if your non-profit has retail sales as a part of a financial plan, you can include that along with the products, services and programs section.

- Free Nonprofit Sample Business Plans - Bplans

- Non-Profit Business Plan Template - Growthink

- Sample Nonprofit Business Plans - Bridgespan

- Nonprofit Business Plan Template - Slidebean

- 23+ Non Profit Business Plan Templates - Template.net

Nonprofit business plan sections

The exact content is going to vary based on the size, purpose, and nature of your nonprofit. However, there are certain sections that every business plan will need to have for investors, donors, and lenders to take you seriously. Generally, your outline will be built around the following main sections:

1. Executive summary

Many people write this last, even though it comes first in a business plan. This is because the executive summary is designed to be a general summary of the business plan as a whole. Naturally, it may be easier to write this after the rest of the business plan has been completed.

After reading your executive summary a person should ideally have a general idea of what the entire plan covers. Sometimes, a person may be interested in learning about your non-profit, but doesn’t have time to read a 20+ page document. In this case, the executive summary could be the difference between whether or not you land a major donor.

As a start, you want to cover the basic need your nonprofit services, why that need exists, and the way you plan to address that need. The goal here is to tell the story as clearly and and concisely as possible. If the person is sold and wants more details, they can read through the rest of your business plan.

2. Products/Services/Programs

This is the space where you can clarify exactly what your non-profit does. Think of it as explaining the way your nonprofit addresses that base need you laid out earlier. This can vary a lot based on what type of non-profit you’re running.

This page gives us some insight into the mechanisms Bucks County Historical Society uses to further their mission, which is “to educate and engage its many audiences in appreciating the past and to help people find stories and meanings relevant to their lives—both today and in the future.”

They accomplish this goal through putting together both permanent exhibits as well as regular events at their primary museum. However, in a non-profit business plan, you need to go further.

It’s important here not only to clearly explain who benefits from your services, but also the specific details how those services are provided. For example, saying you “help inner-city school children” isn’t specific enough. Are you providing education or material support? Your non-profit business plan readers need as much detail as possible using simple and clear language.

3. Marketing

For a non-profit to succeed, it needs to have a steady stream of both donors and volunteers. Marketing plays a key role here as it does in a conventional business. This section should outline who your target audience is, and what you’ve already done/plan on doing to reach this audience. How you explain this is going to vary based on what stage your non-profit is in. We’ll split this section to make it more clear.

Nonprofits not in operation

Obviously, it’s difficult to market an idea effectively if you’re not in operation, but you still need to have a marketing plan in place. People who want to support your non-profit need to understand your marketing plan to attract donors. You need to profile all the data you have about your target market and outline how you plan to reach this audience.

Nonprofits already in operation

Marketing plans differ greatly for nonprofits already in operation. If your nonprofit is off the ground, you want to include data about your target market as well, along with other key details. Describe all your current marketing efforts, from events to general outreach, to conventional types of marketing like advertisements and email plans. Specific details are important. By the end of this, the reader should know:

- What type of marketing methods your organization prefers

- Why you’ve chosen these methods

- The track record of success using these methods

- What the costs and ROI of a marketing campaign

4. Operations

This is designed to serve as the “how” of your Products/Services/Programs section.

For example, if your goal is to provide school supplies for inner-city schoolchildren, you’ll need to explain how you will procure the supplies and distribute them to kids in need. Again, detail is essential. A reader should be able to understand not only how your non-profit operates on a daily basis, but also how it executes any task in the rest of the plan.

If your marketing plan says that you hold community events monthly to drum up interest. Who is in charge of the event? How are they run? How much do they cost? What personnel or volunteers are needed for each event? Where are the venues?

This is also a good place to cover additional certifications or insurance that your non-profit needs in order to execute these operations, and your current progress towards obtaining them.

Your operations section should also have a space dedicated to your team. The reason for this is, just like any other business plan, is that the strength of an organization lies in the people running it.

For example, let’s look at this profile from The Nature Conservancy . The main points of the biography are to showcase Chief Development Officer Jim Asp’s work history as it is relevant to his job. You’ll want to do something similar in your business plan’s team section.

Equally important is making sure that you cover any staff changes that you plan to implement in the near future in your business plan. The reason for this is that investors/partners may not want to sign on assuming that one leadership team is in place, only for it to change when the business reaches a certain stage.

The sections we’ve been talking about would also be in a traditional for profit business plan. We start to deviate a bit at this point. The impact section is designed to outline the social change you plan to make with your organization, and how your choices factor into those goals.

Remember the thoughts that go into that mission statement we mentioned before? This is your chance to show how you plan to address that mission with your actions, and how you plan to track your progress.

Let’s revisit the idea of helping inner-city school children by providing school supplies. What exactly is the metric you’re going to use to determine your success? For-profit businesses can have their finances as their primary KPI, but it’s not that easy for non-profits. Let’s say that your mission is to provide 1,000 schoolchildren in an underserved school district supplies for their classes. Your impact plan could cover two metrics:

- How many supplies are distributed

- Secondary impact (improved grades, classwork completed, etc).

The primary goal of this section is to transform that vision into concrete, measurable goals and objectives. A great acronym to help you create these are S.M.A.R.T. goals which stands for: specific, measurable, attainable, relevant, and timely.

Vitamin Angels does a good job of showing how their action supports the mission. Their goal of providing vitamins to mothers and children in developing countries has a concrete impact when we look at the numbers of how many children they service as well as how many countries they deliver to. As a non-profit business plan, it’s a good idea to include statistics like these to show exactly how close you are to your planned goals.

6. Finances

Every non-profit needs funding to operate, and this all-important section details exactly how you plan to cover these financial needs. Your business plan can be strong in every other section, but if your financial planning is flimsy, it’s going to prove difficult to gather believers to your cause.

It's important to paint a complete, positive picture of your fundraising plans and ambitions. Generally, this entails the following parts:

- Current financial status, such as current assets, cash on hand, liabilities

- Projections based off of your existing financial data and forms

- Key financial documents, such as a balance sheet, income statements, and cash flow sheet

- Any grants or major contributions received

- Your plan for fundraising (this may overlap with your marketing section which is okay)

- Potential issues and hurdles to your funding plan

- Your plans to address those issues

- How you'll utilize surplus donations

- Startup costs (if your non-profit is not established yet)

In general, if you see something else that isn’t accounted for here, it’s better to be safe than sorry, and put the relevant information in. It’s better to have too much information than too little when it comes to finances, especially since there is usually a clear preference for transparent business culture.

- How to Make a Five-Year Budget Plan for a Nonprofit

- Financial Transparency - National Council of Nonprofits

7. Appendix

Generally, this serves as a space to attach additional documents and elements that you may find useful for your business plan. This can include things like supplementary charts or a list of your board of directors.

This is also a good place to put text or technical information that you think may be relevant to your business plan, but might be long-winded or difficult to read. A lot of the flow and structure concerns you have for a plan don’t really apply with an appendix.

In summary, while a non-profit may have very different goals than your average business, the ways that they reach those goals do have a lot of similarities with for-profit businesses. The best way to ensure your success is to have a clear, concrete vision and path to different milestones along the way. A solid, in-depth business plan also gives you something to refer back to when you are struggling and not sure where to turn.

Alongside your business plan, you also want to use tools and resources that promote efficiency at all levels. For example, every non-profit needs a consistent stream of donations to survive, so consider using a program like GiveForms that creates simple, accessible forms for your donors to easily make donations. Accounting and budgeting for these in your plans can pay dividends later on.

Share this Article

Related articles, start fundraising today.

- Insights & Analysis

- Nonprofit Jobs

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Cookie settings

We use cookies

We use cookies to improve your experience on our platform. By clicking “Accept all cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage and assist in our marketing efforts.

The Ultimate Guide to Writing a Nonprofit Business Plan

https://home.simplyk.io/blog/nonprofit-business-plan

What is a nonprofit business plan?

In simple terms, a nonprofit business plan is your organization’s roadmap to success. It’s a comprehensive document that outlines your nonprofit’s goals, strategies, and action plans for achieving its mission. Just like a GPS guides you to your destination, a well-crafted business plan guides your nonprofit toward its vision of a better world.

Do I need a nonprofit business plan?

A nonprofit business plan is more than just an additional tool—it’s an essential part of any nonprofit. A business plan:

Guides your organization: A nonprofit business plan serves as your organization’s compass, guiding you toward your goals. It provides clarity on what you want to achieve and how you’ll get there. Without a plan, you’re like a ship adrift at sea—directionless and vulnerable to the whims of the waves.

Facilitates strategy: A well-crafted plan helps you make informed decisions about resource allocation, program development, fundraising strategies, and more.

Promotes accountability: When donors, volunteers, and community members invest their time, money, and trust in your organization, they want to know their efforts aren’t going to waste. A nonprofit business plan demonstrates your commitment to achieving results and holds you accountable to stakeholders. It’s your promise to deliver on your mission and make a meaningful impact in the world.

Supports sustainability: Economic downturns, shifts in public opinion, and evolving community needs can all impact your organization’s ability to thrive. A nonprofit business plan helps you anticipate and navigate these challenges, ensuring your organization remains resilient and sustainable for the long haul.

The 10-Step guide on writing a business plan for nonprofits

Crafting a business plan for your nonprofit organization is a crucial step toward success. This comprehensive guide will walk you through each step, providing actionable insights and tips to help you create a robust plan that sets your nonprofit up for success.

Step 1: Clarify your mission

Your mission and vision are the heart and soul of your nonprofit. Start by defining your mission statement—what you do and why it matters. Then, articulate your vision statement, outlining the future you aspire to create. Be concise, compelling, and specific.

Gather your team and brainstorm ideas to refine your mission and vision statements. Consider what sets your organization apart and how you envision making a difference.

Step 2: Conduct a needs assessment

Understanding the needs of your community or target audience is essential for designing effective programs and services. Conduct thorough research, engage with stakeholders, and gather data to identify the most pressing issues you aim to address.

To do this, create a needs assessment survey or conduct interviews with community members, partners, and experts. Analyze the data to prioritize the most significant needs your organization can address.

Step 3: Define your goals

Set clear, measurable goals that align with your mission and address the identified needs. Break down each goal into specific objectives, outlining the steps you’ll take to achieve them. Use the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—to ensure your goals are realistic and actionable.

Host a goal-setting workshop with your team to brainstorm and prioritize objectives. Use a goal-setting framework like OKRs (Objectives and Key Results) to ensure alignment and accountability.

Step 4: Outline your programs

Describe the programs and services your nonprofit will offer to address the identified needs. Define the goals, activities, target audience, and expected outcomes of each program. Consider how your programs will complement each other and work together to achieve your overall mission.

Step 5: Develop a marketing and outreach plan

Create a marketing and outreach plan to raise awareness about your organization and attract supporters, volunteers, and beneficiaries. Define your target audience, messaging, channels, and tactics for reaching and engaging key stakeholders.

To do this, conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to assess your organization’s marketing and outreach capabilities. Develop a marketing calendar with key milestones and campaigns to guide your efforts.

Step 6: Create a financial plan

Develop a detailed budget and financial projections for your nonprofit. Identify potential revenue streams, such as grants, donations, fundraising events, membership fees, and earned income. Estimate expenses for staffing, programs, operations, and overhead costs.

Step 7: Establish governance and management structure

Define your nonprofit's organizational structure, including leadership roles, board of directors, staff positions, and volunteer management. Clarify responsibilities, decision-making processes, and lines of authority to ensure effective governance and management.

Action: Review and update your bylaws, policies, and procedures to reflect your organization’s current needs and goals. Provide board orientation and training to ensure board members understand their roles and responsibilities.

Step 8: Consider risks

Identify potential risks and challenges that could impact your organization’s ability to achieve its goals. Develop strategies to mitigate these risks and ensure the sustainability of your nonprofit. Consider risks related to funding, operations, legal compliance, reputation, and external factors.

Step 9: Monitor and evaluate

Establish systems for monitoring and evaluating the effectiveness of your programs and operations. Define key performance indicators (KPIs) and metrics to track progress towards your goals. Regularly review and update your business plan based on feedback and results.

Step 10: Communicate your plan

Share your business plan with stakeholders, including board members, staff, volunteers, donors, partners, and the community. Solicit feedback, build buy-in, and encourage collaboration toward achieving your nonprofit’s mission and vision. Use various communication channels and platforms to keep stakeholders informed and engaged.

To do this, you might host a launch event or town hall meeting to present your business plan to stakeholders and answer questions. Develop a communications plan to ensure consistent messaging and updates across all channels.

Essential nonprofit business plan elements

- Mission and vision : Clearly define the nonprofit's purpose and long-term goals.

- Needs assessment : Identify the needs of the community or target audience your nonprofit serves.

- Programs and services : Describe the programs and services your nonprofit offers to address identified needs.

- Marketing and outreach : Develop strategies to raise awareness and attract supporters, volunteers, and beneficiaries.

- Financial plan : Create a budget and financial projections, outlining revenue sources and expenses.

- Governance and management : Establish the organizational structure and define roles and responsibilities.

- Risk management : Identify potential risks and develop strategies to mitigate them.

- Monitoring and evaluation : Set up systems to track progress and evaluate program effectiveness.

- Communication and engagement : Share your business plan with stakeholders and engage them in your nonprofit's work.

- Executive summary : Provide a concise overview of the nonprofit and its key objectives.

Nonprofit business plan template

1. executive summary.

- Mission Statement: [Briefly describe your nonprofit's mission and vision.]

- Objectives: [List the key objectives your nonprofit aims to achieve.]

- Strategies: [Summarize the strategies and tactics your nonprofit will use to achieve its objectives.]

- Financial Overview: [Provide an overview of your nonprofit's financial projections and funding needs.]

2. Organization Description

- Mission Statement: [State your nonprofit's mission.]

- Vision Statement: [Outline your nonprofit's vision for the future.]

- History: [Briefly describe the history and background of your nonprofit.]

- Legal Structure: [Specify the legal structure of your nonprofit (e.g., 501(c)(3) status).]

- Governance: [Describe the governance structure of your nonprofit, including the board of directors and leadership team.]

3. Needs Assessment

- Community Needs: [Identify the needs of the community or target audience your nonprofit serves.]

- Data and Research: [Provide data and research supporting the identified needs.]

- Program Impact: [Explain how your nonprofit addresses the identified needs and the impact of its programs.]

4. Programs and Services

- Program Descriptions: [Describe the programs and services your nonprofit offers, including goals, objectives, and outcomes.]

- Logic Models: [Include logic models or theory of change diagrams for each program.]

5. Marketing and Outreach Plan

- Target Audience: [Define your nonprofit's target audience.]

- Messaging: [Outline the messaging and branding strategies for your nonprofit.]

- Marketing Channels: [List the marketing channels and tactics you will use to reach your target audience.]

6. Financial Plan

- Budget: [Provide a detailed budget for your nonprofit, including income and expenses.]

- Financial Projections: [Include financial projections for the next three to five years.]

- Revenue Streams: [Identify potential revenue streams, such as grants, donations, and fundraising events.]

7. Governance and Management

- Organizational Structure: [Describe the organizational structure of your nonprofit, including the board of directors, staff positions, and volunteer management.]

- Roles and Responsibilities: [Clarify the roles and responsibilities of board members, staff, and volunteers.]

8. Risk Management

- Risk Identification: [Identify potential risks and challenges that could impact your nonprofit's operations.]

- Risk Mitigation: [Develop strategies to mitigate the identified risks and ensure the sustainability of your nonprofit.]

9. Monitoring and Evaluation

- Key Performance Indicators: [Define key performance indicators (KPIs) and metrics to track progress toward your nonprofit's objectives.]

- Evaluation Framework: [Establish an evaluation framework for assessing program effectiveness and impact.]

10. Communication and Engagement

- Stakeholder Communication: [Develop a stakeholder communication plan to keep stakeholders informed and engaged.]

- Engagement Strategies: [Outline strategies for engaging board members, staff, volunteers, donors, and the community in your nonprofit's work.]

Add free fundraising to your nonprofit business plan

Whether you’re a brand new nonprofit looking to get your fundraising up and running, or an established one looking for new tools and features to make even more impact, Zeffy is one of the best all-in-one solutions for all of your nonprofit needs.

From event tracking and management to marketing and engagement tools, custom donation forms, and even the ability to create an online shop or nonprofit membership association, Zeffy offers everything you need without charging a single fee.

Simple and powerful — and packed with free support whenever you need it — Zeffy ensures that your donor’s gifts are going right to the cause, and nowhere else.

Nonprofit Business Plan FAQS

Starting a nonprofit organization with no money requires strategic planning. To cut down on costs, consider:

- Using volunteers: Leverage volunteers for administrative, fundraising, or program work, to reduce the need for paid staff.

- Seeking out in-kind donations and grants: Ask for donations of goods and services from businesses, individuals, or other organizations to support your nonprofit's activities (think office space or equipment). And, research grant opportunities to generate free financial support for your nonprofit's mission.

- Leveraging partnerships: Look for potential partners, such as other nonprofits or community organizations, who might want to collaborate on shared goals.

- Taking advantage of free tools and platforms: Be sure to use fundraising and donor engagement tools that are completely free to use, like Zeffy. That way, you’ll never have to worry about hidden fees and can get started making an impact right away — without paying a cent.

Start fundraising with Zeffy for free

Here are some ways nonprofit founders can pay themselves:

- Salary or wages: Nonprofit founders can receive a salary or hourly wages for their services, similar to employees of the organization.

- Reimbursement for expenses: Nonprofit founders can be reimbursed for reasonable and necessary expenses incurred in the course of their duties, such as travel expenses, office supplies, and professional development costs.

- Consulting or contractual arrangements: Nonprofit founders may enter into consulting or contractual agreements with the organization to provide specific services or expertise on a project basis.

Donor management and fundraising software can support strategic planning in a few ways:

- Data centralization: Donor management software centralizes donor information for analysis and insights.

- Targeted engagement: Software enables personalized communication and engagement strategies.

- Campaign management: Facilitates planning, execution, and tracking of fundraising campaigns.

- Donor retention: Supports cultivation and stewardship efforts to retain donors.

More articles

How to start a school in 10 steps: a guide for nonprofits, the essential nonprofit capacity building guide for growth, keep reading :.

Everything you need to know about creating a nonprofit annual report. Learn what to include, best practices, and annual report examples.

Learn how to start a nonprofit with our comprehensive guide. Ready to make a difference ? Discover the 9 steps to transform your passion into action.

Maximize your nonprofit's impact with our 7-step guide to creating an effective strategic plan. Learn how to set SMART goals, engage stakeholders, and align your fundraising efforts.

Free Nonprofit Business Plan Templates

By Joe Weller | September 18, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up the most useful list of nonprofit business plan templates, all free to download in Word, PDF, and Excel formats.

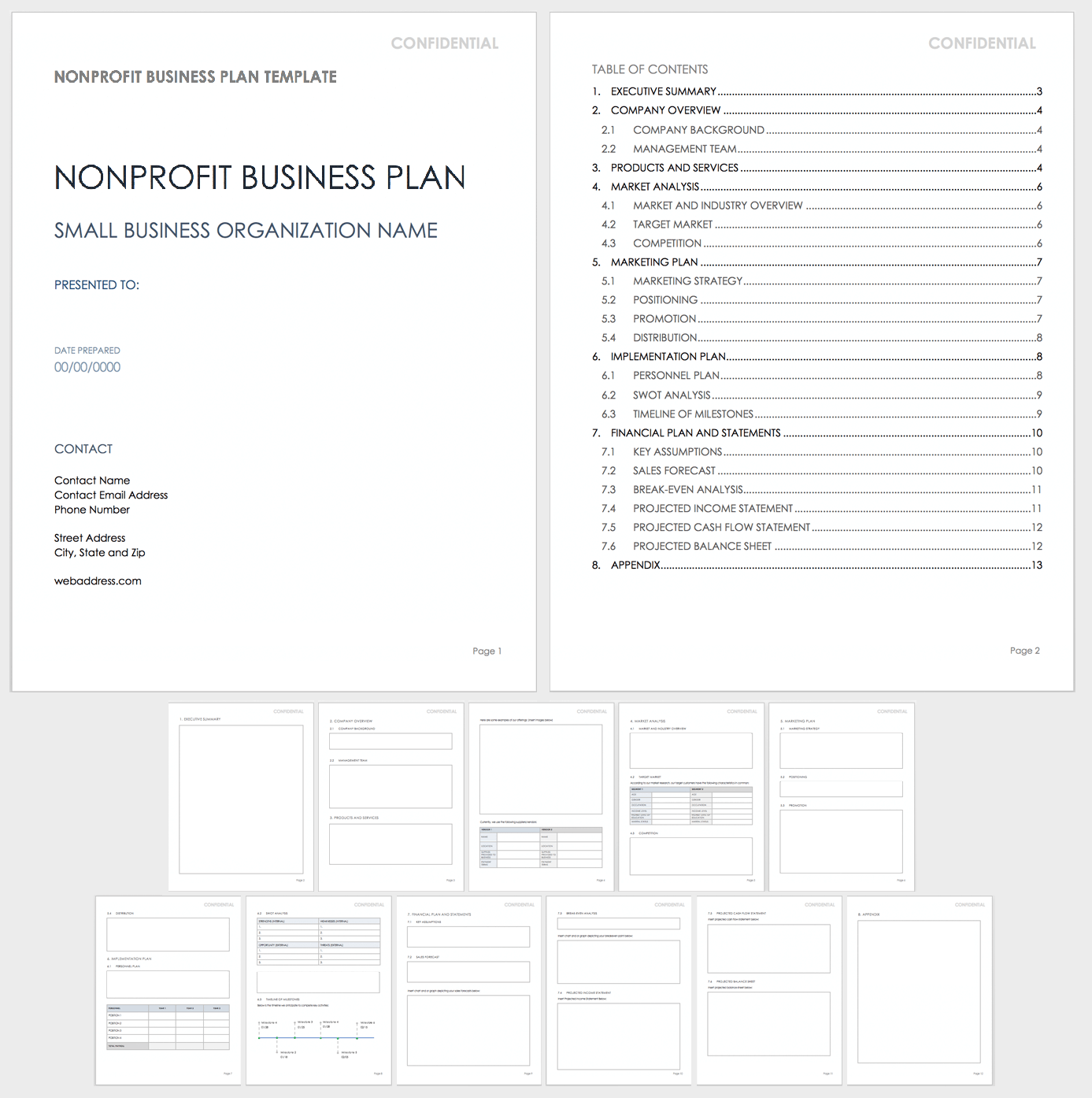

Included on this page, you’ll find a one-page nonprofit business plan template , a fill-in-the-blank nonprofit business plan template , a startup nonprofit business planning timeline template , and more. Plus, we provide helpful tips for creating your nonprofit business plan .

Nonprofit Business Plan Template

Use this customizable nonprofit business plan template to organize your nonprofit organization’s mission and goals and convey them to stakeholders. This template includes space for information about your nonprofit’s background, objectives, management team, program offerings, market analysis, promotional activities, funding sources, fundraising methods, and much more.

Download Nonprofit Business Plan Template

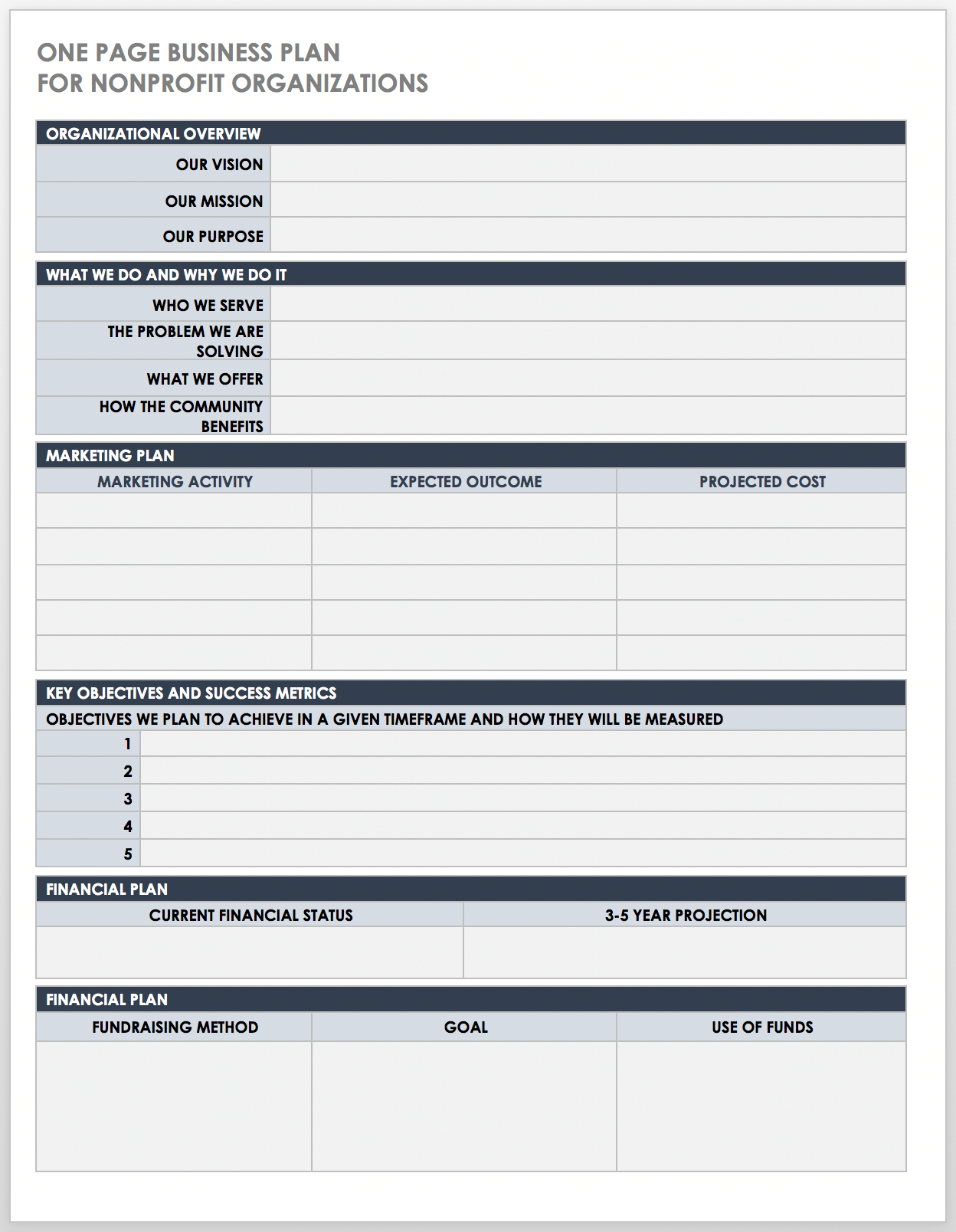

One-Page Business Plan for Nonprofit Template

This one-page nonprofit business plan template has a simple and scannable design to outline the key details of your organization’s strategy. This template includes space to detail your mission, vision, and purpose statements, as well as the problems you aim to solve in your community, the people who benefit from your program offerings, your key marketing activities, your financial goals, and more.

Download One-Page Business Plan for Nonprofit Template

Excel | Word | PDF

For additional resources, including an example of a one-page business plan , visit “ One-Page Business Plan Templates with a Quick How-To Guide .”

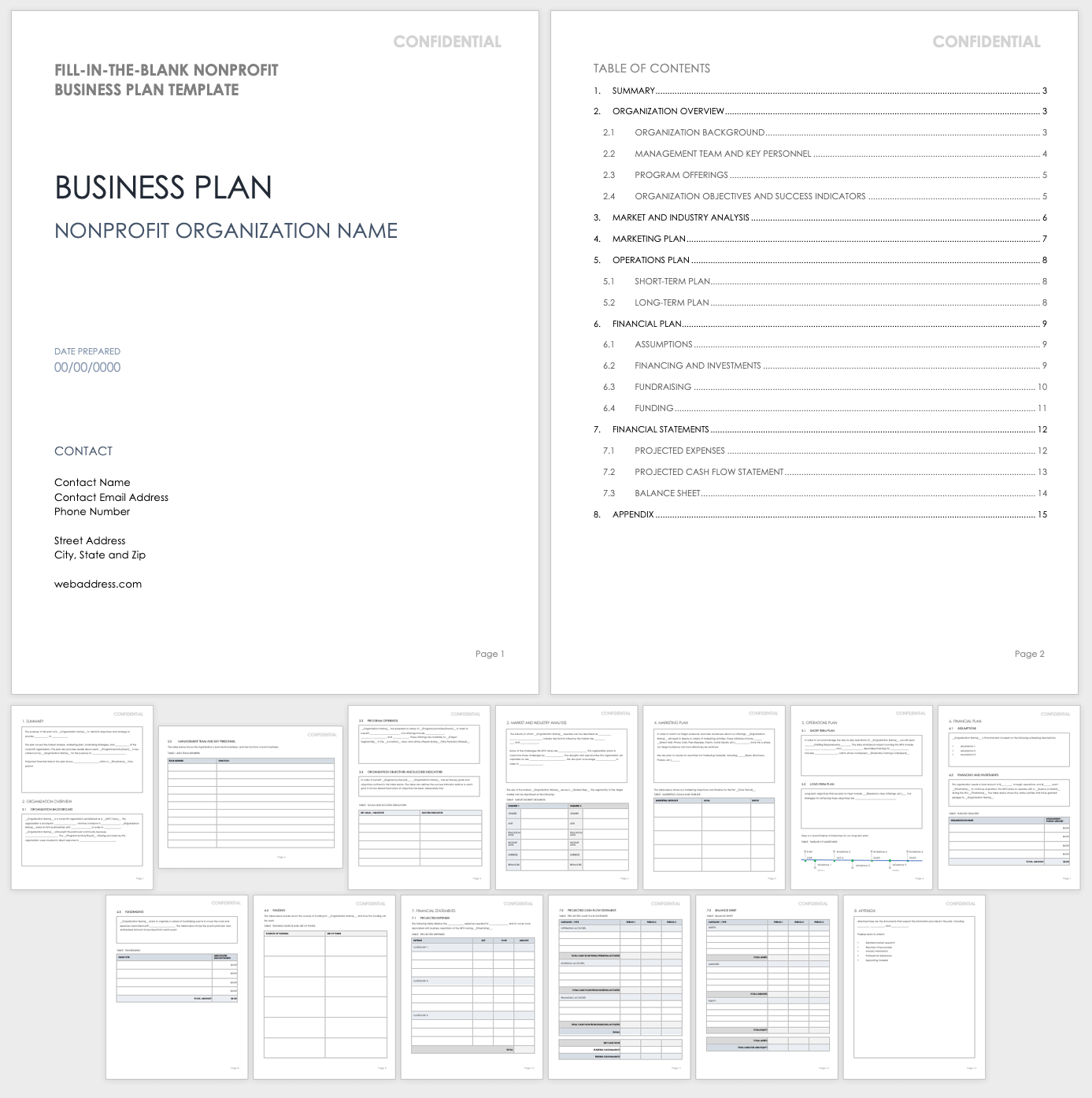

Fill-In-the-Blank Nonprofit Business Plan Template

Use this fill-in-the-blank template as the basis for building a thorough business plan for a nonprofit organization. This template includes space to describe your organization’s background, purpose, and main objectives, as well as key personnel, program and service offerings, market analysis, promotional activities, fundraising methods, and more.

Download Fill-In-the-Blank Nonprofit Business Plan Template

For additional resources that cater to a wide variety of organizations, visit “ Free Fill-In-the-Blank Business Plan Templates .”

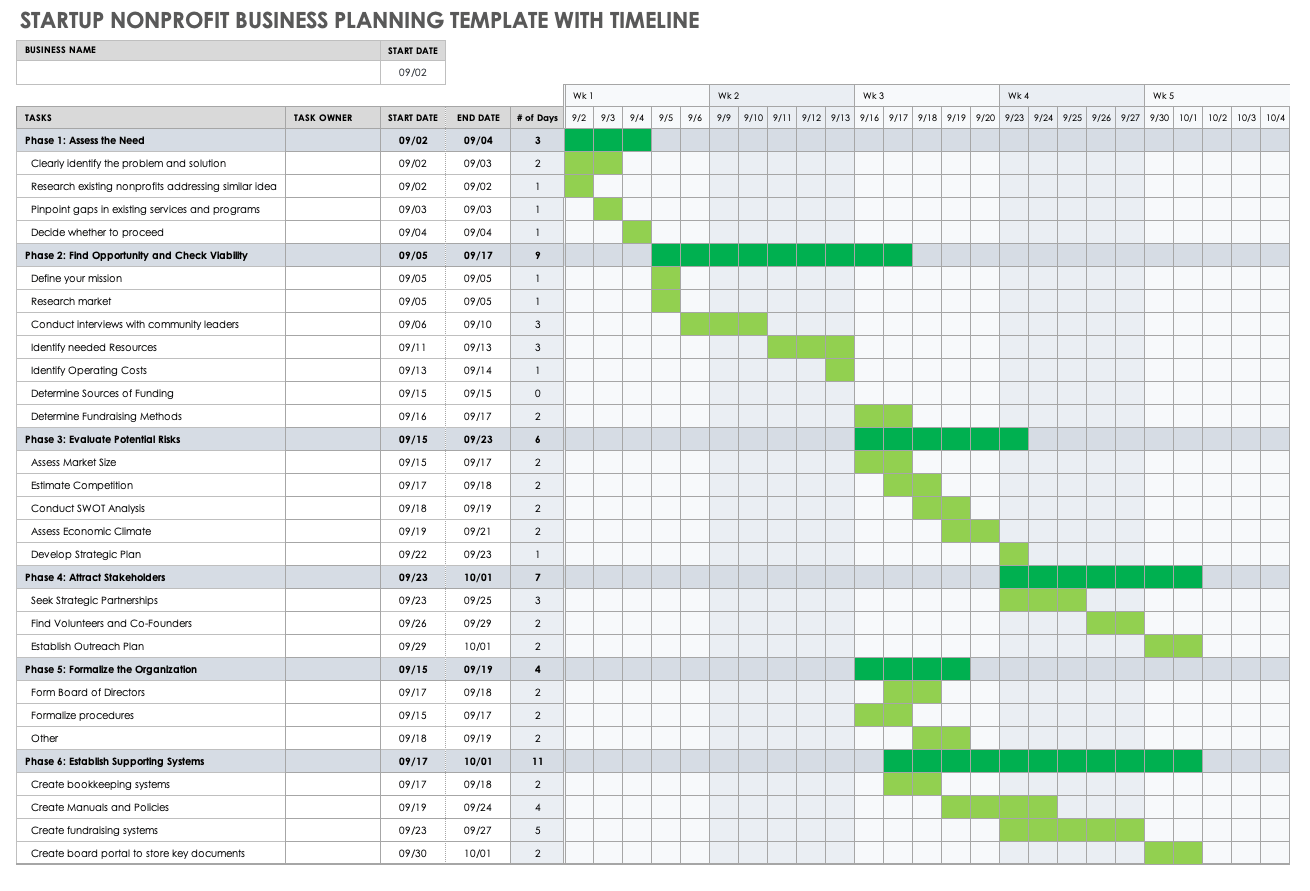

Startup Nonprofit Business Planning Template with Timeline

Use this business planning template to organize and schedule key activities for your business. Fill in the cells according to the due dates, and color-code the cells by phase, owner, or category to provide a visual timeline of progress.

Download Startup Nonprofit Business Planning Template with Timeline

Excel | Smartsheet

Nonprofit Business Plan Template for Youth Program

Use this template as a foundation for building a powerful and attractive nonprofit business plan for youth programs and services. This template has all the core components of a nonprofit business plan. It includes room to detail the organization’s background, management team key personnel, current and future youth program offerings, promotional activities, operations plan, financial statements, and much more.

Download Nonprofit Business Plan Template for Youth Program

Word | PDF | Google Doc

Sample Nonprofit Business Plan Outline Template

You can customize this sample nonprofit business plan outline to fit the specific needs of your organization. To ensure that you don’t miss any essential details, use this outline to help you prepare and organize the elements of your plan before filling in each section.

Download Sample Nonprofit Business Plan Outline Template

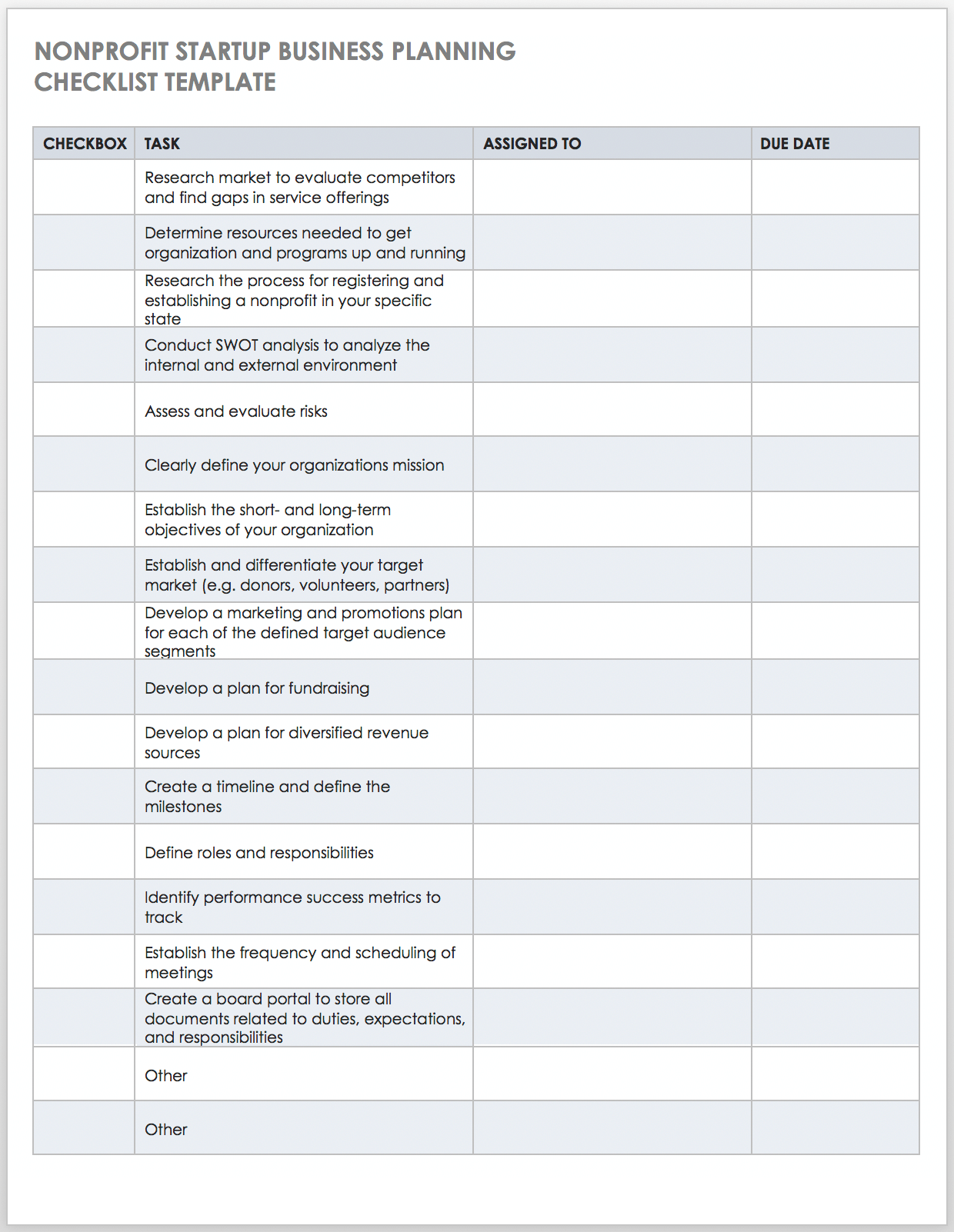

Nonprofit Startup Business Planning Checklist Template

Use this customizable business planning checklist as the basis for outlining the necessary steps to get your nonprofit organization up and running. You can customize this checklist to fit your individual needs. It includes essential steps, such as conducting a SWOT analysis , fulfilling the research requirements specific to your state, conducting a risk assessment , defining roles and responsibilities, creating a portal for board members, and other tasks to keep your plan on track.

Download Nonprofit Startup Business Planning Checklist Template

Tips to Create Your Nonprofit Business Plan

Your nonprofit business plan should provide your donors, volunteers, and other key stakeholders with a clear picture of your overarching mission and objectives. Below, we share our top tips for ensuring that your plan is attractive and thorough.

- Develop a Strategy First: You must aim before you fire if you want to be effective. In other words, develop a strategic plan for your nonprofit in order to provide your team with direction and a roadmap before you build your business plan.

- Save Time with a Template: No need to start from scratch when you can use a customizable nonprofit business plan template to get started. (Download one of the options above.)

- Start with What You Have: With the exception of completing the executive summary, which you must do last, you aren’t obligated to fill in each section of the plan in order. Use the information you have on hand to begin filling in the various parts of your business plan, then conduct additional research to fill in the gaps.

- Ensure Your Information Is Credible: Back up all the details in your plan with reputable sources that stakeholders can easily reference.

- Be Realistic: Use realistic assumptions and numbers in your financial statements and forecasts. Avoid the use of overly lofty or low-lying projections, so stakeholders feel more confident about your plan.

- Strive for Scannability: Keep each section clear and concise. Use bullet points where appropriate, and avoid large walls of text.

- Use Visuals: Add tables, charts, and other graphics to draw the eye and support key points in the plan.

- Be Consistent: Keep the voice and formatting (e.g., font style and size) consistent throughout the plan to maintain a sense of continuity.

- Stay True to Your Brand: Make sure that the tone, colors, and overall style of the business plan are a true reflection of your organization’s brand.

- Proofread Before Distribution: Prior to distributing the plan to stakeholders, have a colleague proofread the rough version to check for errors and ensure that the plan is polished.

- Don’t Set It and Forget It: You should treat your nonprofit business plan as a living document that you need to review and update on a regular basis — as objectives change and your organization grows.

- Use an Effective Collaboration Tool: Use an online tool to accomplish the following: collaborate with key personnel on all components of the business plan; enable version control for all documents; and keep resources in one accessible place.

Improve Your Nonprofit Business Planning Efforts with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Nonprofit Business Plan Template & Guide [Updated 2024]

Nonprofit business plan template.

Are you passionate about making a positive impact in your community? Are you part of a nonprofit organization or considering starting one? If so, you need a business plan and you’re in the right place to do that!

Below, we’ll guide you through the essential elements of a nonprofit business plan, sharing valuable insights and a user-friendly template to set you on the path to success.

- How to Write a Nonprofit Business Plan

Growthink’s nonprofit business plan template below is the result of 20+ years of research into the types of business plans that help nonprofit organizations (NPOs) to secure funding and achieve their goals.

Follow the links to each section of our non-profit business plan template:

- Executive Summary – The Executive Summary will provide a brief overview of each section of your nonprofit business plan including your mission statement, goals and objectives, key achievements, and financial highlights.

- Organization Overview – The Organization Overview which should include a description of your organization, its guiding philosophy, and the programs and services it provides.

- Products, Programs, and Services – In the Products, Programs and Services section, you will describe in detail the services or products your nonprofit provides to its target audience.

- Industry Analysis – The Industry Analysis section should provide an overview of the market in which your organization operates, including key trends, competitors, and potential opportunities for growth.

- Customer Analysis – The Customer Analysis section will identify the key customer segment(s) your NPO serves and then provide demographics and psychographic details about them.

- Marketing Plan – In the Marketing Plan section, you will outline how you plan to reach and engage with your target audience through various marketing and communication strategies.

- Operational Plan – The Operational Plan will include all the details of your day-to-day operations, including staffing, facilities, and any necessary equipment or technology.

- Management Team – The Management Team section will describe the organizational structure of your NPO, including key personnel, board members, and their roles and responsibilities.

- Financial Plan – The Financial Plan section will include a detailed budget, financial projections and analysis, as well as information on how your organization plans to generate revenue and manage expenses.

- Appendix – In the Appendix, you will include supporting documents and research for your business plan which may include the IRS status letter, financial statements, market research, and any additional information to support your organization’s financial goals and specific objectives.

NPO Planning Resources & FAQs

Below are answers to the most common questions asked by nonprofits:

Is there a nonprofit business plan template I can download?

Where can i download a nonprofit business plan pdf, what is a nonprofit business plan.

A non-profit business plan describes your organization as it currently exists (which could be just an idea) and presents a road map for the next three to five years. It lays out your goals, challenges, and plans for meeting your goals. Your business plan should be updated frequently, as it is not meant to be stagnant. It is particularly important to create/update your business plan annually to make sure your nonprofit remains on track towards successfully fulfilling its mission.

A nonprofit business plan template is a tool used to help your nonprofit business quickly develop a roadmap for your business.

Why do you need a business plan for your nonprofit?

What are the types of nonprofit organizations (npos).

There are several types of nonprofits. These are categorized by section 500(c) by the IRS for tax exempt purposes. Listed below, are some of the frequently filed sections:

Corporations formed under Act of Congress. An example is Federal Credit Unions.

Holding corporations for tax exempt organizations. This group holds title to the property for the exempt group.

This is the most popular type of NPO. Examples include educational, literary, charitable, religious, public safety, international and national amateur sports competitions, organizations committed to the prevention of cruelty towards animals or children, etc. Organizations that fall into this category are either a private foundation or a public charity. Examples include Getty Foundation, Red Cross, Easter Seals, etc.

Examples include social welfare groups, civil leagues, employee associations, etc. This category promotes charity, community welfare and recreational/educational goals.

Horticultural, labor and agricultural organizations get classified under this section. These organizations are instructive or educational and work to improve products, working conditions and efficiency.

Examples include real estate boards, business leagues, etc. They work to ameliorate business conditions.

Recreation and social clubs that promote pleasure and activities fall into this category.

Fraternal beneficiary associations and societies belong to this section.

Voluntary Employees’ beneficiary associations which provide benefits, accidents and life payments to members are a part of this section.

When filling in your nonprofit business plan template, include the type of nonprofit business you intend to be.

What are the primary sources of funding for nonprofit business plans?

The primary funding sources for most nonprofit organizations are donors, grants and bank loans. Donors are individuals that provide capital to start and grow your nonprofit. Major donors, as the name implies, write large checks and are often instrumental in launching nonprofits. Grants are given by organizations and others to achieve specific goals and often nonprofits qualify for them. Business loans, particularly for asset purchases like buildings and equipment, are also typically used by nonprofits.

NPOs may also sell products or services, work with investors or develop their own investments. The expertise of the non-profit staff, members and board of directors will impact funding options for a nonprofit organization. The nonprofit’s mission, resources, goals and vision will all impact the funding sources a nonprofit business will place in it’s business plan as well.

How do you write a nonprofit business plan?

How do you start a nonprofit, how many nonprofit organizations are in the us.

According to the National Center for Charitable Statistics , there are approximately 1.54 million nonprofits registered in the United States (data pulled from registrations with the Internal Revenue Service (IRS)).

The nonprofit sector has annual expenses exceeding 2.46 trillion U.S dollars.

Does your action plan and fundraising plan belong in your plan?

Yes, both belong in your plan.

Include your action plan in the operations plan section.

Your fundraising plan goes in your financial plan section. Here you will discuss how much money you must raise and from whom you plan to solicit these funds, as well as outlines your fundraising events. It should clearly outline your fundraising goals and potential donors.

Where do you include your non profit mission in your plan?

What do you include in a nonprofit’s financial projections.

Your financial projections must include an Income Statement, Balance Sheet and Cash Flow Statement. These statements within your business plan show how much money your organization will bring in from donors and customers/clients and how much your organization will spend.

The key purpose of your these projections is to ensure you have enough money to keep your organization operating. They also can be an important component of your nonprofit business plan template, as donors, your board of directors, and others may review to understand financial requirements of your nonprofit.

How do nonprofit owners get paid?

How much does it cost to start a nonprofit business.

NPOs must complete Form 1023 with the IRS in order to get exemption status. The filing fee for this form is $600. If neither actual nor projected annual income for the organization exceeds $50,000, you can file form Form 1023-EZ which costs just $275.

In addition to the filing fee, there are other costs associated with starting a nonprofit organization based on the type of organization you are developing (for example, if you require buildings and equipment). Gathering information through the business planning process will help you accurately estimate costs for your nonprofit business plan template.

Where can I download a nonprofit business plan template doc?

Additional nonprofit resources.

- How to Start a Non-Profit Organization

- Sample Nonprofit Business Plan

- Nonprofit Marketing Plan + Template

- How to Write a Mission Statement for Your Nonprofit Organization

- NonProfit Business Plan PDF

- National Council of Nonprofits

- Nonprofit Quarterly

- The Fundraising Authority

Helpful Video Tips for Nonprofit Business Plans