Price Discrimination

Definition – Price discrimination involves charging a different price to different groups of people for the same good. For example – student discounts, off peak fares cheaper than peak fares.

Different Types of Price Discrimination

1. First Degree Price Discrimination

This involves charging consumers the maximum price that they are willing to pay. There will be no consumer surplus.

2. Second Degree Price Discrimination

This involves charging different prices depending upon the choices of consumer. For example quantity, time period, collecting coupons

- After 10 minutes phone calls become cheaper.

- Electricity is more expensive for the first number of units. For a higher quantity of electricity consumed the marginal cost is lower.

- Loyalty cards reward frequent buyers with discounts on future products.

- If you collect coupons from a newspaper you can get a discount.

2nd-degree price discrimination is sometimes known as ‘indirect price discrimination’ because the firm allows consumers to choose which price they will pay. Some choices are offered cheaper because they impose costs on consumers (e.g. collecting coupons, buying in bulk or unsocial hours.

3. Third Degree Price Discrimination – ‘Group price discrimination’

This involves charging different prices to different groups of people. For example:

- Student discounts,

- Senior citizen railcard

- Peak travel/ off-peak travel

- Cheaper prices by the time of the day (e.g. happy hour’s in pubs – usually earlier on in evening where demand is lower.

More on third-degree price discrimination

3rd degree price-discrimination is sometimes known as direct price discrimination. Because a firm directly sets different prices depending on distinct groups of consumers (e.g. age)

Product versioning

One way firms practise price discrimination is to offer slightly different products as a way to discriminate between consumers ability to pay. For example:

- Priority boarding tickets. Same flight but for a premium, you get a shorter queue.

- Organic coffee / fair trade coffee

- Extra legroom on aeroplanes

- First-class/second class

This is a form of indirect segmentation. By offering slightly different choices, the firm is able to separate consumers who are willing to pay higher prices.

Conditions necessary for price discrimination

Firm is a price maker. The firm must operate in imperfect competition; it must be a price maker with a downwardly sloping demand curve.

Separate markets . The firm must be able to separate markets and prevent resale. E.g. stopping an adults using a child’s ticket. Prevent business travellers from buying discount tickets.

Different elasticities of demand . Different consumer groups must have elasticities of demand. E.g. students with low income will be more price elastic and sensitive to price. Business travellers will have more inelastic demand.

- Low admin costs . It must be relatively cheap to separate markets and implement price discrimination.

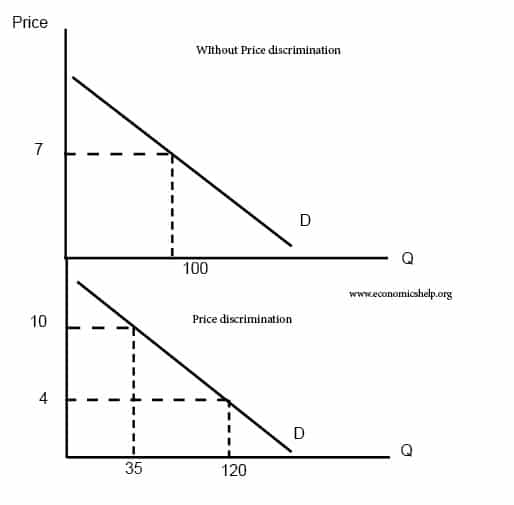

Simple diagram for Price Discrimination

WIth price discrimination, the firm can charge two different prices:

- £10 * 35 = £350

- £4 * 120 = £480

Total revenue = £830. Therefore, the firm makes more revenue under price discrimination.

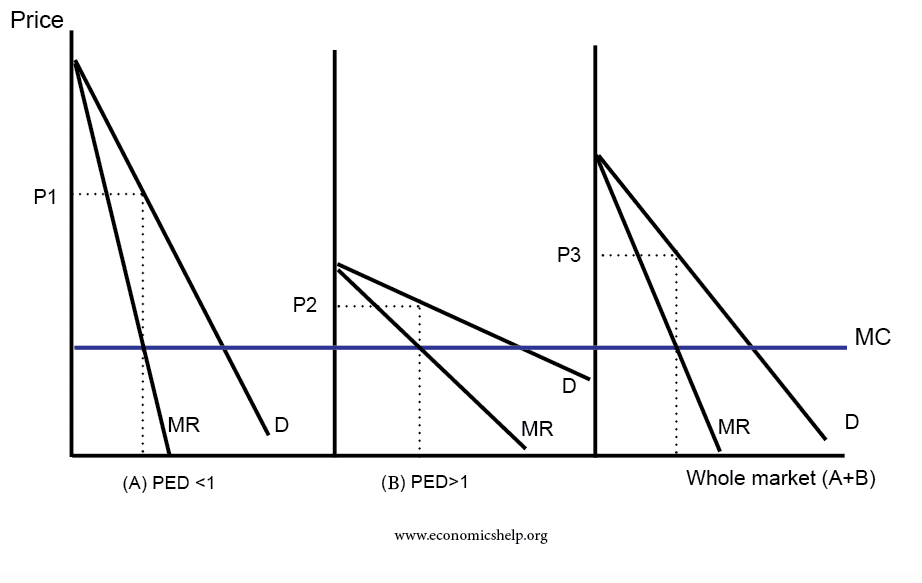

Profit maximisation under Price Discrimination

To maximise profits a firm sets output and price where MR=MC. If there are two sub markets with different elasticities of demand. The firm will increase profits by setting different prices depending upon the slope of the demand curve.

- Therefore for a group, such as adults, PED is inelastic – the price will be higher

- For groups like students, prices will be lower because their demand is elastic

Diagram of Price Discrimination

Profit is maximised where MR=MC. WIthout price discrimination, there would just be one price set for the whole market (A+B). There would be a price of P3.

- However, price discrimination allows the firm to set different prices for segment A (inelastic demand) and segment B (elastic demand)

- Because demand is price inelastic, segment (A) will have a higher profit maximising price (P1)

- In segment (B) demand is price elastic, so the profit maximising price is lower.

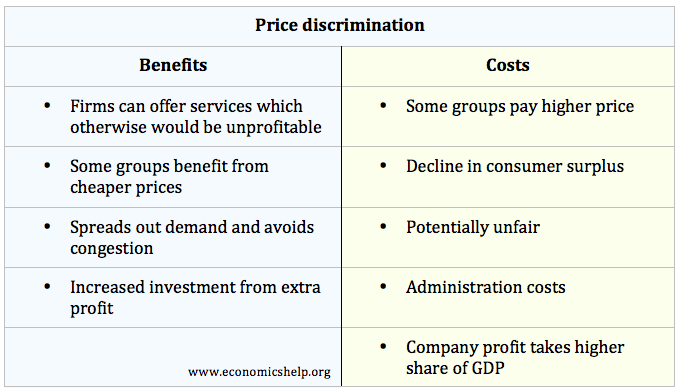

Advantages of price discrimination

Firms will be able to increase revenue . Price discrimination will enable some firms to stay in business who otherwise would have made a loss. For example price discrimination is important for train companies who offer different prices for peak and off-peak. Without price discrimination, they may go out of business or be unable to provide off-peak services.

Increased investment . These increased revenues can be used for research and development which benefit consumers

Lower prices for some . Some consumers will benefit from lower fares. For example, old people benefit from lower train companies; old people are more likely to be poor. Also, customers willing to spend time in researching ‘special offers’ and travelling at awkward times will be rewarded with lower prices.

- Manages demand . Airlines can use price discrimination to encourage people to travel at unpopular times (early in the morning) This helps avoid over-crowding and helps to spread out demand.

Disadvantages of Price Discrimination

Higher prices for some . Under price discrimination, some consumers will end up paying higher prices (e.g. people who have to travel at busy times). These higher prices are likely to be allocatively inefficient because P > MC.

Decline in consumer surplus . Price discrimination enables a transfer of money from consumers to firms – contributing to increased inequality.

Potentially unfair . Those who pay higher prices may not be the poorest. For example, adults paying full price could be unemployed, senior citizens can be very well off.

Administration costs. There will be administration costs in separating the markets, which could lead to higher prices.

Predatory pricing . Profits from price discrimination could be used to finance predatory pricing .

Importance of marginal cost in price discrimination

In markets where the marginal cost of an extra passenger is very low, the firm has an incentive to use price discrimination to sell all the tickets. This is why sometimes prices for airlines can be very low just before their date. Once the company is due to fly the MC of an extra passenger will be very low. Therefore this justifies selling the remaining tickets at a low price.

- Examples of price discrimination

- Student discounts on trains

- Discounts for buying train tickets in advance

- Discounts for travelling at off-peak time

- Lower unit cost price for buying high quantity.

- Phone deals which give 100 texts free.

- Initially, units of electricity are set at one tariff, but for higher quantity, price is lower.

Does price discrimination help the consumer?

Benefits and disadvantages of price discrimination

- Airline price discrimination

Price Discrimination

Firms use price discrimination to capture consumer surplus (the difference between someone's willingness to pay and the price they pay).

Conditions needed for price discrimination

- The groups being discriminated between must have a different price elasticity of demand.

- There must be a way of stopping arbitrage opportunities that arise from consumers buying cheap, and selling to those who have been charged a higher price.

- The firm discriminating must be a price-setter.

,h_400,q_80,w_640.png)

First degree price discrimination

- First degree price discrimination involves a complete transfer of consumer surplus (the disparity between the price the consumer is willing to pay and the actual product price) to the producer.

- This is because each customer is charged the very maximum they are happy and able to pay for a good or service.

- This method is rarely used because of asymmetric information, and the difficulty of gathering information on every customer.

,h_400,q_80,w_640.png)

Second degree price discrimination

- Second degree price discrimination involves charging different prices based on the quantity purchased.

- The more you purchase, the cheaper the product.

- This generates revenue from part of the consumer surplus that has been transferred.

- Bulk buying from a wholesaler like Costco may lead to cheaper prices. This is second degree price discrimination.

Third degree price discrimination

- Software companies like Balsamiq charge different prices for non-profits.

- This is based on the idea that different segments of a market will have different price elasticity of demands. Profits are maximised when the price is set where marginal cost is equal to marginal revenue for each particular segment.

The impact of third degree price discrimination

- Consumers with more inelastic demand will be charged a higher price of Pa. They will receive less consumer surplus than if a firm could not segregate the two groups.

Advantages and Disadvantages of Price Discrimination

There are a number of advantages and disadvantages associated with the three types of price discrimination.

Advantages of price discrimination

- Price discrimination will lead to increased revenue for the firm. Higher profits could be reinvested and improve dynamic efficiency.

- E.g Google Chromebooks in schools.

- To decide whether this is fair and improves equality or not, we need to make a value judgement.

Disadvantages of price discrimination

- This is because the price is greater than marginal cost.

- Some may argue that consumers paying a different price for the same good or service is unfair. This is more of a moral or normative judgement though.

1 Introduction to Markets

1.1 Nature of Economics

1.1.1 Economics as a Social Science

1.1.2 Positive & Normative Economic Statements

1.1.3 The Economic Problem

1.1.4 Resources

1.1.5 Production Possibility Frontiers

1.1.6 Specialisation & Division of Labour

1.1.7 Types of Economies

1.1.8 End of Topic Test - Nature of Economics

1.1.9 Application Questions - Nature of Economics

1.2 How Markets Work

1.2.1 Rational Decision Making

1.2.2 Demand

1.2.3 Elasticities of Demand

1.2.4 Elasticities of Demand 2

1.2.5 Elasticity & Revenue

1.2.6 Supply

1.2.7 Elasticity of Supply

1.2.8 Price Determination

1.2.9 Price Mechanism

1.2.10 Consumer & Producer Surplus

1.2.11 Indirect Taxes & Subsidies

1.2.12 A-A* (AO3/4) - Taxing Prices or Quantities?

1.2.13 Alternative View of Consumer Behaviour

1.2.14 End of Topic Test - Markets

1.2.15 A-A* (AO3/4) - Markets

2 Market Failure

2.1 Market Failure

2.1.1 Types of Market Failure

2.1.2 Externalities

2.1.3 The Deadweight Welfare Loss of Externalities

2.1.4 A-A* (AO3/4) - The Externalities of Education

2.1.5 Public Goods

2.1.6 Information Gaps

2.1.7 End of Topic Test - Market Failure

2.1.8 Application Questions - Market Failure

2.2 Government Intervention

2.2.1 Government Intervention in Markets

2.2.2 Subsidies & Price Controls

2.2.3 Pollution Permits & Regulation

2.2.4 A-A* (AO3/4) - European Emissions Trading

2.2.5 State Provision & Information Provision

2.2.6 Government Failure

2.2.7 End of Topic Test - Government Intervention

2.2.8 A-A* (AO3/4) - Government Intervention

3 The UK Macroeconomy

3.1 Measures of Economic Performance

3.1.1 Measuring Economic Growth

3.1.2 National Income Data

3.1.3 Inflation

3.1.4 Causes of Inflation

3.1.5 Consequences of Inflation

3.1.6 Employment & Unemployment

3.1.7 Causes & Impact of Unemployment

3.1.8 A-A* (AO3/4) - Hysteresis

3.1.9 Balance of Payments

3.1.10 Current Account Deficit & Imbalances

3.1.11 End of Topic Test - Economic Performance

3.1.12 Application Questions Macroeconomy

3.2 Aggregate Demand

3.2.1 Aggregate Demand

3.2.2 Consumption

3.2.3 Investment

3.2.4 Government Expenditure

3.2.5 Net Trade

3.2.6 End of Topic Test - Aggregated Demand

3.2.7 Application Questions - AD

3.3 Aggregate Supply

3.3.1 Aggregate Supply

3.3.2 End of Topic Test - Aggregated Supply

3.3.3 A-A* (AO3/4) -Aggregate Supply

3.4 National Income

3.4.1 National Income

3.4.2 Injections & Withdrawals

3.4.3 Equilibrium Level of Real National Output

3.4.4 Multiplier Effect

3.4.5 End of Topic Test - National Income

3.4.6 Application Questions - National Income

3.5 Economic Growth

3.5.1 Causes of Economic Growth

3.5.2 Output Gaps

3.5.3 Business Cycle

3.5.4 Impact of Economic Growth

3.5.5 End of Topic Test - Economic Growth

3.5.6 A-A* (AO3/4) - Growth

4 The UK Economy - Policies

4.1 Macroeconomic Objectives & Policies

4.1.1 Possible Objectives

4.1.2 Demand-Side Policies - Monetary

4.1.3 Demand-Side Policies - Monetary 2

4.1.4 A-A* (AO3/4) - The Future of Interest Rates

4.1.5 Demand-Side Policies - Fiscal

4.1.6 Demand-Side Policies in 2007-08

4.1.7 Strengths & Weaknesses of Demand Side

4.1.8 Supply-Side Policies

4.1.9 Supply-Side Policies 2

4.1.10 Conflicts Between Objectives

4.1.11 A-A* (AO3/4) - Conflicting Incentives

4.1.12 Phillips Curve

4.1.13 End of Topic Topic - Policies & Objectives

4.1.14 Application Questions - UK Policies

5 Business Behaviour

5.1 Business Growth

5.1.1 Size & Types of Firms

5.1.2 Business Growth

5.1.3 Pros & Cons of External Expansion

5.1.4 Demergers

5.1.5 End of Topic Test - Business Growth

5.1.6 A-A* (AO3/4) - Business Growth

5.2 Business Objectives

5.2.1 Business Objectives

5.2.2 End of Topic Test - Business Objectives

5.2.3 Application Questions - Business Objectives

5.3 Revenues, Costs & Profits

5.3.1 Revenue

5.3.2 Costs

5.3.3 Economies & Diseconomies of Scale

5.3.4 Profits

5.3.5 Profits 2

5.3.6 End of Topic Test - Revenue, Costs & Profits

5.3.7 A-A* (AO3/4) - Revenue, Costs & Profit

6 Market Structures

6.1 Market Structures

6.1.1 Efficiency

6.1.2 Perfect Competition

6.1.3 Perfect Competition 2

6.1.4 Monopolistic Competition

6.1.5 Oligopolies

6.1.6 The Prisoner's Dilemma

6.1.7 Collusion in Oligopolistic Markets

6.1.8 A-A* (AO3/4) - Which Factors Affect Collusion?

6.1.9 Monopolies

6.1.10 Price Discrimination

6.1.11 Monopsony

6.1.12 A-A* (AO3/4) - Models in Economics

6.1.13 Contestability

6.1.14 Benefits of Contestability

6.1.15 End of Topic Test - Market Structures

6.1.16 Application Questions - Market Structures

6.1.17 A-A* (AO3/4) - Cereal Collusion

6.2 Labour Market

6.2.1 Demand for Labour

6.2.2 Supply of Labour

6.2.3 Labour Market Imperfections

6.2.4 A-A* (AO3/4) - Labour Productivity & Unemployment

6.2.5 A-A* (AO3/4) - What Level of Unionisation is Good?

6.2.6 Wage Determination

6.2.7 Elasticity of Labour Supply & Demand

6.2.8 Intervention in Setting Wages

6.2.9 End of Topic Test - Labour Market

6.2.10 A-A* (AO3/4) - Labour Markets

6.3 Government Intervention

6.3.1 Reasons for Government Intervention

6.3.2 Government Promotion of Competition

6.3.3 Usefulness of Competition Policy & Examples

6.3.4 A-A* (AO3/4) - Modern Competition Policy

6.3.5 Privatisation

6.3.6 Government Regulation

6.3.7 A-A* (AO3/4) - Nationalisation vs Privatisation

6.3.8 Government Protection of Suppliers and Employees

6.3.9 Impact of Government Intervention

6.3.10 End of Topic Test - Government Intervention

6.3.11 Application Questions - Government Intervention

7 A Global Perspective

7.1 International Economics - Globalisation & Trade

7.1.1 Globalisation

7.1.2 Globalisation for LEDCs

7.1.3 Globalisation for MEDCs

7.1.4 Specialisation & Trade

7.1.5 Pattern of Trade

7.1.6 Terms of Trade

7.1.7 Trading Blocs

7.1.8 UK, EU & WTO

7.1.9 End of Topic Test - Globalisation & Trade

7.1.10 A-A* (AO3/4) - Globalisation & Trade

7.2 International Economics - Currency

7.2.1 Merged Currency

7.2.2 Restrictions on Free Trade

7.2.3 Arguments for Protectionism

7.2.4 Arguments Against Protectionism

7.2.5 Balance of Payments

7.2.6 Balance of Payments 2

7.2.7 Floating Exchange Rates

7.2.8 Fixed Exchange Rate

7.2.9 International Competitiveness

7.2.10 End of Topic Test - International Economy

7.2.11 Application Questions - International Economics

8 Finance & Inequality

8.1 Poverty & Inequality

8.1.1 Absolute & Relative Poverty

8.1.2 Inequality

8.1.3 Inequality 2

8.1.4 Lorenz Curve

8.1.5 Government Policy on Poverty

8.1.6 End of Topic Test - Poverty & Inequality

8.1.7 A-A* (AO3/4) - Inequality & Poverty

8.2 Emerging & Developing Economies

8.2.1 Measures of Development

8.2.2 Factors Influencing Growth & Development

8.2.3 Barriers to Development

8.2.4 Barriers to Development 2

8.2.5 A-A* (AO3/4) - The Bottom Billion

8.2.6 Development Strategies

8.2.7 Interventionist Strategies

8.2.9 International Institutions

8.2.10 International Institutions 2

8.2.11 End of Topic Test - Emerging & Developing

8.2.12 Application Questions - Developing Countries

8.3 The Financial Sector

8.3.1 Role of Financial Markets

8.3.2 Market Failure in the Financial Sector

8.3.3 Role of Central Banks

8.3.4 End of Topic Test - The Financial Sector

8.3.5 A-A* (AO3/4) - Financial Sector

8.4 Role of the State in the Macroeconomy

8.4.1 Public Expenditure

8.4.2 Taxation

8.4.3 Public Sector Finances

8.4.4 End of Topic Test - Role of the State

8.4.5 Application Questions - Role of the State

9 Examples of Global Policy

9.1 International Policies

9.1.1 Global Debt & Deficit Policies

9.1.2 Poverty & Inequality Policies

9.1.3 Changes in Interest Rates

9.1.4 Competitiveness Policies

9.1.5 End of Topic Test - International Policies

9.1.6 A-A* (AO3/4) - International Policies

9.2 Policy Responses to Shocks

9.2.1 International Tax Policies

9.2.2 Problems for Policymakers

9.2.3 End of Topic Test - Policy Responses

9.2.4 Application Questions - Policy Responses

Jump to other topics

Unlock your full potential with GoStudent tutoring

Affordable 1:1 tutoring from the comfort of your home

Tutors are matched to your specific learning needs

30+ school subjects covered

Monopoly ( Edexcel A Level Economics A )

Revision note.

Economics & Business Subject Lead

Characteristics of Monopoly

- A monopoly is a market structure in which there is a single seller

- There are no substitute products

- This allows the firm to maximise supernormal profit in the short-run

- There is no long-run erosion of supernormal profit as competitors are unable to enter the industry

- E.g. by purchasing companies who are a potential threat

- It acts to prevent this from happening in most industries

Profit Maximising Equilibrium

- There is no differentiation between the firm & the industry

- This means that its revenue curves are downward sloping

- In order to maximise profits, it produces at the point where marginal cost (MC) = marginal revenue (MR)

A diagram illustrating a monopoly making supernormal profit in the short-run & long-run as the AR > AC at the profit maximisation level of output (Q 1 )

Diagram Analysis

- At this level the AR (P 1 ) > AC (C 1 )

Some exam questions require application of your knowledge. E.g. You may be asked to draw a cost and revenue diagram to show the likely impact of a reduction in sales on profits. This requires you to modify the diagram presented above by shifting the demand curve inwards. You will draw a second AR & MR curve to the left of the existing ones & then illustrate the new level of profit.

Third Degree Price Discrimination

- There are different types (degrees) of price discrimination

- Third degree price discrimination occurs when a firm charges different prices to different consumers for the same good/service e.g. rail fares are priced differently depending on the time of travel

- Some airline ticket portals charge higher prices to customers using an Apple computer as they are likely to have higher income

The Following Conditions Must Be Met for Third Degree Price Discrimination to Occur

The firm must have the ability to & it works best when there are no/few | Some consumers must be & the firm must be able to identify these different c i.e. split the market into sub-markets | It must be able to buying in the low-price sub-market & reselling in the higher ones |

Illustrating Third Degree Price Discrimination

- In order to illustrate third degree price discrimination diagrammatically, the different sub-market diagrams are placed side by side

- The total profit is a combination of profits from the sub-markets

- The diagram below illustrates the market for rail travel in the UK where inelastic demand is 'peak' hour demand & elastic demand is any other time of the day i.e. 'off-peak'

A third-degree price discrimination diagram demonstrates a market that has been divided based on price inelastic (peak travel) & price elastic demand (off-peak travel). Following the revenue rule , prices are raised for peak demand & lowered for off-peak demand

- Each train route has an effective monopoly provider

- This point is extrapolated to both sub-markets on the left by using the lower dotted line

- The average cost is extrapolated across both sub-markets using the upper dotted line (C 1 )

- A higher price for peak travel has been set at P a & a lower price for off-peak travel has been set at P b

- Following the revenue rule, total revenue increases in both markets

- The profit for sub-market A = (P a -C 1 ) * Q 1

- The profit for sub-market B = (P b -C 1 ) * Q 2

- Total profit = (P t -C 1 ) * Q 3

- The firms' total profits are higher than if they had charged a single price to all customers

Costs & Benefits of Third-Degree Price Discrimination

Costs & Benefits of Third-Degree Price Discrimination to Consumers & Producers

| as they will be able to take advantage of the & in some markets this can increase consumer e.g. on train services it helps limit over-crowding | at the expense of a decrease in |

Costs & Benefits of Monopoly

- Theoretically this is possible, however in many cases the desire to maximise profits would prevent this from happening

The Advantages & Disadvantages Of Monopoly Power

| generate money for continued investment in technology & can increase thereby lowering the average cost can increase revenue | can create inefficiencies . The price is above the opportunity cost of providing the goods | |

| can lower prices on some products that the firm provides If firms pass on their cost savings (due to economies of scale) in the form of lower product prices | as are available & worse product quality over time as the incentive to improve it is limited offered by the firm e.g. Champagne prices | |

| for some suppliers as they are able to supply products that are distributed nationally or internationally | they will pay to suppliers (monopsony power) in the long run |

Natural Monopoly

- This is often due to associated infrastructure issues e.g. delivery of utility services like water where it does not make sense to have multiple pipelines

- It can also be due to the significant cost that is generated when entering the industry e.g. the sunk costs

- It can also be due to the ability of economies of scale to lower prices for consumers e.g. it makes sense to have one firm building five nuclear power stations as opposed to five firms as average costs will be lower with one firm producing

- This regulation is often in the form of a maximum price

When evaluating monopolies demonstrate critical thinking by acknowledging the positives as well as the negatives. For example, Amazon has partly become a monopoly by being very good at what they do & consumers benefit from lower prices & greater choice. However, this power means that they can also abuse the suppliers on their platform.

When evaluating natural monopolies , consider the government failure that may occur with regard to regulation & the imposition of maximum prices . There is a lot of disagreement about the level of profits that natural monopolies should be allowed to make. It is a normative issue.

You've read 0 of your 10 free revision notes

Get unlimited access.

to absolutely everything:

- Downloadable PDFs

- Unlimited Revision Notes

- Topic Questions

- Past Papers

- Model Answers

- Videos (Maths and Science)

Join the 100,000 + Students that ❤️ Save My Exams

the (exam) results speak for themselves:

Did this page help you?

Author: Steve Vorster

Steve has taught A Level, GCSE, IGCSE Business and Economics - as well as IBDP Economics and Business Management. He is an IBDP Examiner and IGCSE textbook author. His students regularly achieve 90-100% in their final exams. Steve has been the Assistant Head of Sixth Form for a school in Devon, and Head of Economics at the world's largest International school in Singapore. He loves to create resources which speed up student learning and are easily accessible by all.

Price Discrimination – A-level Economics Notes

Price discrimination means charging different consumers different prices for the same good.

First-degree price discrimination means every consumer faces a different price.

Second-degree price discrimination means consumers may get discounts for buying different amounts of the good; in other words, bulk-buying.

Third-degree price discrimination means different consumer groups face different prices for the same good. This could include discounts for students or pensioners for example or peak versus off-peak pricing.

Cinemas charge different prices for example Cineworld charges lower price to seniors, students and children compared to the price for adults.

Rail tickets – Student Railcards can offer a discount on trains.

Uber – at different times of day, there are different prices for Uber rides. There are also different prices for different qualities of vehicle (e.g. Uber Lux).

Apple – offers slightly different prices on some goods e.g. Macbooks to consumers in different countries.

Conditions necessary for price discrimination

To be able to conduct price discrimination, the following conditions need to be met:

- There are at least two groups with different price elasticities of demand.

- These groups can be separated. The firm can tell which consumers belong to which group and can prevent consumers pretending to be part of another group.

- The firm is a price maker, so they are able to charge different prices to different groups.

- Low administration and enforcement costs. Otherwise if these costs are high, then price discrimination could harm the firm’s profit overall.

This diagram below shows the case of third-degree price discrimination.

The left diagram shows the whole market. We assume the firm is a price maker, so marginal revenue and average revenue are downward sloping. We also assume constant marginal costs for simplicitly.

The left diagram shows the whole market. The firm maximises profit and sets quantity where MR=MC and so produces at price p1. This gives the price if the firm did not price-discriminate and is drawn over the other diagrams in red for comparison.

The middle diagram shows the group with the more elastic price elasticity of demand, so MR and AR are flatter. For example this could be the peak travel group in the case of on-peak, off-peak train tickets. These people could be more flexible about when they travel. In this case to maximise profits, the firm produces quantity q2 and price p2. This price is below the original price p1 when there is no price discrimination. So the elastic group is better off under price discrimination – they face a lower price and higher consumer surplus.

The right diagram shows the group with the more inelastic price elasticity of demand, so MR and AR are steeper. This could be the off-peak travel group in the case of train tickets. These people may be commuters and may be less flexible about when they can travel – they may need to get to work. Again to maximise profits, the firm produces quantity q3 at price p3. The new price with price discrimination is above the original price p1 under no price discrimination. This group is worse off under price discrimination, with a higher price and lower consumer surplus.

- Higher profits for firms. For the elastic group, lowering the price leads to higher revenues and profits (given constant marginal costs). For the inelastic group, raising the price will increase profits.

- More price-elastic group benefits from lower prices and sees higher consumer surplus.

- Higher profits could be reinvested into company to improve research and development and quality of product, benefitting consumers.

- The profits may also be used to support (“cross-subsidise”) loss-making parts of your company e.g. rural bus routes, benefitting even more people.

- If the poorer group has the more elastic PED, then price discrimination could reduce inequality.

- May help manage capacity. For example charging more for peak train use may lead to less overcrowding in trains at peak times, as some consumers switch to other off-peak travel times.

Disadvantages

- More price-inelastic group sees higher prices and reduced consumer surplus.

- The firm incurs costs from price discrimination from adminstration. Price discrimination may lower firms’ profits if administrative costs are too high.

- May be difficult in practice to prevent “seepage” – consumers can pretend to be part of another group to get a discount e.g. a student discount.

Other evaluation points

- The benefits of price discrimination depend on whether the necessary conditions hold.

- The impact on inequality depends on whether the group with more elastic PED is the poorer or the richer group.

- The benefit of higher profits depends on how those profits are used. Profits could go to dividends instead of investment. For Apple for example, roughly 25% of their profits go out as dividends.

Return to microeconomics notes

Latest Posts

- 2.2 Aggregate demand notes for Edexcel A Economics

- 2.1.2 Inflation Edexcel A Economics Notes

- Don’t be fooled! How to understand economic statistics

- 3.3.2 Costs

- Essay competition season – advice for economics students

An Essay on Price Discrimination

Cite this chapter.

- Paul Milgrom

91 Accesses

1 Citations

The modern theory of price discrimination began with the work of Pigou (1920). Joan Robinson devoted two chapters of her book The Economics of Imperfect Competition (1969) to the problem of (‘third degree’) price discrimination. Her account examines the conditions that make price discrimination possible, presents a graphical analysis of the discriminating monopolist’s pricing decision which has become the standard textbook treatment, and ends with an inquiry into the consequences of price discrimination for both allocative efficiency and distributional equity. Although Pigou’s and Robinson’s contributions have proved of lasting value, the theory of price discrimination has by no means remained unaltered. 1

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Unable to display preview. Download preview PDF.

Similar content being viewed by others

Price Discrimination (Theory)

Price discrimination (empirical studies).

Law of One Price

You can also search for this author in PubMed Google Scholar

Editor information

Editors and affiliations.

University of Tennessee, USA

George R. Feiwel ( Alumni Distinguished Service Professor and Professor of Economics ) ( Alumni Distinguished Service Professor and Professor of Economics )

Copyright information

© 1989 George R. Feiwel

About this chapter

Milgrom, P. (1989). An Essay on Price Discrimination. In: Feiwel, G.R. (eds) The Economics of Imperfect Competition and Employment. Palgrave Macmillan, London. https://doi.org/10.1007/978-1-349-08630-6_10

Download citation

DOI : https://doi.org/10.1007/978-1-349-08630-6_10

Publisher Name : Palgrave Macmillan, London

Print ISBN : 978-1-349-08632-0

Online ISBN : 978-1-349-08630-6

eBook Packages : Palgrave Economics & Finance Collection Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Essay on Price Discrimination | Products | Economics

Here is an essay on ‘Price Discrimination’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Price Discrimination’ especially written for school and college students.

Essay on Price Discrimination

Essay Contents:

- Essay on the Desirability of Price Discrimination

Essay # 1. Meaning of Price Discrimination:

Generally a manufacturer charges one price for one product from all the customers but sometimes it happens that different prices are charged for the same product (or service) from different customers. This policy is commonly known as price differential or price discrimination policy.

ADVERTISEMENTS:

Mrs. John Robinson has defined price discrimination as follows. “The act of selling the same article, produced under a single control at different prices to different buyers is known as price discrimination”. According Prof. J.S. Bain, “Price discrimination refers strictly to the practice by a seller of simultaneously charging different prices to different buyers for the same goods.”

According to Spencer and Siegleman, “Differential pricing may be defined as the practice by a seller or charging different prices to the same or to different buyers for the same goods without corresponding difference in cost.”

Thus, price discrimination may be of various types such as individual price discrimination, geographical price discrimination use discrimination etc.

Essay # 2. Motives behind Price Discrimination:

From the seller’s standpoint, the differential price that result from the application of various discount structures and from product- line pricing may serve several purpose, it is, therefore (desirable to look first at the company’s structure of price discriminations in terms of its motives, which may be grouped follows:

1. Market Expansion:

Differential pricing that is designed encourage new users or new customers is a common goal product- line pricing, but it also extends over various phases of discount structure, depending upon the circumstances of a purchase by a new user.

2. Market Segmentation:

A major objective of price discrimination is to achieve profitable market segmentation when legal and competitive considerations permit discrimination. It permits the appropriation of the consumer’s surplus so that it accrues to the producer rather than to the consumer.

3. Implementation or Marketing Strategy:

The patterns of price differentials should implement the company’s overall marketing strategy. These price differentials should efficiently geared with other elements in the marketing programme to reach of the sectors the market selected by strategy. In doing so the job of a particular structure of discounts may be quite specific.

4. Reduction of Production Costs:

Differential prices can sometimes help solve problems of production. Seasonal or other forms of time-period discounts may be allowed partly for the purpose of regularising Output changing the timing of sale. For example, since electricity cannot be stored, classification of electric rates is designed to encourage off season users and penalizing users that contributed to peak.

5. Competitive Adaptation:

Differential prices are a major device for selective adjustment to the competitive environment. Discounts are often designed to match what competitors charge under comparable, conditions of purchase, in terms of net price to each customer class. When products are homogeneous, competitive parity is a compelling consideration.

Essay # 3. Conditions of Price Discrimination:

Price discrimination needs some conditions in the market.

They are as follows:

1. Existence or Monopoly:

Discrimination is possible only if monopoly exists and there is no competitor in the market or when the producers enter into agreement among themselves to sell the products at agreed prices.

2. Division or the Markets into Sub-Markets:

The market is distinctly divisible into various parts among which the product cannot be exchanged; examples are a home and a foreign market separated by governmental restrictions or by a tariff wall and the market for hair-cuts or a surgeon’s fees- in the former case domestic buyers cannot import the product at the low price and in the latter services are rendered to individuals personally.

3. Expenditure in Sub-Dividing the Market should not be More than the Expected Profit Increase from Price Discrimination:

Sometimes a monopolist has to incur some expenditure on keeping the sub-markets separate so that he can fix different prices in different sub-markets and the consumers are restrained from transferring the product from one sub-market to the other.

4. Consumer’s Ignorance:

When the consumers of one market are ignorant of the prices prevailing in the other markets, price discrimination can be successful.

5. Difference in Consumer’s Purchasing Power:

Variance in the purchasing power of the customers also helps in price discrimination. Non-price factors in such a situation pay to the producers.

6. Purchaser’s Irrational Feeling:

Some purchasers judge the quality of goods only by the high or low prices. There the policy of price discrimination can successfully be launched.

7. Geographical Distance and Tariff Walls:

Between two distant markets where the transportation charges make differences in the cost of the product, price discrimination can be practised easily.

8. Nature or Goods and Service:

Goods and services which are not transferable among buyers e.g., charging more from rich and less from poor by a doctor can be easily subjected to price discrimination.

9. Sale on Orders:

When the goods are produced on the specific instructions of the customers, price discrimination is possible. One customer does not know what is being charged from the other.

10. Product Differentiation:

Sometimes a monopolist’s market consists of rich and poor consumers. He takes advantage of the whims of the rich and offers the same production in a deluxe packing. Thereby he is able to charge a higher price from the richer section of consumers.

11. Govt. Sanction:

Sometimes government also permits the public utility services like the railway to charge different prices from different consumers, and different prices for the use of electricity by Individual and domestic purposes.

Essay # 4. Degrees of Price Discrimination:

Price discrimination is done only when elasticity of demand for the product is different for different buyers, the amounts demanded of the product differs at the same price i.e., the demand prices differ. Discrimination is designed to gain revenue by varying the price in term of the demand prices of the customers. On the basis of the limit to which a monopolist can go on charging different prices for his product from his customers, various degrees of discrimination were discussed by Professor A.C. Pigou.

(1) First Degree Discrimination:

In discrimination of the first degree the monopolist is supposed to know the maximum amount of money each consumer will pay for any quality. He then sets his prices accordingly and extracts from each consumer the entire amount of the consumer’s surplus. Such a monopolist, in Mrs. Robinson’s phrase, is a ‘perfect’ discriminator.

This is ‘perfect’ price discrimination because it is an extreme limiting case of the same. In practice, few monopolists can and actually do that. An example of limited discrimination of the type is to be found in the practice of doctors of varying the charges on their customers according to their income status.

A breeder of horses dealing individually with various buyers in different parts of the country, with a highly imperfect market and absence of knowledge on the part of each buyer of the prices being charged from other buyers, may be able to carry on perfect discrimination to a limited extent. Obviously, perfect discrimination is useful only in theory as a concept.

(2) Second Degree Discrimination:

It occurs where a monopolist sets different prices for different customers but does not fully exploit their potential demand prices; the monopolist captures only parts of his customer’s consumer’s surpluses. The schedules of rates typically charged by public utilities like railways can be regarded as form of second-degree discrimination.

(3) Third Degree Discrimination:

It means that the monopolist divides his customers into two or more classes or groups on the basis of the elasticity of their demand for the product, and charging a different price to each class of buyers. Each group is a separate market.

In discrimination, of the third degree, the monopolist makes some attempt to benefit from the differences in the elasticity of demand for the product on the part the different groups of buyers. This is the only type ordinarily possible and therefore we address ourselves to this type of discrimination in detail and study the price and output determination of such a monopolist.

Essay # 5. Desirability of Price Discrimination:

Price discrimination is generally hatred as an unpopular idea because justice is supposed to go with the concept of equality and similar treatment among all customers. Therefore, it is considered as anti-social, undesirable and unprofitable act.

But, now-a-days, it has become essential for the seller to create market for the goods taking into consideration the various factors such as economics, social, geographical location, availability of goods, available alternatives etc. Price discrimination is not anti-social, infact, it means charging reasonable prices from all sections of the buyers according to their capacity, status, elasticity of demand, etc.

Such differentiation helps the manufacturer in not only increasing the sale but serving the maximum members of the society.

In the following circumstances, price discrimination is very well justified:

(1) When Community’s Welfare is the Main Aim:

There are many public services which would not be available to the poor if there was no price discrimination. For example, electricity, water, doctor, education may be cited here.

(2) Operation of Public Utility Services: Such public utilities as railways, electric supply companies and water supply companies must be allowed to have price discrimination. This is because the price of the service has to be kept low.

For example, electric supply rates have to be low for industrial concerns and agricultural operations if we want to encourage industrialisation and agricultural development. This necessitates charging higher price from consumers who can pay, otherwise, costs will not be covered.

Related Articles:

- Price Discrimination: Definitions, Types, Conditions and Degrees

- Conditions under which Price Discrimination is Possible

- Price Discrimination: Kind, Effects and Evils | Monopoly

- Degrees of Price Discrimination | Monopoly

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Study Notes

Monopoly - Price Discrimination

Last updated 22 Nov 2021

- Share on Facebook

- Share on Twitter

- Share by Email

What is price discrimination?

Price discrimination happens when a firm charges a different price to different groups of consumers for an identical good or service, for reasons not associated with costs of supply.

Price discrimination takes us away from the standard assumption in that there is a single profit-maximising price for the same good or services.

Make sure you have at least one applied example of each type of price discrimination in your notes. Nearly all businesses make use of dynamic pricing methods where prices are heavily determined by the strength of demand and consumers’ willingness & ability to pay. Price discrimination is also known as yield management.

Test your understanding with this past exam multiple choice question!

What are the main types of price discrimination?

1st degree: Charging different prices for each individual unit purchased – where people pay their own individual willingness to pay

2nd degree: Prices varying by quantity sold such as bulk purchase discounts. Prices varying by time of purchase such as peak-time prices

3rd degree: Charging different prices to groups of consumers segmented by the coefficient of price elasticity of demand , income, age, sex

What are the main conditions required for a business to use price discrimination?

- Firms must have sufficient monopoly power: Monopolists always have pricing power – they are price makers not takers

- Identifying different market segments: There must be groups of consumers with different price elasticities of demand

- Ability to separate different groups: Requires information on the purchasing behaviour of consumers – often achieved by accumulating data on previous buying patterns

- Ability to prevent re-sale (arbitrage): No secondary markets where arbitrage can take place at intermediate prices - limiting sales might be done by using age-restrictions, ID cards and so on

Price discrimination does not happen in perfectly competitive markets. It is only a feature of imperfect competition where firms have some discretion / power over the prices they charge.

What are the main aims of price discrimination?

Providing that extra units can be sold for a price above the marginal cost of supply, price discrimination is an effective way to increase revenue and profits

- To increase total revenue by extracting consumer surplus and turning it into producer surplus

- To increase total profit providing the marginal profit from selling to customers is positive

- To generate cash-flow especially during a recession

- To increase market share and build customer loyalty

- To make more efficient use of a firm’s spare capacity

- To reduce waste and cut the cost of keeping products in stock / storage

What are the main advantages from price discrimination?

- It makes fuller use of spare capacity leading to less waste and unsold stock. There are potential environmental benefits from this.

- Helps generate extra cash flow for businesses which can ensure survival during a recession / tough economic times.

- Can help fund the cross-subsidy of goods and services – for example premium prices for some can fund discounts for other groups perhaps living on lower incomes.

- Higher monopoly profits can finance research and development spending which then drives improved dynamic efficiency.

What are some disadvantages from price discrimination?

- Price discrimination operates mainly in the interests of producers as they extract consumer surplus and turn it into extra supernormal profit

- Can be used as a pricing tactic to reduce competition and reinforce the market dominance of leading firms

- May lead to manipulation of groups with a price inelastic demand, not all of whom are on high incomes

- Can be viewed as unfair to certain groups , for example there is some evidence of businesses using gender pricing on selected products

- Price Discrimination

- Pricing Strategies

- Welfare economics

- Economic welfare

You might also like

Fiscal policy - distribution of income and wealth, monopoly and anti-competitive behaviour - key definitions.

Uber Surge Pricing and the Tube Strike

9th July 2015

Welfare and incentives: The Silver Lining of Unemployment Benefits

6th November 2015

Business Growth: Hotel Chocolat Plans a Floatation

10th March 2016

Beyond the Bike lesson resource for returning AS students

25th May 2016

Principal Agent Problem Short Answers

Topic Videos

Are cash-rich companies holding back economic growth?

14th July 2017

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

IMAGES

COMMENTS

A-level Economics "DISCUSS THE EXTENT TO WHICH PRICE DISCRIMINATION IS BENEFICIAL TO PRODUCERS AND CONSUMERS" ESSAY PLAN 1) Define. Price discrimination occurs when a seller charges different prices to different customers for exactly the same product. 2) Explain the benefits to the producer.

It must be relatively cheap to separate markets and implement price discrimination. Simple diagram for Price Discrimination. Without price discrimination, the firm charges one price £7 * 100 = £700 revenue. WIth price discrimination, the firm can charge two different prices: £10 * 35 = £350; £4 * 120 = £480; Total revenue = £830.

In this video we walk through an answer to a question about whether price discrimination helps or harms consumer welfare. We hope this is useful in showing how to build clear chains of reasoning and well-supported evaluation. tutor2u. ... A-Level Economics Essay Walkthrough. Level: A-Level, IB Board: AQA, Edexcel, OCR, IB, Eduqas, WJEC

In this video we walk through an answer to a question about whether price discrimination helps or harms consumer welfare. We hope this is useful in showing h...

The Conditions Necessary for Price Discrimination. Price discrimination occurs when a firm charges a different price for the same good/service in order to maximise its revenue. There are different types (degrees) of price discrimination. First degree discrimination occurs when a firm separates consumers based on their ability to pay.

4.1.5.7 Price Discrimination (AQA A Level Economics Teaching Powerpoint) Teaching PowerPoints. Price Discrimination and Consumer Welfare - A-Level Economics Essay Walkthrough Practice Exam Questions. Price Discrimination and Economic Welfare 29th November 2022. Dynamic Pricing: Ticketmaster pricing system criticised ...

Level: A-Level, IB. Board: AQA, Edexcel, OCR, IB, Eduqas, WJEC. Last updated 29 Jan 2024. Share : This in-depth revision video covers both analysis and evaluation of the economics of price discrimination. Price Discrimination I A Level and IB Economics. Share :

This page is about 'Price Discrimination' taken from AQA Economics Syllabus Topic 4.1. Learn economics alongside the AQA A-level Economics specification. Revise exactly what you need to know for the exam.

Price discrimination often means that those with higher incomes pay more for a good or service than those with lower incomes. This may help cross-subsidise products so that poorer people can afford them. E.g Google Chromebooks in schools. To decide whether this is fair and improves equality or not, we need to make a value judgement.

This comprehensive guide to price discrimination for students of A-Level Economics delves into the complex strategies businesses use to set different prices ...

This in-depth revision video covers both analysis and evaluation of the economics of price discrimination. #edexceleconomics #aqaeconomics #ibeconomics #ocre...

Price Discrimination A-level Economics. Fair or unfair? Definition: when firms charge different prices to different customers for the same product. ... 10 Past Papers with Model Answers on Market Failure. Written by an experienced Economics tutor. Full model answers with diagrams.

Answers > Economics > A Level > Article This question is a 25 mark question, it requires a variety of different skills and a strong structure to recieve the highest marks possible. This is a 'discuss' question therefore different arguments should be presented.

Students should be able to: A copy of this presentation, which is part of our substantial collection of Teaching Resources for A Level Economics, can be downloaded from the links below: tutor2u Price Discrimination (PowerPoint) tutor2u Price Discrimination (PDF) Check out this revision video. This is an updated revision presentation of the ...

Illustrating Third Degree Price Discrimination. In order to illustrate third degree price discrimination diagrammatically, the different sub-market diagrams are placed side by side; The total market diagram is a combination of the sub-market diagrams The total profit is a combination of profits from the sub-markets; The diagram below illustrates the market for rail travel in the UK where ...

Price discrimination means charging different consumers different prices for the same good. First-degree price discrimination means every consumer faces a different price. Second-degree price discrimination means consumers may get discounts for buying different amounts of the good; in other words, bulk-buying.

The modern theory of price discrimination began with the work of Pigou (1920). Joan Robinson devoted two chapters of her book The Economics of Imperfect Competition (1969) to the problem of ('third degree') price discrimination. Her account examines the conditions that make price discrimination possible, presents a graphical analysis of the discriminating monopolist's pricing decision ...

Get A-level Economics free model answers. Complete our challenges and test your ability. ... Price Discrimination Essay Question and Model Answer. Mr Banks. March 2, 2018. A-level Economics Model Answers. In this post, we will look at the topic of price discrimination. We are looking at a "discuss" question, and we will go over the model answer.

This AQA Economics Study Note covers Price Discrimination. Topic: Conditions Necessary for Price Discrimination. Definition: Price discrimination refers to the practice of charging different prices to different customers for the same good or service, based on their willingness to pay. Conditions for Price Discrimination: Market Power:

4.1.5.7 Price Discrimination (AQA A Level Economics Teaching Powerpoint) Teaching PowerPoints Price Discrimination and Consumer Welfare - A-Level Economics Essay Walkthrough

Essay # 4. Degrees of Price Discrimination: Price discrimination is done only when elasticity of demand for the product is different for different buyers, the amounts demanded of the product differs at the same price i.e., the demand prices differ. Discrimination is designed to gain revenue by varying the price in term of the demand prices of ...

Providing that extra units can be sold for a price above the marginal cost of supply, price discrimination is an effective way to increase revenue and profits. To increase total revenue by extracting consumer surplus and turning it into producer surplus. To increase total profit providing the marginal profit from selling to customers is positive.