Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

15 Banking Resume Examples That Made the Cut in 2024

Best for professionals eager to make a mark

Looking for one of the best resume templates? Your accomplishments are sure to stand out with these bold lines and distinct resume sections.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

Banking Resume

- Banking Resume by Experience

- Banking Resumes by Role

- Write Your Banking Resume

Banking FAQs

Whether you’re an entry-level bank teller or you’ve climbed the ladder to being a manager, working in banking requires that you know your stuff. Thanks to your in-depth knowledge of the financial landscape, interpersonal skills, and keen eye for numbers, your bank’s customers walk away happy after each visit.

With various legal regulations, keeping up to date with the latest banking software, and studying new products, you’ve got your hands full on a daily basis. However, you’ll need to find the time to create an effective resume to advance your career.

That’s where we come in. Our AI cover letter generator , banking resume examples and handy resume tips helped hundreds of banking professionals land their next jobs, and now, it’s your turn!

or download as PDF

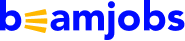

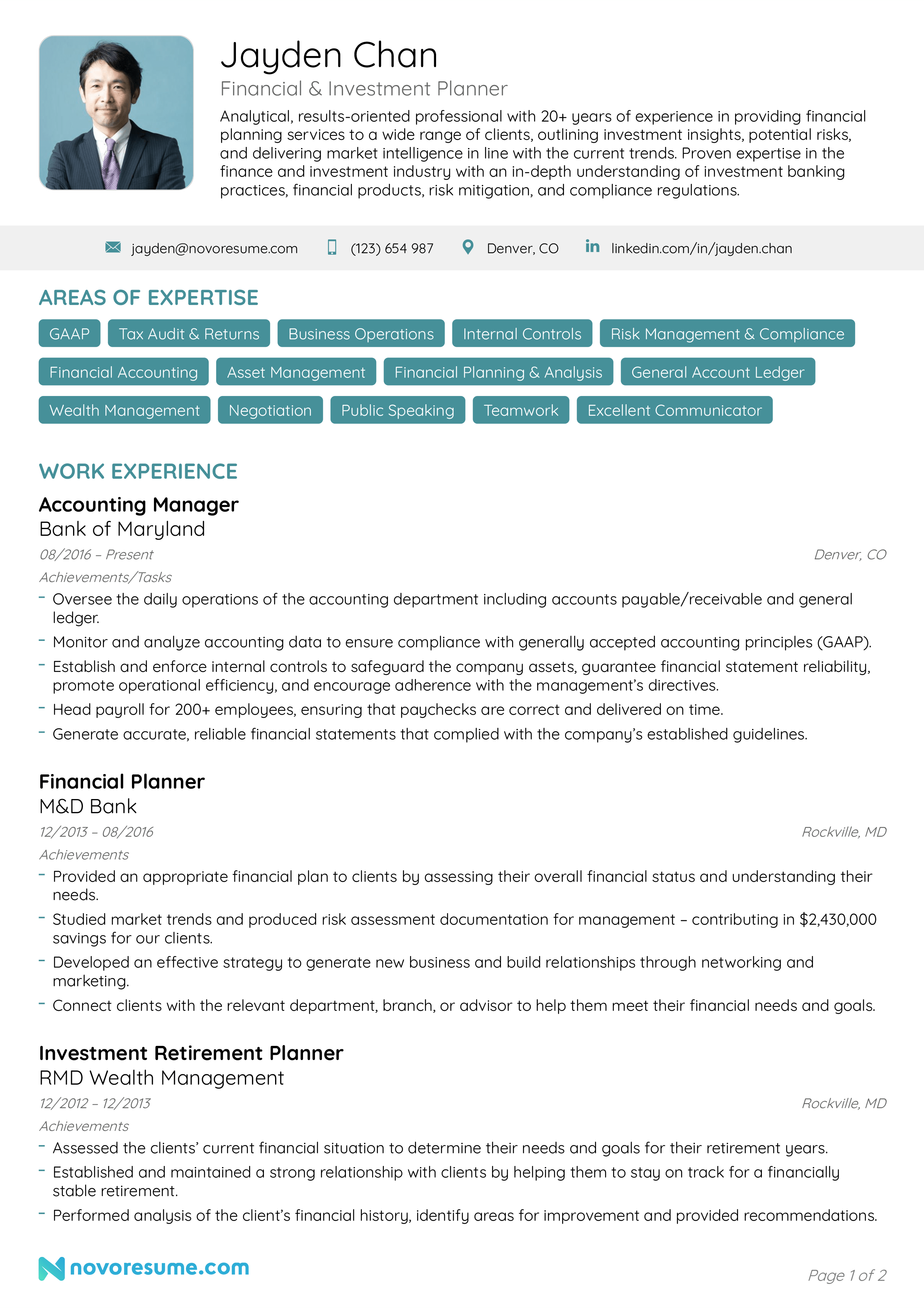

Why this resume works

- Show your workplace impact in your banking resume by detailing your numbers in driving customer satisfaction, solving problems, and cutting down process time to optimize profits.

Experienced Banker Resume

- On top of your achievements, including a certification such as a Certified Bank Teller further lends credibility to your application and gets you closer to the door.

Associate Banker Resume

- Your Certified Wealth Strategist (CWS) or Commercial Banking & Credit Analyst (CBCA) certification, for instance, can give your associate banker resume a much-needed facelift. It signals to recruiters that you meet industry benchmarks and are willing to go the extra mile to strengthen your skill set and propel your career forward.

Senior Banker Resume

- Integrate your measurable achievements such as meeting sales quotas, solving customer problems, driving up profits, and so on in your personal banker resume .

Bank Branch Manager Resume

- To do this, display how you’ve streamlined processes, led teams, and boosted customer satisfaction. Now is great time to introduce metrics such as cutting administrative overhead, spearheading staff training, and more.

Personal Banker Resume

Bank Manager Resume

- Impress potential employers by showing your sales performance, customer service, and business growth metrics in your bank manager resume .

Relationship Banker Resume

- We suggest injecting some life into your work history with quantified accomplishments. Take “…ensuring 100% compliance with JPMorgan’s regulatory standards while processing $2.7 million in assets over six months” and “…preventing over $$99K in load default losses,” for instance. Now, that’s how you turn a good narration into a wow moment for hiring managers.

Universal Banker Resume

- Get down to specifics like how you turned detective with Experian Fraud Detection tools, screening transaction data, and customer behavior, thus preventing six fraud attempts in a month. Or how you advocated the integration of DocuSign for account opening procedures, which not only trimmed document turnaround time (by maybe two days) but also boosted client satisfaction. That’s gold!

Business Banker Resume

- Calling attention to at least one experience in a work setting similar to that you’re vying to join can do the trick for your business banker resume. And don’t rattle off your duties to give recruiters a taste of your potential; do them one better by serving up your proudest accomplishments complemented by genuine metrics.

Private Banker Resume

- Your updated contact deets (think phone number and professional email address) should sit at the top, regardless of the resume template you go with. And right after that, it’s smart to hyperlink to your LinkedIn profile, inviting hiring managers to dig deeper into your professional world.

Mortgage Banker Resume

- So, why not let software like Calyx Point, Salesforce, Dropbox Business, ComplianceEase, and LoanSifter steal the show in the skills part of your mortgage banker resume? Spice things up a bit, though—your work history section should illustrate how you’ve milked the tools dry to squeeze out impressive results at various companies.

Retail Banker Resume

- You see statements such as “Processed $2.3M in in-person and online card payments through Worldpay” and “…spearheading a new membership growth initiative that attracted 854 new customers over six months?” That will catch the recruiter’s eye and showcase your value straight away. Keep the accentuation to the right amount, though—a single phrase per job listing will do.

Commercial Banker Resume

- Nailing the look of your commercial banker resume comes down to a few key elements: white space, a legible, consistent font, and well-defined sections. A splash of color doesn’t hurt either. So, feel free to give your header, names of former places of work, and sidebar sections a pop with something vibrant like burnt orange.

Corporate Banker Resume

- Let’s say you have a bachelor’s degree in finance. Mentioning it boosts professionalism and credibility, plus signals you have the chops for this job. Now, if you’ve pursued a Master’s in something related, that’s even cooler. Let it take the lead in your education credentials, with your bachelor’s degree sitting proudly after that—reverse chronological order, remember.

Related resume examples

- Investment Banking

- Bank Teller

- Financial Analyst

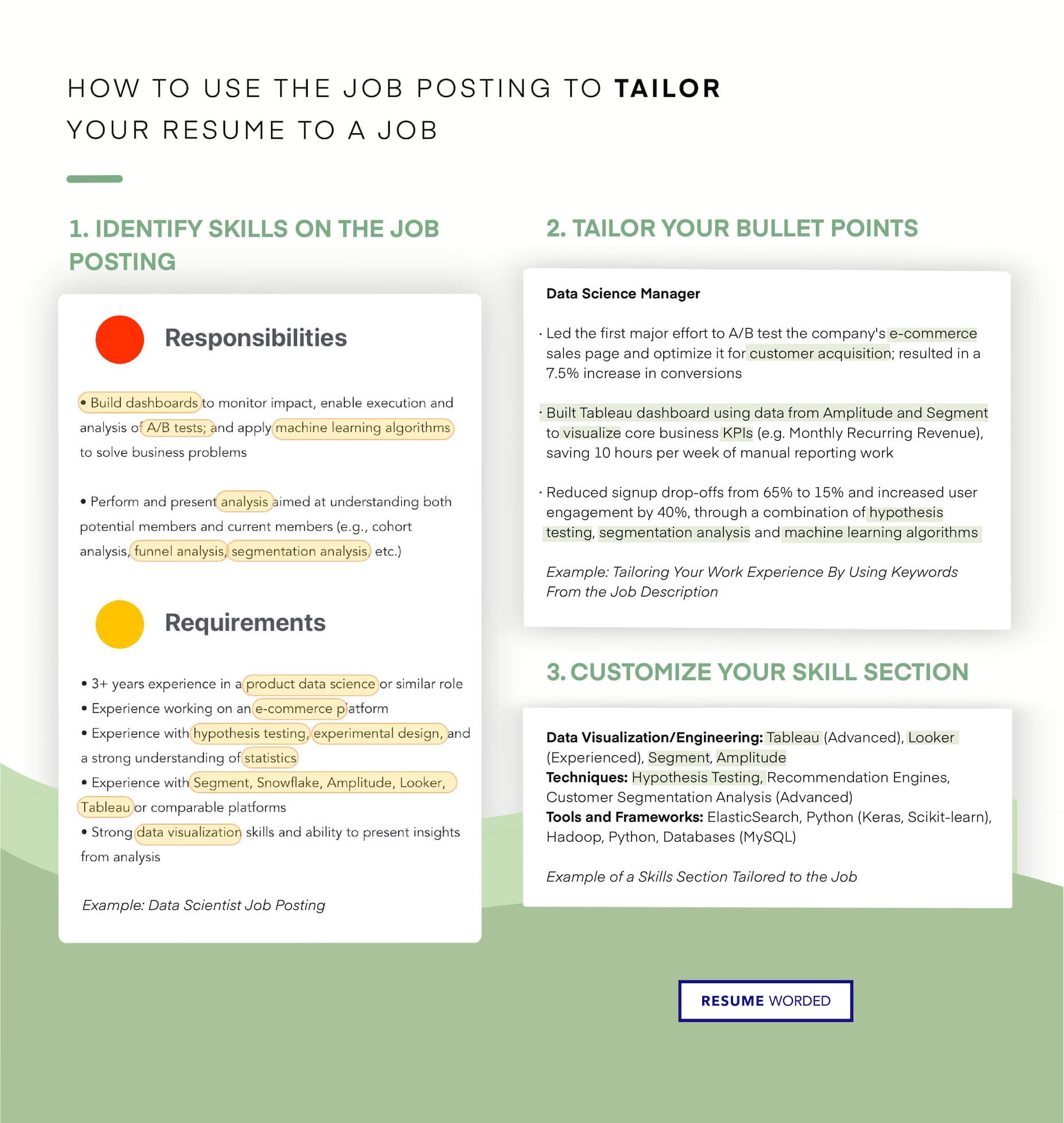

Create a Banking Resume that Matches the Job Description Perfectly

The key to crafting an irresistible application is to match the job description as closely as you can.

For instance, if you’re applying for a senior bank teller role, include a good mix of skills that point to your banking proficiency as well as a couple of your interpersonal abilities. That includes things like conflict resolution and cross-selling, but also knowledge of anti-fraudulent measures and Oracle Flexcube.

In any case, try to check some of the most important boxes in the job listing. Keep things specific—instead of a vague “team player,” use more descriptive skills like “relationship building.”

Want some inspiration?

15 popular banking skills

- Fiserv Signature

- Loan Processing

- Banking Regulations

- Credit Analysis

- Oracle Flexcube

- Microsoft Dynamics

- Fraud Detection

- Basic Accounting

- Customer Service

- Sales Strategies

- FIS Horizon

- Crisis Management

- Temenos T24 Transact

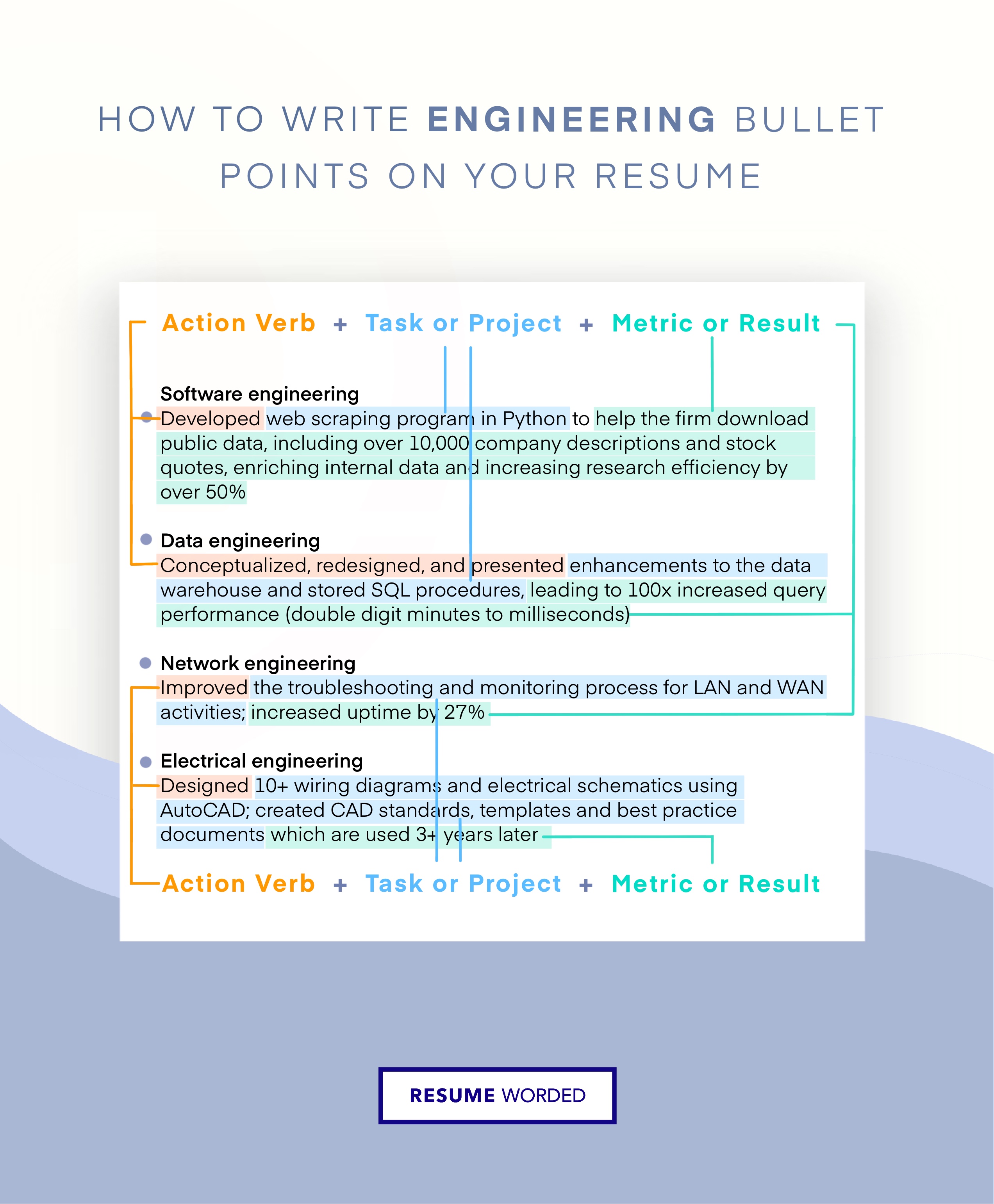

Your banking work experience bullet points

You’re no stranger to various kinds of data, be it financial figures or customer satisfaction metrics. Data will be your best friend as you work on this part of your resume and discuss your greatest achievements.

Refrain from simply listing off every single task from your past jobs—instead, frame your work as accomplishments and back it up with metrics.

In banking, money speaks volumes. Talk about the types of client accounts you’ve handled, investments you’ve guided, or branch budgets you’ve handled. There are many equally useful metrics, from reducing customer complaints to lowering the average wait times at your branch.

- Discuss your success in driving profits for the bank and its clients with financial metrics, such as revenue growth, ROI, and cost-to-income ratio.

- Mention any increases in efficiency, such as the branch performance rate, directing customers to other channels to free up more tellers, or optimizing client documentation.

- Take a customer-centric approach and talk about customer satisfaction ratings, retention, and engagement.

- Sales play a big part in banking, so show off metrics related to cross-selling, up-selling, handling loans, credit cards, and investments.

See what we mean?

- Fixed minor jam errors on NCR Selfserv that decreased customer wait time by 67%

- Detected 91% of fraud cases on Verafin and thwarted them without escalation to the supervisor

- Built 101 long-term client relationships, exceeding annual sales quota by 117%

- Conceptualized payment strategies for 12 big clients on Acuity that improved repayments to 98% rates

9 active verbs to start your banking work experience bullet points

- Facilitated

3 Tips for Writing a Banking Resume if You’re Starting Your Career

- You may be new to banking, but as long as you have any experience in working with customers, you’ve got a lot to talk about. Highlight past jobs where you worked with people, such as retail or tech support, but also college projects and internships.

- Banking requires a great deal of attention to detail, so don’t make the mistake of sending out a resume that’s tailored to a different job. Take the time to read the job description and update your work experience and skills accordingly.

- Pick a resume template that lets you add courses or certifications and include them to increase your credibility. The Certified Bank Teller (CBT) certification is great, but so is the Anti-Money Laundering (AML).

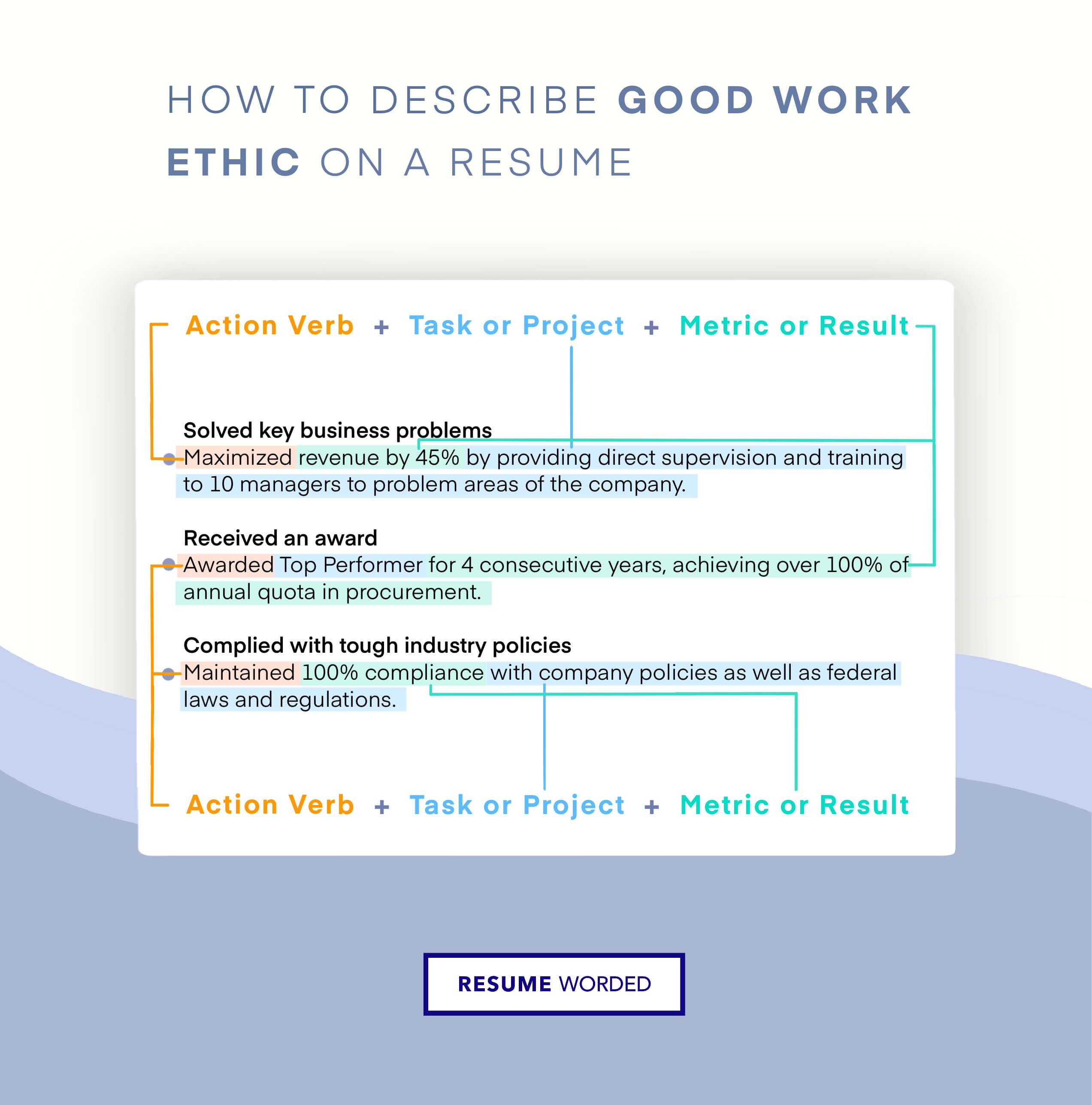

3 Tips for Writing a Banking Resume for a Seasoned Financial Expert

- As you advance in your career, leadership becomes a key skill, whether it is training new colleagues or managing an entire branch. Provide examples of times when you were in charge, such as assigning tasks or handling performance appraisals.

- Don’t be afraid to flaunt your financial acumen by talking about your ability to manage budgets, control costs, or drive growth. For instance, discuss the kinds of budgets you managed for your branch or for particular business accounts, making sure to mention ROI to showcase your impact.

- A successful banker is one who leaves a trail of happy customers behind. Underscore this in your resume by including metrics like customer retention, cross-selling, or satisfaction ratings, as well as mentioning how you helped your staff stick to bank policies.

Unless your career spans over 10 years, we recommend sticking to a one-page resume . Much the way customers only skim the contracts they sometimes sign, recruiters only spend a few seconds scanning your resume, so it’s best to keep it short and sweet.

A resume summary or objective can be an effective way to quickly highlight a career-defining achievement or describe why you’re the right fit for this particular banking job. Use it to mention a couple of key skills, such as your risk management, and include the name of the company you’re applying to.

You can, but it’s better to show them through your work experience bullet points. If you do add some, make them relevant to the job—for instance, employee engagement for a bank manager position.

Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Investment Banking Resume Guide & Examples

Banker Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Commercial Banker

- Personal Banker

Get advice on each section of your resume:

Jump to a resource:

- Banker Resume Tips

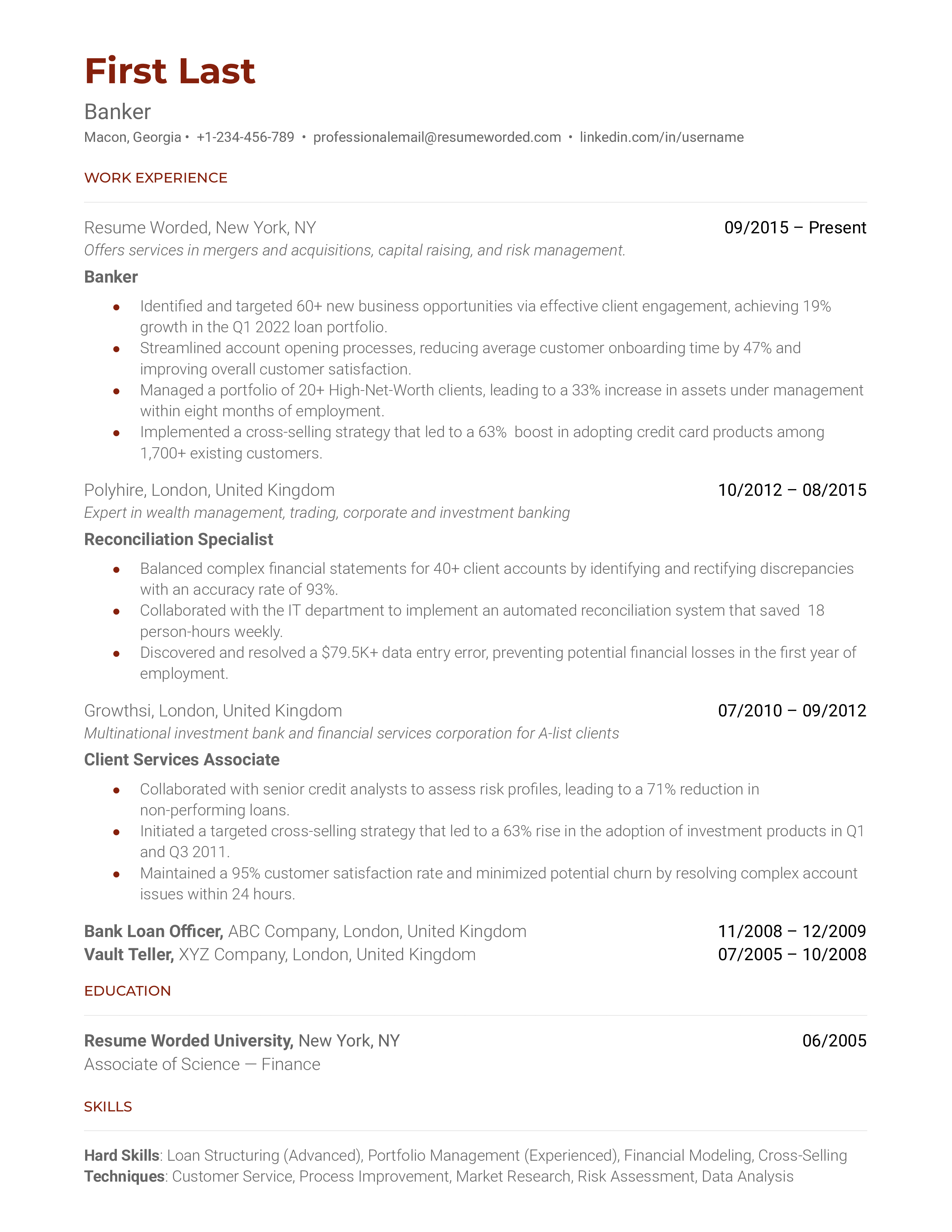

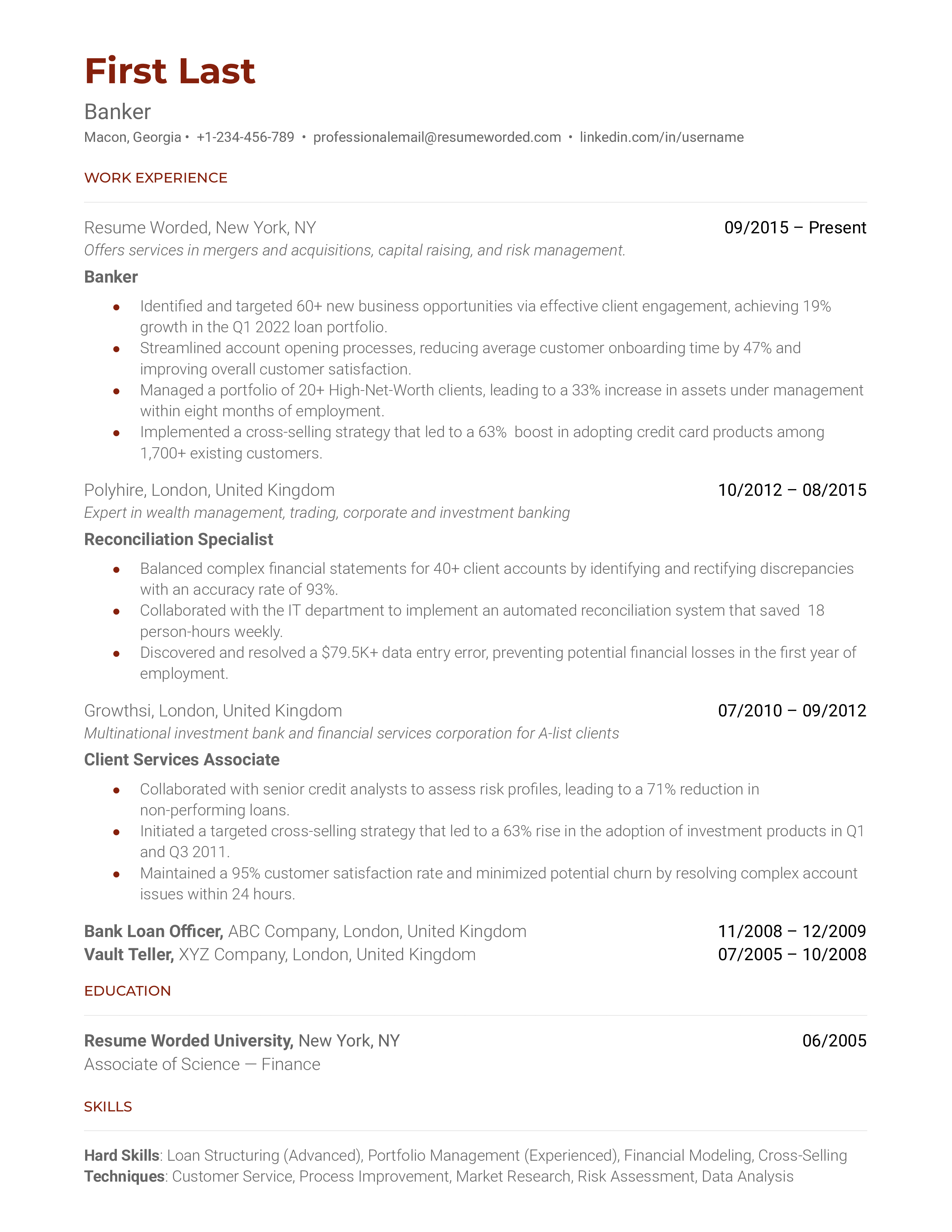

Banker Resume Template

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., banker resume sample.

The banking industry is all about trust, relationship management, and understanding complex financial systems. A strong resume for a Banker role should reflect your ability to handle these tasks. Recently, the industry has been leaning heavily on technological innovation with online banking and digital transactions becoming standard. Also, sustainability and ethical banking practices are gaining traction. So, while it's essential to demonstrate your fundamental banking knowledge and financial acumen, showcasing your proficiency in the latest banking technologies and awareness of ethical banking practices could give you an added advantage. When crafting your resume, bear in mind that bankers are detail-oriented and value effective communication. Therefore, your resume needs to be impeccably neat, clear, and concise. It needs to quickly communicate your qualifications, experience, and skills relevant to the banking world.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

Tips to help you write your banker resume in 2024, showcase technical skills and digital proficiency.

Banking is no longer just about traditional financial services; it's rapidly going digital. Mention any experience or familiarity with banking software, online transaction systems, or fintech innovations. This shows you’re not just adaptable, but also forward-thinking.

Highlight understanding of ethical banking norms

As the industry shifts towards ethical banking practices and sustainable investing, it’s crucial to demonstrate your knowledge in this area. If you’ve been involved in any projects or initiatives related to ethical banking, sustainable finance, or corporate social responsibility (CSR), make sure it's there on your resume.

As a banker, your role is about more than just crunching numbers; you're expected to provide financial guidance, build relationships with clients, and work effectively in a highly regulated environment. Digital banking continues to grow so it's critical to understand latest technological trends and how they fit within the banking industry. By being mindful of these factors, you can tailor your resume to reflect the skills and experience that make you stand out in the evolving banking landscape. In crafting an effective banker resume, remember to emphasize your financial acumen and your customer service expertise. Don't just list out your duties; instead, quantify your achievements. It's a competitive field, so giving concrete evidence of your successes will definitely make your application more compelling.

Demonstrate knowledge of banking regulations

In your resume, you should clearly state your understanding and application of banking regulations. Mention specific regulatory projects you've managed or contributed to. This shows that you can navigate the complexities of banking law, a crucial skill for any banker.

Showcase your digital literacy

In light of the digital banking trend, demonstrating that you’re tech-savvy is a plus. List any software, tools or technologies you’ve used or learned that are relevant to banking. If you’ve been part of a project involving digital banking or fintech, make sure to include this in your list of accomplishments.

Commercial Banker Resume Sample

Personal banker resume sample.

We spoke with hiring managers at top banks like JPMorgan Chase, Bank of America, and Wells Fargo to understand what they look for in a banker's resume. The following tips will help you create a strong resume that stands out from other applicants and gets you interviews.

Highlight your banking experience and skills

Recruiters want to see that you have relevant experience and skills for the banking role you are applying for. Emphasize your banking experience and skills in your resume, such as:

- 5+ years of experience in retail banking, managing customer accounts and transactions

- Expertise in financial analysis, risk assessment, and lending products

- Strong knowledge of banking regulations and compliance requirements

Quantify your achievements wherever possible to show the impact you made. Instead of generic statements, use specific examples like:

- Managed customer accounts

- Skilled in financial analysis

- Managed 200+ customer accounts with $10M+ in assets, consistently meeting sales targets

- Conducted financial analysis for 50+ commercial lending deals, averaging $5M per deal

Tailor your resume to the specific banking role

Banking is a broad field with many different roles, such as retail banking, commercial banking, investment banking, and risk management. Tailor your resume to the specific role you are applying for. Here are some examples:

- For a retail banking role, focus on your experience with customer service, sales, and account management.

- For a commercial banking role, highlight your experience with business lending, financial analysis, and relationship management.

- For an investment banking role, emphasize your experience with financial modeling, deal execution, and client presentations.

Customizing your resume shows the recruiter that you understand the role and have the relevant skills and experience.

Use industry-specific keywords

Many banks use applicant tracking systems (ATS) to screen resumes for relevant keywords before a recruiter even looks at them. Include banking-specific keywords in your resume to increase your chances of passing the ATS screening. Some examples:

- Risk assessment

- Financial analysis

- Lending products

- Regulatory compliance

- Customer relationship management

Sprinkle these keywords throughout your resume in the relevant sections, such as your professional summary, skills, and work experience. However, avoid keyword stuffing or using keywords that do not apply to your actual experience.

Show your career progression

Recruiters want to see that you have progressed in your banking career and taken on increasing responsibilities. Show your career progression by listing your work experience in reverse-chronological order, with your most recent and relevant experience first.

For each job, include your title, the company name, dates of employment, and a few bullet points highlighting your key responsibilities and achievements. Use action verbs to describe what you did and the results you achieved. Here's an example:

Commercial Banking Relationship Manager, ABC Bank, 2018-2022 Managed a portfolio of 50+ mid-sized business clients with $100M+ in total loans Conducted financial analysis and risk assessment for new loan applications, resulting in a 20% increase in loan volume Developed and implemented a new client onboarding process, reducing onboarding time by 30%

Include relevant education and certifications

In addition to work experience, recruiters also look for relevant education and certifications on a banker's resume. Include your degree(s), major(s), and any relevant coursework or projects. Here are some examples:

- Bachelor of Science in Finance, XYZ University, 2015

- Coursework: Financial Accounting, Corporate Finance, Investment Analysis

- Capstone project: Developed a financial model for a $50M real estate investment

Also include any relevant banking certifications you have earned, such as:

- Chartered Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

These certifications show your expertise and commitment to the banking profession.

Demonstrate your soft skills

In addition to technical skills, banks also look for candidates with strong soft skills, such as communication, teamwork, and leadership. Demonstrate your soft skills by including examples in your work experience bullet points. Here are some examples:

- Collaborated with a cross-functional team of 10+ bankers, credit analysts, and underwriters to structure and close a $25M syndicated loan deal

- Presented quarterly portfolio performance reports to senior management, highlighting key risks and opportunities

- Mentored and trained 5 junior bankers on financial analysis and credit underwriting, resulting in a 50% reduction in errors

You can also include a separate skills section on your resume to highlight your key soft skills, such as:

- Relationship building

- Problem-solving

- Attention to detail

Writing Your Banker Resume: Section By Section

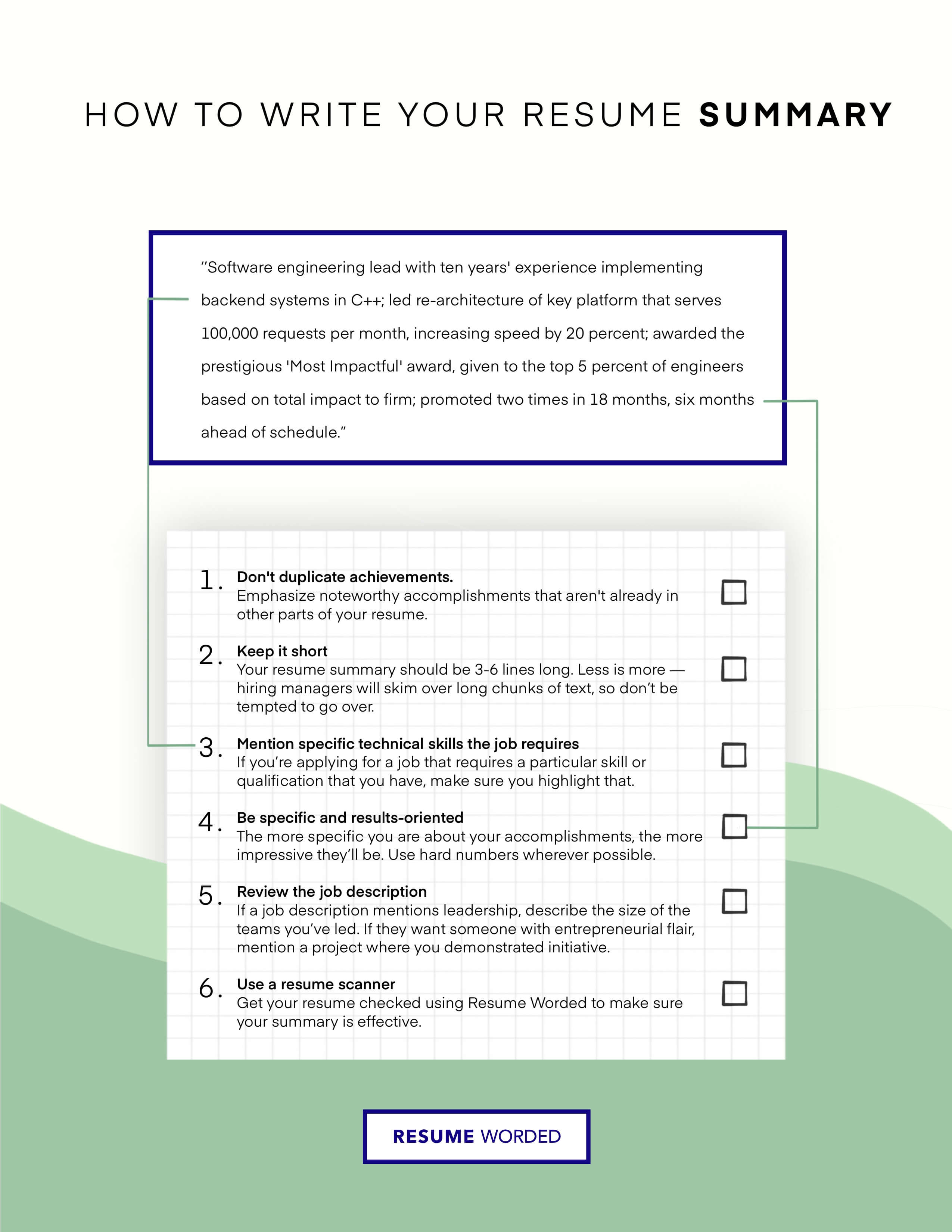

summary.

A resume summary for a banker is an optional section that provides a brief overview of your professional experience, skills, and career goals. While a summary is not required, it can be a useful tool to provide context for your resume and highlight your most relevant qualifications. However, it's important to avoid using an objective statement, as these are outdated and focus on what you want rather than what you can offer the employer.

When writing your banker resume summary, focus on your key strengths, accomplishments, and the value you can bring to the role. Tailor your summary to the specific position you're applying for and the financial institution's needs. Keep it concise, no more than a few sentences or a short paragraph.

To learn how to write an effective resume summary for your Banker resume, or figure out if you need one, please read Banker Resume Summary Examples , or Banker Resume Objective Examples .

1. Highlight your banking expertise and specializations

In your resume summary, showcase your specific areas of expertise within the banking industry. This helps employers quickly understand your focus and how you can contribute to their organization. Consider the following examples:

- Experienced banker with a proven track record of success.

- Skilled professional with experience in various banking roles.

Instead, be more specific and highlight your key areas of specialization:

- Commercial banker with 5+ years of experience in loan origination and portfolio management.

- Investment banker specializing in mergers and acquisitions for technology startups.

By focusing on your specific expertise, you demonstrate your value to potential employers and help them envision how you can contribute to their team.

2. Emphasize your achievements and impact

When crafting your banker resume summary, focus on your achievements and the impact you've made in your previous roles. Quantify your results whenever possible to provide concrete evidence of your success.

Experienced relationship manager with strong communication and interpersonal skills. Proven ability to build and maintain client relationships.

While this summary mentions relevant skills, it lacks specific achievements and impact. Instead, consider a summary that highlights quantifiable results:

Accomplished relationship manager with a track record of growing client portfolio by 30% and increasing revenue by $5M+ annually. Skilled in developing strategic partnerships and providing exceptional client service to high-net-worth individuals.

By emphasizing your achievements and impact, you demonstrate your value to potential employers and set yourself apart from other candidates.

Experience

The work experience section is the heart of your resume. It's where you demonstrate your qualifications and show the hiring manager how you've applied your skills to produce results. When writing your work experience section, aim to create a compelling narrative that paints a clear picture of your career trajectory and accomplishments.

1. Highlight banking experience and skills

When describing your work experience, focus on the aspects of your roles that are most relevant to banking. This could include:

- Managing client accounts and portfolios

- Conducting financial analysis and risk assessments

- Developing investment strategies and providing financial advice

- Collaborating with cross-functional teams to deliver banking solutions

By emphasizing your banking-specific experience and skills, you demonstrate your qualifications for the role and make it easier for the hiring manager to visualize you in the position.

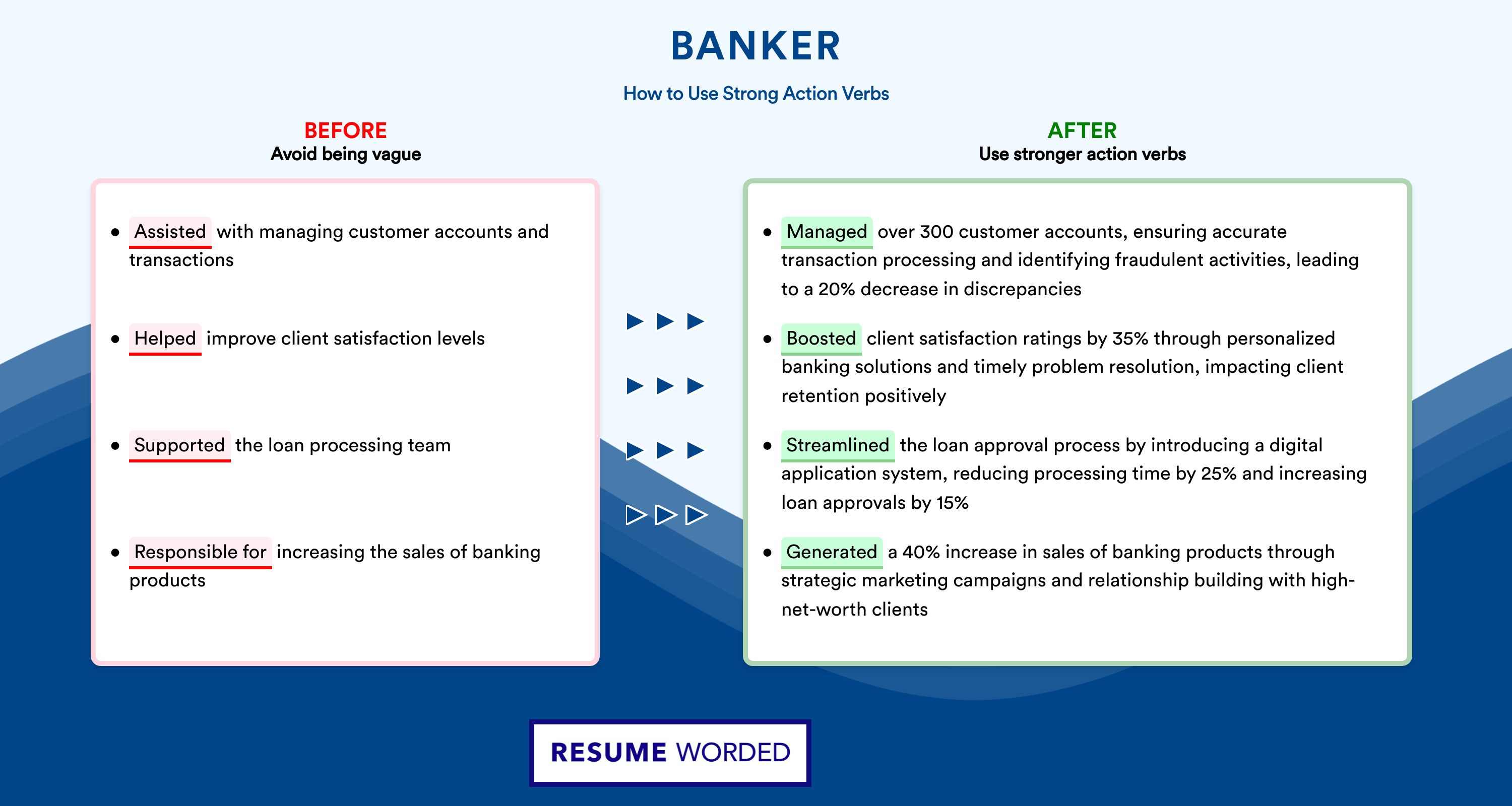

2. Use strong banking action verbs

When describing your achievements, use strong action verbs that resonate with the banking industry. Compare the following examples:

- Responsible for managing client portfolios

- Worked on financial analysis and risk assessment

Instead, use powerful verbs that convey your impact:

- Spearheaded the management of a $50M client portfolio, implementing strategies that generated a 15% return on investment

- Conducted in-depth financial analysis and risk assessments, identifying potential threats and opportunities for clients

Action verbs like "spearheaded," "implemented," "generated," "conducted," and "identified" create a stronger impression of your contributions and leadership.

After writing your work experience section, use our Score My Resume tool to get instant feedback on the strength of your resume based on criteria hiring managers care about, including your use of action verbs.

3. Quantify your banking accomplishments

Whenever possible, use metrics to quantify your achievements and provide context for your contributions. Numbers help hiring managers understand the scope and impact of your work. For example:

Managed a portfolio of 50+ high-net-worth clients, overseeing $250M in assets and achieving an average annual return of 12%

If you don't have access to specific metrics, you can still provide context by using numbers or percentages, such as:

- Collaborated with a team of 15 bankers to develop and implement a new risk assessment framework

- Streamlined the account opening process, reducing average processing time by 30%

4. Demonstrate career growth in banking

Showcase your career progression within the banking industry by highlighting promotions, increased responsibilities, and key projects. This demonstrates your ability to learn, grow, and take on new challenges. For example:

Promoted to Senior Financial Analyst after consistently exceeding performance targets and demonstrating strong leadership skills. In this role, led a team of five analysts in developing and implementing a new investment strategy that increased client portfolio returns by an average of 10%.

By showcasing your career growth, you signal to hiring managers that you have the potential to continue advancing and making valuable contributions to their organization.

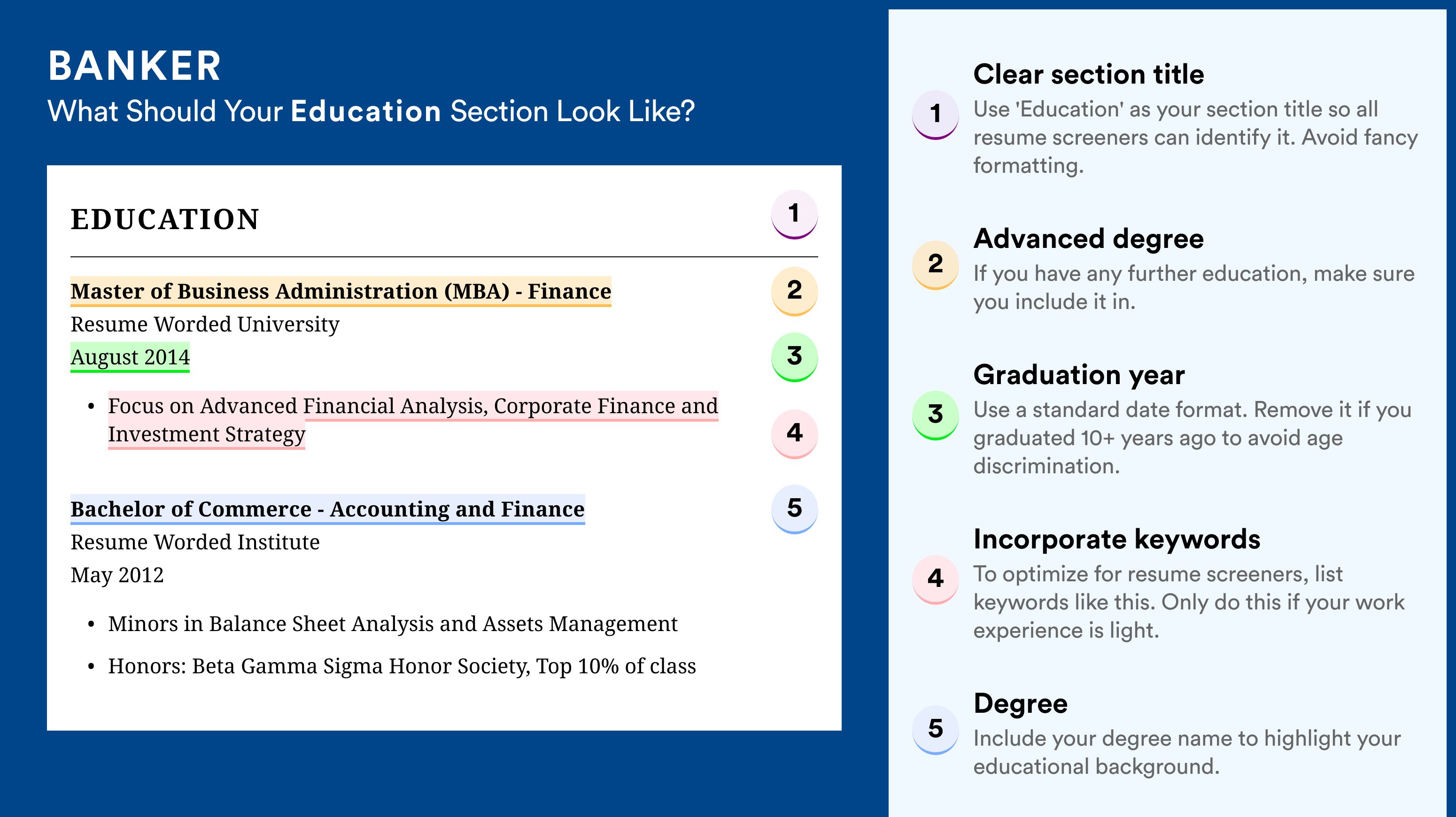

Education

Your education section is a key part of your resume as a banker. It shows hiring managers that you have the necessary knowledge and qualifications for the role. In this section, we'll cover what to include and how to format your education section to make it stand out.

1. List your degrees in reverse chronological order

Start with your most recent degree first, and work backwards. This is the standard format for resumes in the banking industry.

For each degree, include:

- Name of the degree (e.g. Bachelor of Science in Finance)

- Name of the university

- Graduation year

- GPA (if above 3.5)

Here's an example of how to format your degrees:

- Master of Business Administration (MBA), XYZ University, 2020

- Bachelor of Science in Finance, ABC University, 2016

2. Highlight relevant coursework for entry-level bankers

If you are a recent graduate or have limited work experience, you can strengthen your education section by listing relevant coursework. This shows hiring managers that you have specific knowledge that applies to the banking role.

However, avoid listing every course you've taken. Instead, choose 3-5 courses that are most relevant to the job description.

Here's an example:

Bachelor of Science in Finance, DEF University, 2022 Relevant Coursework: Financial Modeling, Investment Banking, Corporate Finance, Financial Accounting

3. Keep it concise for experienced bankers

If you are a senior-level banker with many years of experience, your education section should be brief. Hiring managers will be more interested in your professional accomplishments than your degrees from many years ago.

Here's an example of what not to do:

- Master of Business Administration, XYZ University, 1995-1997

- Bachelor of Arts in Economics, ABC College, 1991-1995

- Online Course in Advanced Excel for Finance, 2005

Instead, keep it short and sweet:

- MBA, XYZ University

- B.A. Economics, ABC College

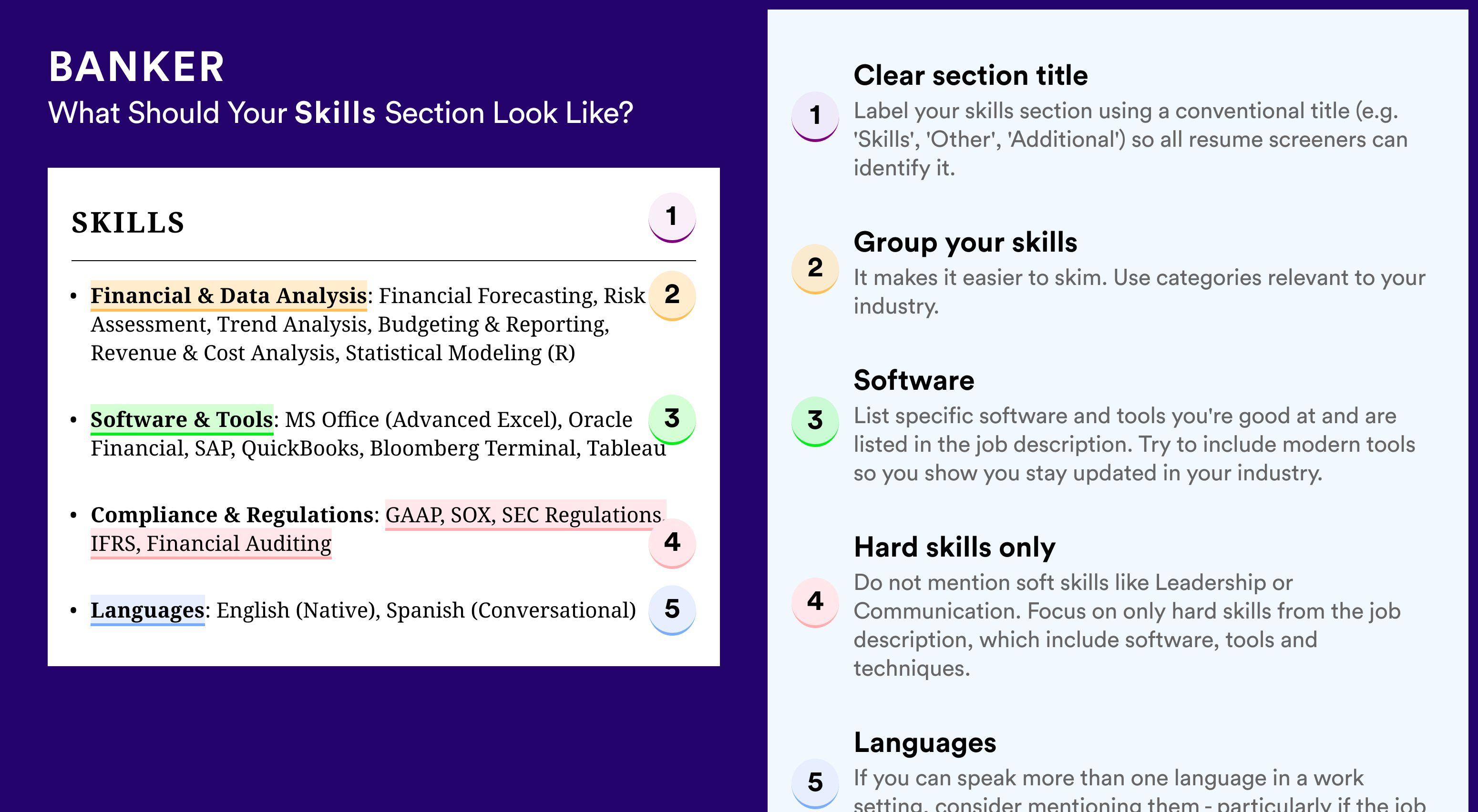

Skills

The skills section of your banker resume is a critical component that showcases your abilities and qualifications to potential employers. It's important to highlight the most relevant and valuable skills that align with the job requirements and demonstrate your expertise in the banking industry. In this section, we'll provide you with tips and examples to help you craft a compelling skills section that will catch the attention of hiring managers and increase your chances of landing an interview.

1. Prioritize banking-specific skills

When listing your skills, focus on those that are directly related to the banking industry and the specific job you're applying for. Highlight your expertise in areas such as financial analysis, risk management, loan processing, and customer service.

Here's an example of a well-structured skills section for a banker resume:

Financial Analysis : Financial modeling, financial statement analysis, credit analysis, budgeting and forecasting Risk Management : Risk assessment, fraud detection, compliance, anti-money laundering (AML) Loan Processing : Loan origination, underwriting, documentation, closing Customer Service : Relationship building, problem-solving, communication, sales

To ensure your skills section is tailored to the job, review the job description carefully and incorporate the key skills and qualifications mentioned. Using our Targeted Resume tool can help you identify the most important skills to include based on the specific job posting.

2. Avoid generic or outdated skills

When crafting your skills section, steer clear of listing generic or outdated skills that don't add value to your resume. For example, instead of simply stating "computer skills," be specific and mention the relevant software or tools you're proficient in, such as financial analysis software or customer relationship management (CRM) systems.

Computer skills Microsoft Office Communication Teamwork

Instead, showcase your skills in a more targeted and impactful way:

Financial Software : Bloomberg Terminal, Thomson Reuters Eikon, Morningstar CRM Systems : Salesforce, Oracle CRM, Microsoft Dynamics Data Analysis : Excel (Advanced), SQL, Tableau

Keep in mind that hiring managers often use Applicant Tracking Systems (ATS) to filter resumes based on the presence of specific skills and keywords. By including relevant and up-to-date skills, you increase your chances of passing the ATS screening and reaching the next stage of the hiring process.

3. Quantify your skills with proficiency levels

To provide hiring managers with a clear understanding of your skill levels, consider including proficiency indicators next to each skill. This can be done using terms like "Expert," "Advanced," "Intermediate," or "Beginner," or by using a visual scale, such as stars or bars.

Here's an example of how you can incorporate proficiency levels into your skills section:

Financial Analysis (Expert) Risk Management (Advanced) Loan Processing (Intermediate) Customer Service (Expert)

By quantifying your skills, you provide hiring managers with a quick and easy way to assess your capabilities and determine if you're a good fit for the role.

To ensure your skills section is effective and impactful, consider using our Score My Resume tool, which provides instant expert feedback on your resume, including an assessment of your skills section. The tool checks your resume against 30+ key criteria that hiring managers look for and offers suggestions for improvement.

Skills For Banker Resumes

Here are examples of popular skills from Banker job descriptions that you can include on your resume.

- DCF Valuation

- Financial Analysis

- Capital Markets

- Python (Programming Language)

- Due Diligence

- S&P Capital IQ

- Financial Modeling

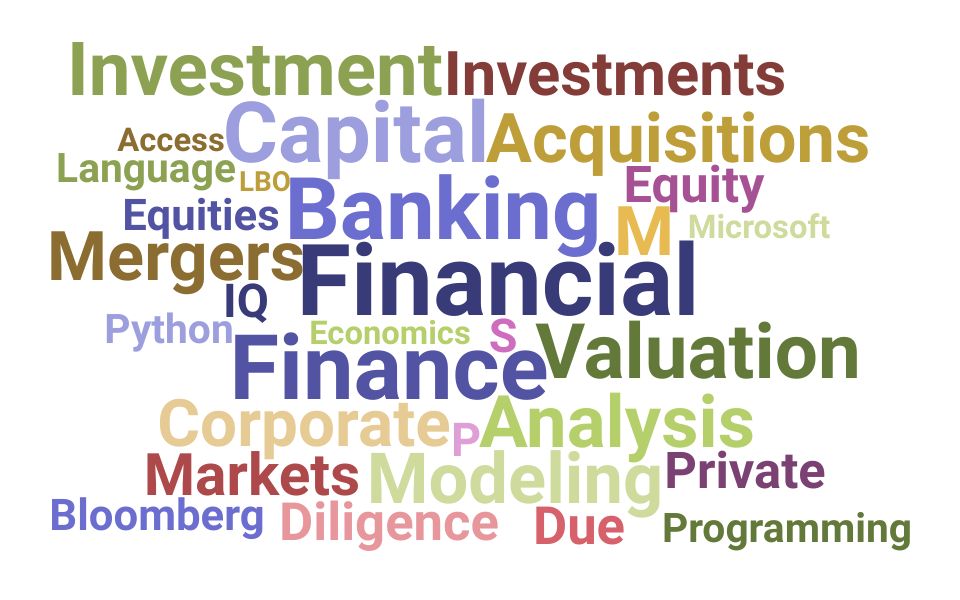

Skills Word Cloud For Banker Resumes

This word cloud highlights the important keywords that appear on Banker job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

Similar resume templates, investment banking.

- C-Level and Executive Resume Guide

- Accounts Payable Resume Guide

- Collections Specialist Resume Guide

- Bookkeeper Resume Guide

- Financial Advisor Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Investment Banking Resume Guide & Examples for 2022

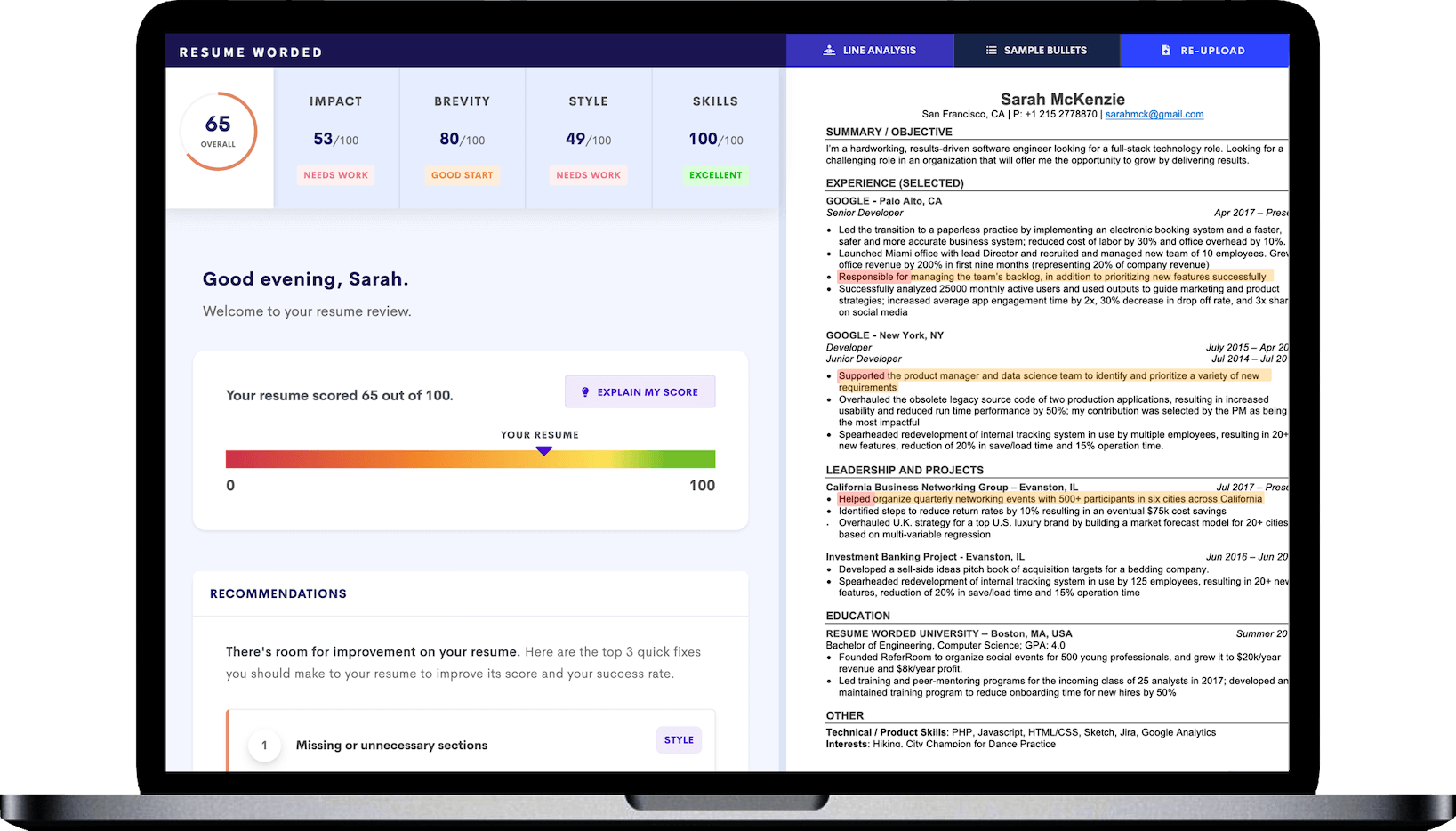

Improve your Banker resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Banker resumes in your industry.

• Fix all your resume's mistakes.

• Find the Banker skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Banker Resumes

- Template #1: Banker

- Template #2: Banker

- Template #3: Banker

- Template #4: Commercial Banker

- Template #5: Personal Banker

- Skills for Banker Resumes

- Free Banker Resume Review

- Other Finance Resumes

- Banker Interview Guide

- Banker Sample Cover Letters

- Alternative Careers to a Investment Banking Specialist

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 8 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 8 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Professional Banker Resume Examples

If you are looking to apply for a position as a professional banker, having a well-written and effective resume can make all the difference. Your resume should accurately reflect your qualifications, experience, and skills, which will set you apart from the competition. To make sure your resume stands out, it’s helpful to look at professional banker resume examples. This resume writing guide will provide you with some useful tips and examples on how to create an effective resume that can help you stand out to employers. With this guide, you will be able to craft a resume that will showcase your qualifications and increase your chances of getting the job.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Professional Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

I am a professional banker with over 10 years of banking industry experience. I have a proven track record of providing innovative solutions to complex financial challenges and exceeding customer expectations. I am adept at delivering effective customer service and maintaining positive relations with all stakeholders. I am a team player and have strong communication, problem- solving, and analytical skills. I am confident that I can be a valuable asset to any organization.

Core Skills :

- Excellent customer service skills

- Detail- oriented

- Strong problem solving and analytical skills

- Knowledge of banking industry trends and regulations

- Proficient in MS Office Suite and banking software

- Excellent communication and interpersonal skills

Professional Experience : Banker, ABC Bank, NY

- Provided excellent customer service to all clients

- Resolved complex customer inquiries in a timely manner

- Performed loan and account closings, as well as account reviews

- Identified banking and financial services needs of customers

- Assisted with the development of new banking products and services

- Maintained banking industry knowledge by attending monthly seminars

Education : Bachelor of Science in Finance, New York University, NY

- Graduated with honors

- Received the Dean’s Award for Outstanding Academic Performance

Create My Resume

Build a professional resume in just minutes for free.

Professional Banker Resume Examples Resume with No Experience

- Recent college graduate with a Bachelor of Business Administration degree in Banking and Finance

- Strong understanding of banking principles, processes and procedures

- Well- developed analytical and problem- solving skills

- Excellent written and verbal communication skills

- Ability to work independently or in a team setting

- Proficiency in Microsoft Office Suite (Word, Excel and PowerPoint)

- Knowledge of financial analysis and reporting

- Familiarity with banking systems and software

- Excellent organizational, time management, and multitasking skills

- Ability to maintain confidentiality in financial matters

Responsibilities :

- Processing banking transactions, such as deposits, withdrawals, and transfers

- Providing customer service to banking clients

- Performing account reconciliation and balancing

- Assisting customers with questions and concerns about their banking accounts

- Identifying and recommending banking products and services

- Managing daily banking operations and reporting

- Recommending banking procedures and policies to management

Experience 0 Years

Level Junior

Education Bachelor’s

Professional Banker Resume Examples Resume with 2 Years of Experience

Dynamic and self- motivated professional banker with more than 2 years of experience in the financial services industry. Possess strong knowledge of banking regulations, customer service techniques, and loan evaluation process. Proven ability to identify and analyze financial trends, create reports, and develop customized solutions for clients. Possess excellent communication, interpersonal, and organizational skills.

- Knowledge about banking regulations, products, and services

- Customer service and problem- solving abilities

- Proficiency in Microsoft Office applications (Word, Excel, PowerPoint)

- Strong analytical and research capabilities

- Ability to identify and capitalize on market trends

- Excellent verbal and written communication skills

- Assisting customers in understanding banking services and products

- Developing customized loan and investment plans

- Evaluating investment and loan requests

- Monitoring and researching economic and market trends

- Analyzing client financial data

- Supporting sales and marketing initiatives

- Maintaining customer relationships

- Ensuring compliance with banking regulations

Experience 2+ Years

Professional Banker Resume Examples Resume with 5 Years of Experience

I am a professional banker with over 5 years of experience in the banking industry. During my career, I have been responsible for a wide range of banking operations, from loan processing to customer service. I am a highly motivated and organized individual, with excellent communication and problem- solving skills. My experience has allowed me to develop a deep understanding of banking operations, regulations, and customer service. I am confident that I will be an asset to any organization that requires my banking skills.

- Financial analysis

- Loan processing

- Customer service

- Risk assessment

- Banking operations

- Regulatory compliance

- Problem- solving

- Communication

- Processed loan applications and obtained credit checks

- Assisted customers with banking needs such as deposits, withdrawals, and transfers

- Reviewed financial documents and ensured compliance with banking regulations

- Assessed risk associated with loan applications

- Developed and maintained relationships with customers

- Resolved customer inquiries and complaints in a timely manner

- Monitored financial market trends and advised clients on investment decisions

- Processed payment requests and reviewed accounts for accuracy

- Developed and implemented strategies to improve banking operations

Experience 5+ Years

Level Senior

Professional Banker Resume Examples Resume with 7 Years of Experience

Highly experienced and knowledgeable banking professional with 7+ years of experience in banking operations, customer service and sales. Proven ability to develop strong working relationships with clients and colleagues, optimize processes in order to increase operational efficiency and manage complex projects. Fully equipped to review, analyze and assess financial data while delivering top- notch customer service.

- Extensive experience in banking operations.

- Excellent customer service and interpersonal skills.

- Strong problem- solving and analytical skills.

- Proficiency in MS Office Suite and financial software applications.

- Ability to quickly assess financial and market trends.

- Ability to explain complex financial topics in an easy- to- understand manner.

- Conducted financial analysis on various banking products and services.

- Managed customer accounts, ensuring compliance with banking regulations.

- Responded to customer inquiries regarding account statements, loans, rates and services.

- Developed and implemented strategies to maximize customer satisfaction.

- Provided support in managing branch operations, including daily banking activities and audits.

- Performed financial analysis on customer’s portfolio to assess investment opportunities.

- Analyzed and monitored the performance of financial markets and indices.

Experience 7+ Years

Professional Banker Resume Examples Resume with 10 Years of Experience

Highly motivated and experienced banking professional with 10 years of experience in the banking industry. Possess a proven track record of providing financial services and advice to customers, managing portfolios, and providing solutions to challenging situations. Possess a strong work ethic, excellent interpersonal and communication skills, and the ability to work well in a team environment.

- Client Relationship Management

- Business Development

- Portfolio Management

- Financial Analysis

- Credit Risk Management

- Banking and Financial Regulations

- Sales and Marketing

- Actively engaging with clients to understand their financial needs, developing relationships, and providing advice

- Managing a portfolio of clients and providing solutions to their financial situations

- Analyzing financial data and conducting risk assessments

- Developing and adhering to banking and financial regulations

- Identifying and developing new business opportunities

- Promoting the bank’s products and services to potential customers

- Providing sales and marketing support for the bank’s products and services

Experience 10+ Years

Level Senior Manager

Education Master’s

Professional Banker Resume Examples Resume with 15 Years of Experience

Highly experienced Professional Banker with 15 years of experience in the banking sector. Expert in financial analysis and risk management, with a solid understanding of the banking industry. Skilled at developing and managing client relationships, analyzing financial data, and supervising staff. Proven success in developing strategies to increase profitability and create financially sound portfolios.

- Risk management

- Client relations

- Investment strategy

- Staff supervision

- Asset management

- Loan origination

- Portfolio management

- Develop and manage client relationships, providing tailored advice to them

- Analyze financial data, identify trends and recommend solutions to increase profitability

- Supervise and train staff, hold regular performance reviews, and address any issues

- Develop investment strategies to create financially sound portfolios

- Manage assets, originate loans and adhere to relevant regulations

- Identify and mitigate risk in the portfolio, while working to optimize returns

Experience 15+ Years

Level Director

In addition to this, be sure to check out our resume templates , resume formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

What should be included in a Professional Banker Resume Examples resume?

A professional banker resume should be a reflection of your qualifications, certifications, and experience that is tailored to your desired banking industry. Here is a list of the components you should include in a professional banker resume:

- Contact Information: Your name, address, phone number, and email address.

- Professional Summary: A brief overview of your skills, qualifications, and objectives.

- Work Experience: Include all relevant banking positions, including job titles, the name of the company you worked for, the length of time in the position, and the duties you performed.

- Education: Include all relevant degrees, certificates, and other qualifications.

- Professional Skills: List all skills related to the banking industry, such as risk management, financial analysis, customer service, and loan processing.

- Achievements: Include any awards or recognition you have received in the banking industry.

- Certifications: Include any banking or financial certifications you may have.

- References: Include contact information for two to three professional references.

By including all of the above components in your professional banker resume, you will be better equipped to stand out in the competitive banking industry.

What is a good summary for a Professional Banker Resume Examples resume?

A professional banker resume example should include a brief summary that highlights the individual’s experience and qualifications in the banking industry. This summary should include any relevant certifications, such as those from the American Bankers Association or the Institute of Financial Professionals, as well as any relevant experience in the financial services sector. Additionally, the summary should touch on the individual’s skillset in areas such as financial analysis, asset management, credit risk management, and other areas of banking. Finally, the summary should also include any relevant education and qualifications, such as a Bachelor’s degree in finance or accounting. By providing a brief summary of the individual’s qualifications and experience, a professional banker resume example can help employers quickly assess the individual’s credentials and determine whether they are suitable for a banking position.

What is a good objective for a Professional Banker Resume Examples resume?

A professional banker resume should have an objective that emphasizes your career goals and accomplishments. The objective should be tailored to the specific job you are applying for and should be succinct, yet compelling. Here are some examples of good objectives for a professional banker resume:

- To leverage my five years of banking experience and financial acumen to lead a high-performing team and grow the bank’s assets.

- To utilize my MBA in Finance and banking experience to develop and implement strategies that increase the value of bank assets.

- To leverage my expertise in financial analysis, banking regulations, and customer service to maximize profitability and ensure customer satisfaction.

- To use my strong interpersonal and communication skills to build strong relationships with customers and colleagues, while providing superior customer service.

- To use my experience in financial analysis, risk management, and banking regulations to identify and exploit opportunities for growth and expansion.

- To employ my experience in credit analysis, banking operations, and portfolio management to increase the efficiency and profitability of the bank.

How do you list Professional Banker Resume Examples skills on a resume?

When writing a resume for a banking position, it’s important to focus on skills that are pertinent to the position. This is especially true for banking positions, as employers in the banking industry require specific skills and knowledge to complete the job.

When creating a resume, it’s important to make sure that you list the skills you have that are relevant to the position. Here are some of the skills that you should consider including in a professional banker resume example:

- Analytical Thinking: Analytical thinking skills are important for banking professionals, as they help you to analyze financial trends, identify potential problems, and solve them.

- Risk Analysis: Risk analysis is a crucial part of any banking job. Being able to assess the risks associated with a particular financial move is key to making the right decisions for the bank’s customers and the bank itself.

- Financial Planning: Bankers need to be able to create comprehensive financial plans for their customers. This includes helping customers develop budgets, developing retirement plans, and more.

- Negotiation Skills: Bankers need to be able to negotiate with customers and other financial institutions in order to get the best possible deals.

- Customer Service: Bankers must have excellent customer service skills in order to provide their customers with the best banking experience possible.

- Organizational Skills: Being organized is essential for a banker. Bankers must be able to keep track of customer information, documents, and more in order to ensure that everything runs smoothly.

By including these skills in your professional banker resume example, you will be able to show employers that you have the skills and knowledge necessary to excel in the position.

What skills should I put on my resume for Professional Banker Resume Examples?

A professional banker resume should highlight your relevant expertise and experiences in the banking industry. When creating your resume, make sure to include the following skills:

- Understanding of banking regulations: As a professional banker, you must have a thorough knowledge of financial regulations and banking laws. Your resume should emphasize your understanding of banking regulations and compliance.

- Financial analysis: As a banker, you must be able to analyze financial data and trends in order to make informed decisions. Make sure to include your ability to analyze financial data on your resume.

- Risk management: In banking, risk management is key. Make sure to emphasize your experience in managing risk and developing strategies to mitigate risk.

- Customer service: A successful banker must be able to provide excellent customer service. Make sure to include your customer service experience on your resume.

- Problem-solving: In banking, problem-solving skills are essential. Showcase your problem-solving abilities on your resume.

- Communication: As a banker, you will need to be able to communicate effectively with customers, colleagues, and other stakeholders. Showcase your communication skills on your resume.

By including these skills and experiences on your professional banker resume, you will be able to demonstrate to potential employers that you have the skills and knowledge necessary to be a successful professional banker.

Key takeaways for an Professional Banker Resume Examples resume

A professional banker resume is an important tool for any individual who is entering the world of banking and finance. It is essential to ensure that your resume stands out from the crowd and accurately reflects your skills, knowledge, and experience. Here are some key takeaways to consider when creating a professional banker resume:

- Focus on your achievements – When creating a professional banker resume, it is important to emphasize your accomplishments. Make sure to include any awards, honors, or other accomplishments that you have achieved in the banking field. This will demonstrate to potential employers your level of expertise and dedication to the industry.

- Highlight relevant skills – When crafting a professional banker resume, be sure to emphasize any relevant skills and knowledge that you possess. These could include knowledge of banking regulations, experience with financial analysis, or familiarity with financial software.

- Keep it concise – A professional banker resume should be succinct, yet comprehensive. Avoid long paragraphs and instead focus on providing key information in an organized and easily readable format.

- Utilize a professional design – When creating a professional banker resume, make sure to utilize a professional design. This will help ensure that the document is visually appealing and communicates the information in an effective manner.

By following these key takeaways, you can ensure that your professional banker resume is both effective and impressive.

Let us help you build your Resume!

Make your resume more organized and attractive with our Resume Builder

Banking Resume - Examples & How-to Guide for 2024

As someone who works in banking, you’re a trusted professional who knows their way around the finance world.

You give financial advice and guidance to your clients.

But when it comes to creating a job-winning resume, you’re the one who needs advice.

What does a good banking resume look like, anyway?

With so many people competing for the top banking jobs, you can’t afford to leave any questions unanswered.

But don’t worry! Our field-tested resume examples and tips will get your feet through the door of employment.

- A job-winning banking resume example

- How to create a banking resume that hiring managers love

- Specific tips and tricks for the banking industry

Here’s a banking resume example, built with our own resume builder :

Follow the steps below to create a banking resume of your own.

Are you looking for a resume example for a different job position? Head on over to one of our related resume examples instead:

- Bank Teller Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Financial Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

How to Format a Banking Resume

Banking is one of the fiercest industries you can enter.

As such, you really need to put your money where your mouth is.

This involves creating a resume that stands out from the competition.

But before you can get writing, you need to choose the correct format.

You see, even the richest of experience won’t impress a hiring manager that is struggling to read the content.

Have relevant banking experience? Then you’ll want to use the most popular format, known as the “ reverse-chronological ” format. It starts with your most recent work experience and then works backward through your banking history and skills.

You may also want to try these two popular formats:

- Functional Resume - This format focuses on your banking skills, which makes it the best format for those who have the relevant skills, but don’t a wealth of experience as a banker.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, making it perfect for those with both the relevant skills AND banking work experience.

- For a professional and precise resume, keep your banking resume to one-page. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins – Use one-inch margins on all sides

- Font - Pick a professional font that stands out

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As professional banker, the recruiter expects to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Banking Resume Template

Word is great for a lot of things.

Well, except for building resumes.

You see, you need a banking resume with a professional structure.

Those who have used word to create their own resume will know that one tiny change can ruin the whole structure.

For a professional banking resume, you can use a resume template .

What to Include in a Banking Resume

The main sections in a banking resume are:

- Contact Information

- Work Experience

For a banking resume that rises above the other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

So that’s a general overview, now it’s time to get specific about each of the sections.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a banker, you know that accuracy is vital.

And it’s no different than with your contact information section.

In fact, just one digit out of place can render your whole application useless.

For your resume contact information section, include:

- Title – Make this specific to the exact job you’re applying for

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Hannah Atkinson - Banker. 101-358-6095. [email protected]

- Hannah Atkinson - Banking Angel. 101-358-6095. [email protected]

How to Write a Banking Resume Summary or Objective

Creating a professional resume that stands out is the #1 goal .

But HOW is this done?

By using an opening paragraph that brings home the bacon!

These opening paragraphs come in two types: resume summary or objective.

Although slightly different, both are introductory paragraphs that sum up the main points of your resume.

The difference between a summary and objective is that:

A resume summary summarizes your most notable banking experiences and achievements. It’s designed for individuals who have multiple years of finance industry experience.

- Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

A resume objective gives a quick breakdown of your professional goals and aspirations, which makes it perfect for junior bankers. Now, even though you’re talking about your own goals, it’s important to align your message to what the employer wants.

- Enthusiastic finance student looking for a banking role at BANK XYZ. Two years of experience at a local accounting firm. Excellent organization, communication, and analytical skills. Keen to support your banking team, where my interpersonal skills can be leveraged to achieve the best quality of service.

So, which one is best for bankers?

Well, a summary is suited for bankers who have been crunching the numbers for a few years, whereas an objective is suited for individuals who are new to the banking world (student, graduate, or switching careers).

- The hiring manager wants to see the benefits you will bring to the bank, not what it will do for your career. Also, banks want employees who have strong quantitative and communication skills, so use powerful action verbs and be as specific as possible.

How to Make Your Banking Work Experience Stand Out

What’s the best way to impress a recruiter?

Work experience!

Sure, the recruiter wants to hear about your education and skill-set, but nothing proves your talents like a wealth of banking experience.

Use this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

02/2017 - 01/2020

- Voted “Banker of the Year” in 2018 and 2019

- Followed best practises to process over 1000 loan applications

- Studied market trends and produced risk assessment documentation for management – contributing in $430,000 savings for our clients

- Trained and empowered a team of eight new bank tellers

For a resume that shows your best qualities, make sure to mention your achievements, rather than your daily responsibilities.

Instead of saying:

“Risk assessment”

“Studied market trends and produced risk assessment documentation for management – contributing to $430,000 in savings for our clients”

So, how exactly do the two differ?

Well, the second statement goes into much greater detail. It’s a clear example of how your abilities will have a direct impact on the success of the bank.

What if You Don’t Have Work Experience?

Maybe you’ve got a finance degree but have yet to work in a bank?

Or maybe you’re transitioning from a junior position at a competing bank?

Whatever your personal situation, you have options.

You see, despite a lack of bank experience, you are still able to include relevant skills and experiences from other previous jobs.

For example, if you’ve worked as a junior accountant, you can talk about the crossover experiences. Just like a banker, you would have to pay great attention to detail, work with customers, and enjoy working with numbers.

For the students reading this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Banking Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these exact words on nearly all banking resumes.

And since you need your banking resume stand out, we’d recommend using some power words instead:

- Spearheaded

- Conceptualized

How to List Your Education Correctly

Up next in your banker resume comes the education section.

Now, there’s more than one educational path to becoming a bank employee.

The bank manager just wants to know your education to date.

Follow this format:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Chicago State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Finance and Economics, Bank Lending and the Legal Environment, Quantitative Methods for Banking, and more]

Still have questions? If so, here are the most frequently asked questions:

What if I’m still studying?

- No matter if you’re still studying or not, you should still mention every year that you have studied to date

Is my high school education important?

- Only list your high school education if that is your highest form of education

What is more important for a banker, education or experience?

- If you’re an experienced banker, your work experience should be listed before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 16 Skills for a Banking Resume

Being a successful banker requires a certain set of skills.

And the bank manager needs to know you have what it takes!

Now, you could be the most skilled banker in the world, but they still need to be clearly displayed on your resume – not locked away in a bank vault!

Here are the main skills a hiring manager wants to see from a banker:

Hard Skills for a Banker:

- Balancing Ledgers

- Risk Assessment

- Mortgages and Loans

- Deposits and Withdrawals

- Account Maintenance

- Foreign Currency Exchange

- Investment Management

- Safety Deposit Boxes

- Cash Handling

Soft Skills for a Banker:

- Excellent Communicator

- Problem Solving

- Confident & Professional Manner

- Organization

- Negotiation

- Time Management

- Although bankers need soft skills, we recommend only including the main skills on your resume. It is also wise to only include soft skills that you posses, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have a resume that’ll get you through the doors of any bank.

Your #1 goal is a resume that stands above the competition.

And this is not the time to leave your future to chance!

The following sections will set you apart from the other candidates.

Awards & Certifications

Have you been awarded at your previous place of work?

Did you win any competitions at university?

Have you completed any certifications to enhance your expertise?

Whatever your case may be, the manager will want to see any relevant awards and certifications.

Awards & Certificates

- Certified Financial Planner (CFP)

- Certified Financial Analyst (CFA)

- “Learning How to Learn” - Coursera Certificate

- “Banker of the Year” 2019 - XYZ Bank

Able to speak other languages?

Whether or not the job description specifically requires it, the ability to speak another language is an impressive skill.

So if you’re able to speak another language, even to a basic standard, feel free to include it inside your resume, but only if there is space.

Order the languages by proficiency:

- Intermediate

Now, you may be wondering, “ why does the bank manager need to know about my love of golf? ”

Well, the manager doesn’t need to know, but it does show them more about who you really are.

And this is great, as banks want an employee who they’ll get along with.

As such, listing your hobbies and interests can be a good idea, especially if it involves social interaction.

If you want some ideas of hobbies & interests to put on your banking resume , we have a guide for that!

Match Your Cover Letter with Your Resume

You don’t need us to tell you how competitive the finance job market is.

And when competing with experienced professionals, you need an edge.

But HOW can you get one?

Well, with a convincing cover letter!

You see, a letter is the perfect tool for communicating with more depth and personality.

Oh, and it shows that you want THIS banking position in THIS bank.

Just like when building the resume, your cover letter also needs the correct structure.

Here’s how to do that:

We recommend writing the following for each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website.

Hiring Manager’s Contact Information

Their full name, position, location, email

Opening Paragraph

Create a powerful introduction that hooks the reader. Make sure to mention:

- The specific position you’re applying for – Banker

- An impactful summary of your most notable experiences achievements

Once you’ve impressed the hiring manager with your opener, you can delve deeper into the rest of your working history. Some of the points you can mention here are:

- Why you want to work for this specific bank

- What you know about the bank’s culture and vision

- Your most notable experiences and how they relate to this job

- If you’ve worked in similar positions at other banks

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragraph

- Thank the hiring manager for reading

- End with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “ Sincerely ” or “ Best regards. ”

Now, if you’re not a professional wordsmith, creating a job-winning cover letter is a difficult task. But don’t worry, you can use our how to write a cover letter article for guidance.

Key Takeaways

You’ve now unlocked the bank vault and discovered how to create a job-winning resume.

Let’s quickly review everything we’ve covered:

- Based on your specific circumstances, choose the correct format. We recommend starting with a reverse-chronological format, and then following the best layout practices

- Use a captivating resume summary or objective

- In the work experience section, highlight your most notable achievements, not your daily duties

- Match your banking resume with a convincing cover letter

Suggested Reading:

- How to Write a Bank Teller Resume in 2024

- How to Ace Interviews with the STAR Method [9+ Examples]

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Banking Resume Examples and Templates for 2024

Banking Resume Templates and Examples (Downloadable)

How to write a banking resume, how to pick the best banking resume template, banking text-only resume templates and examples, frequently asked questions: banking resume examples and advice, check out related examples.

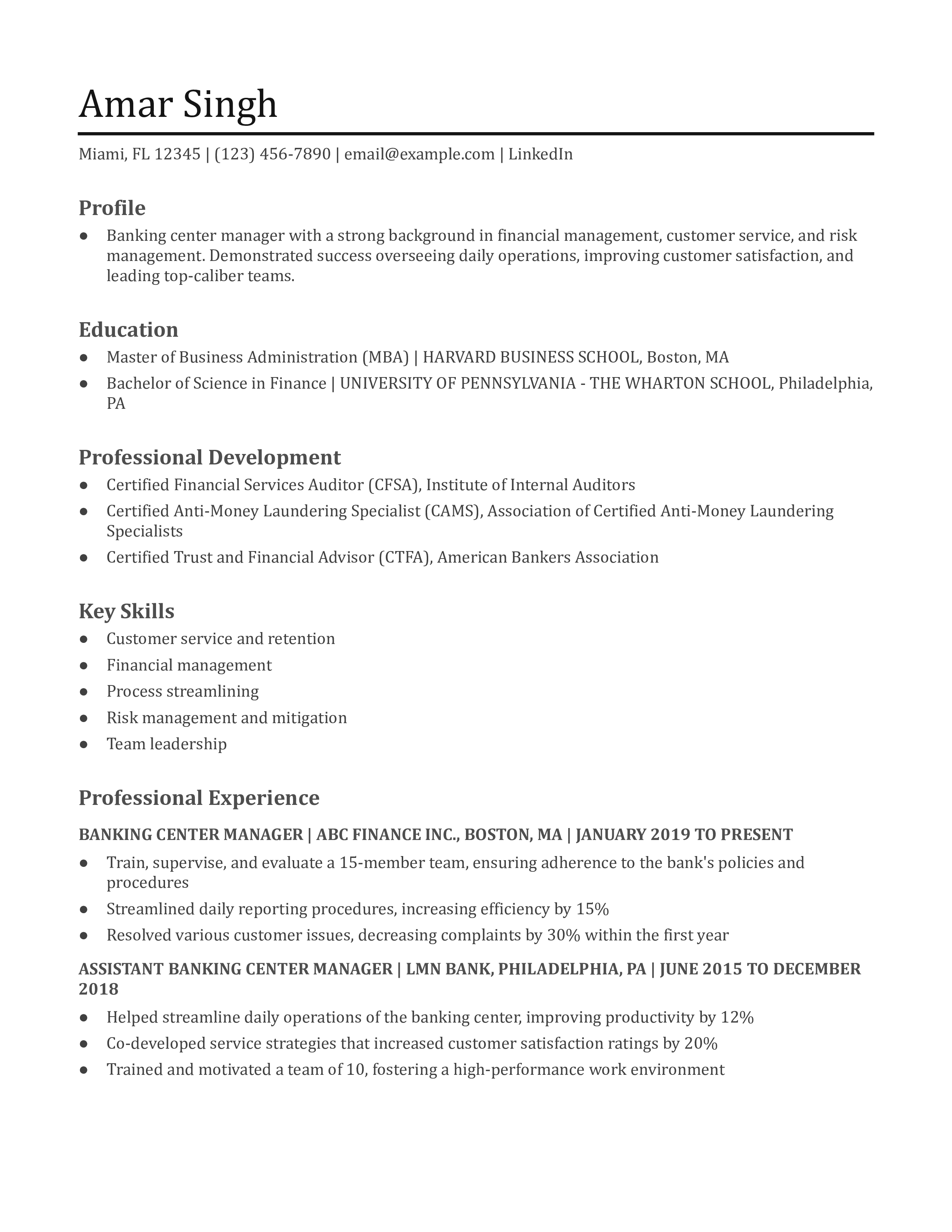

- Banking Center Manager

- Associate Investment Banker

This guide provides expert tips for creating a results-driven resume that emphasizes the best aspects of your banking experience.

Key takeaways:

- Use bullet points to showcase your work highlights. Start each bullet point with a strong verb like “Created” or “Enhanced.”

- Spell out the results of your past work as a banking professional, and describe how your efforts helped customers or the wider organization.

- Show your skills relevant to a banking role, such as customer service, financial analysis, or portfolio management.

Using a template can help you write an effective banking resume. Your banking resume should usually include these sections:

- Contact information

- Professional experience

- Education and certifications

1. Share your contact information

Give your full name, phone number, email address, location, and links to any online professional profiles. Ensure your contact information is current so employers can reach you for an interview.

Your Name (123) 456-7890 [email protected] City, State Abbreviation Zip Code LinkedIn Profile

2. Create a profile by summarizing your banking qualifications

Impress hiring managers at the top of your resume by giving the three to five primary reasons you excel in banking.

Banking center manager with a strong background in financial management, customer service, and risk management. Demonstrated success overseeing daily operations, improving customer satisfaction, and leading top-caliber teams.

3. Create a powerful list of your banking experience

View the experience section as a chance to give detailed examples of your work and success as a banker or in other banking roles.

Banking Center Manager, ABC Finance Inc., Boston, MA | January 2019 to present

- Train, supervise, and evaluate a 15-member team, ensuring adherence to the bank’s policies and procedures

- Streamlined daily reporting procedures, increasing efficiency by 15%

- Resolved various customer issues, decreasing complaints by 30% within the first year

Resume writer’s tip: Quantify your experience

Avoid bland job descriptions by using relevant performance data and metrics to show the results you’ve achieved as a banking professional. Hard numbers put your work in context and give recruiters a better sense of your scope and impact.

- “Analyzed and modeled over 30 investment opportunities, resulting in 10 successful deals”

- “Analyzed investment opportunities”

Resume writer’s tip: Tailor your resume for each application

Most finance organizations rely on some form of applicant tracking system (ATS) to identify qualified candidates for job openings. To get your resume through the initial screening and into the hiring manager’s hands, incorporate keywords from the job posting directly into your profile, professional experience, and skills section.

What if you don’t have experience?

Writing a resume can be hard if you don’t have real-world experience. But you still have valuable skills and knowledge from your education and training. Showcase any relevant coursework you’ve done or certifications you’ve earned. Also, consider including volunteer work or internships you’ve completed in your field, and emphasize your work ethic and willingness to learn. By highlighting these qualities, you can show how you’d be an asset to any team.

4. List any education and certifications relevant to banking

With the education and certifications sections, you can show you have a strong knowledge base in your field. Cite any credentials you’ve earned that speak to your abilities as a banker or banking professional. Following are templates to help you organize this information on your resume (note: years are optional).

[Degree Name], [School Name], [City, State Abbreviation] | [Graduation Year]

Master of Business Administration (MBA), Concentration in Finance, Harvard Business School, Boston, MA

Certifications

[Certification Name], [Awarding Organization] | [Completion Year]

- Certified Financial Services Auditor (CFSA), Institute of Internal Auditors

5. List key skills and proficiencies for banking