Economic Instability and Its Main Causes Essay

Economic instability is the frequent change in a country’s income, employment, or financial well-being that is unpredictable and unintentional. It is a stage that the country’s economy is going through an unhealthy expansion or a recession associated with an increase in the price level of goods and services. It captures a pattern of multiple changes that lead to economic instability created by various issues. It is created by factors like fluctuation in the stock market, black swan events, interest rate changes, and a fall in home prices.

A stock market is where the buying and selling of stocks take place and provides a source of savings for the members. Prices of stocks in the market can rise or fall, causing volatility. When prices decrease, the companies incur losses, making them lay off workers, meaning there will be less income to dispose of in the economy. The value of stocks dropping can affect consumers’ confidence and cause a loss of consumer wealth, making them sell their stocks or buy fewer shares leading to a recession.

Black swan events are unexpected actions that significantly destabilize the economy. They include pandemics like COVID-19 and natural calamities such as hurricanes. They cause short-term fiscal problems and long-term economic impacts. They can lead to increased expenditure and decreased tax revenues to middle-income countries when trying to curb the disease. These events can cause economic shocks due to scarce labor, leading to closed borders and lessening business activities. They also cause quarantines and travel restrictions, leading to a fall in economic growth.

Interest rates control inflation, such that when the rates drop, a lot of money is injected into the economy causing prices of goods and services to rise. To counter this, a country can increase the interest rate, which would attract recession. This is because borrowing becomes expensive with high-interest rates, leading to less consumption and investment. It makes people spend their own saved money, reducing consumer spending and decreasing growth in aggregate demand. It reduces savings, limiting the supply of money in circulation and increasing the currency’s value disadvantaging the citizens. Interest rates also have a delayed effect in that their impact can continue affecting consumers for longer periods.

Today’s real estate markets are essential in a country’s economy. When prices of homes decrease, this will cause a shocking wave to the economy. This is because, for householders’, the value of their houses has reduced to the point that they owe more on loans than their property. This can lead to financial losses for the banks, negative equity, and a rise in defaults. Customers will have lower confidence in spending, and banks will lose money due to failed mortgage payments leading to a fall in bank lending.

In conclusion, economic instability is the frequent change in the economy caused by factors like fluctuations in the stock market, black swan events, and interest rate changes. The increase and decrease in stock value make people buy more or stop purchasing more stock. Black swan events cause economic instability because of loss of labor due to death and illnesses. The increase and decrease of interest rates also cause less consumption and investment because people have to use their saved money. When real estate prices go down, houses’ value decrease and banks lose money due to failed mortgage payments.

- Economics in the Business World

- Great Depression: Annotated Bibliography

- Human Resources of a Hotel in the Swan Valley

- Swan Lake Choreographed by Matthew Bourne

- The Dance Video “Matthew Bourne’s Swan Lake 2”

- The Global Labor Market Regulation

- The Caribbean Culture: Energy Security and Poverty Issues

- Low-Carbon Multi-Energy Options in the UAE

- COVID-19 Impact on China's and Australia's Economy

- World Economic Forum: Revaluation of the Gross Domestic Product

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, August 30). Economic Instability and Its Main Causes. https://ivypanda.com/essays/economic-instability-and-its-main-causes/

"Economic Instability and Its Main Causes." IvyPanda , 30 Aug. 2023, ivypanda.com/essays/economic-instability-and-its-main-causes/.

IvyPanda . (2023) 'Economic Instability and Its Main Causes'. 30 August.

IvyPanda . 2023. "Economic Instability and Its Main Causes." August 30, 2023. https://ivypanda.com/essays/economic-instability-and-its-main-causes/.

1. IvyPanda . "Economic Instability and Its Main Causes." August 30, 2023. https://ivypanda.com/essays/economic-instability-and-its-main-causes/.

Bibliography

IvyPanda . "Economic Instability and Its Main Causes." August 30, 2023. https://ivypanda.com/essays/economic-instability-and-its-main-causes/.

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

IvyPanda uses cookies and similar technologies to enhance your experience, enabling functionalities such as:

- Basic site functions

- Ensuring secure, safe transactions

- Secure account login

- Remembering account, browser, and regional preferences

- Remembering privacy and security settings

- Analyzing site traffic and usage

- Personalized search, content, and recommendations

- Displaying relevant, targeted ads on and off IvyPanda

Please refer to IvyPanda's Cookies Policy and Privacy Policy for detailed information.

Certain technologies we use are essential for critical functions such as security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and ensuring the site operates correctly for browsing and transactions.

Cookies and similar technologies are used to enhance your experience by:

- Remembering general and regional preferences

- Personalizing content, search, recommendations, and offers

Some functions, such as personalized recommendations, account preferences, or localization, may not work correctly without these technologies. For more details, please refer to IvyPanda's Cookies Policy .

To enable personalized advertising (such as interest-based ads), we may share your data with our marketing and advertising partners using cookies and other technologies. These partners may have their own information collected about you. Turning off the personalized advertising setting won't stop you from seeing IvyPanda ads, but it may make the ads you see less relevant or more repetitive.

Personalized advertising may be considered a "sale" or "sharing" of the information under California and other state privacy laws, and you may have the right to opt out. Turning off personalized advertising allows you to exercise your right to opt out. Learn more in IvyPanda's Cookies Policy and Privacy Policy .

Causes of Economic Instability

Readers Question: Undertake an evaluation of the causes of economic instability and the role, if any, that the government can play in reducing economic instability by constraining their discretion in policy making.

Economic instability involves a shock to the usual workings of the economy. Instability tends to reduce confidence and lead to lower investment, lower spending, lower growth and higher unemployment.

Economic instability can be caused by

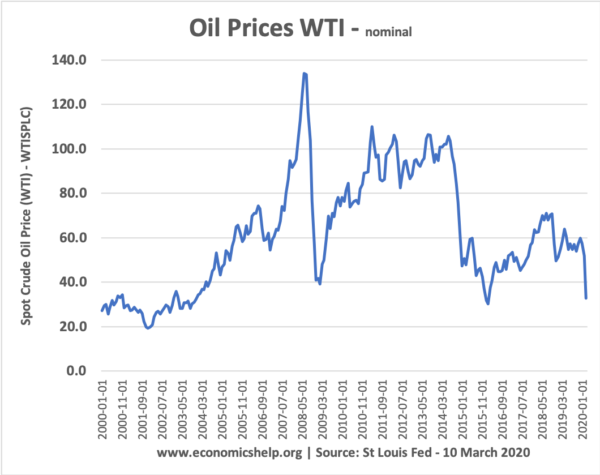

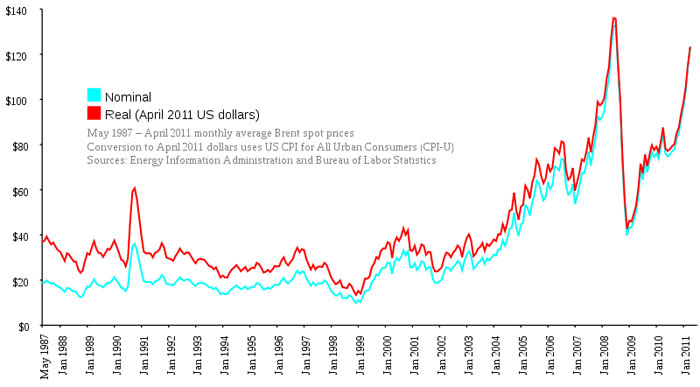

- Changing commodity prices (especially oil, e.g. 1974 oil price shock)

- Changing interest rates (rise in interest rates around 2005-07)

- Change in confidence levels (e.g. worries after 9/11)

- Stock market crashes (e.g. 1929 Stock market crash)

- Black swan events (e.g. major natural disaster, coronavirus outbreak 2020)

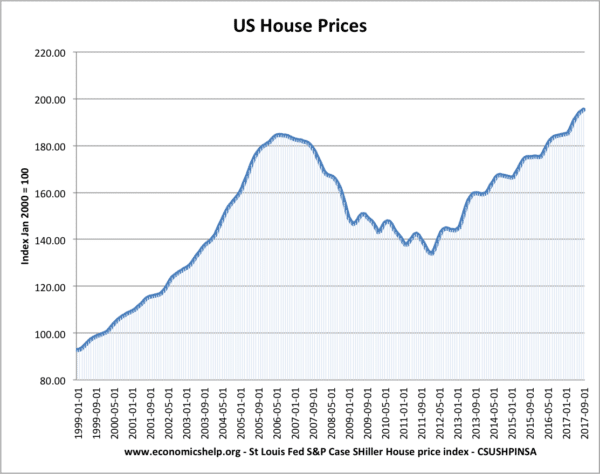

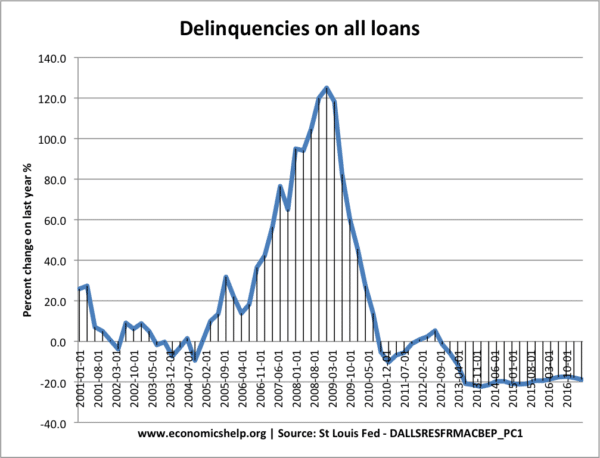

1. Changes in house prices/assets

A fall in house prices can caused a negative wealth effect – householders see a decline in their net worth, leading to lower confidence and less spending. It can also cause financial losses for banks. For example 2006-10, the US saw its housing bubble burst with a 50% fall in house prices. This caused a rise in delinquencies, negative equity (people lost wealth) and a rise in defaults. As a result, banks started to lose money on failed mortgage payments. In 2007, this caused a fall in bank lending, the credit crisis and the 2008 recession.

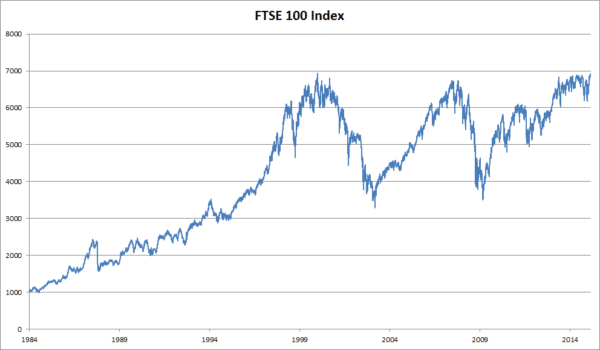

2. Fluctuations in Stock Markets

A big fall in stock markets can trigger falls in consumer confidence, a loss of consumer wealth and lead to a recession. The Wall Street crash of 1929 was a significant cause of the great depression. In 2008, the stock market crash again coincided with the 2008 recession.

However, it is not always the case falling share prices cause instability. The stock market crash of 1987 did not cause an economic downturn. In fact, in the UK it was followed by an unprecedented economic boom. This was partly due to the way the government responded by cutting income tax and cutting interest rates. The falls 2000-2004 also did not cause a recession.

However, if the stock market falls are due to a real shock to the economy (e.g. Coronavirus in March 2020) then the falls in share prices are likely to exacerbate the uncertainty.

3. Global Credit Markets

The subprime mortgage problems in the US caused many firms to go insolvent. This cause a big fall in confidence in lending money. This shortage of credit led to a shortage of credit. This caused the problems of northern rock and reduced consumer confidence. See: credit crisis

4. Changes in Interest Rates

Interest rates are used as a tool in controlling inflation. However, they can also have an impact on consumer spending. Sometimes interest rates may have little impact; however, if they coincide with other factors they can cause a much bigger than expected fall in consumer spending. For example, in the UK, many homeowners have a variable mortgage. Therefore a small change in interest rates can have a big effect on disposable income. If an increase in interest rates was combined with another factor such as the slowing down of house price growth it may cause a big fall in spending.

- Note, interest rates can have a delayed effect. E.g. the effect of interest rate increases last year may continue to affect consumer spending for up to 18 months

5. Global Factors

In an era of globalisation, there is an increasing interdependence of the world economies. For example, if China’s boom was to end, there would be a marked slowdown in global growth. It used to be the case the world was very dependent on the US economy. if the US economy suffered a recession, it would often drag the rest of the world into recession. This was because the US was the world’s biggest consumer of imports. However, it is argued that the world is less dependent on the US economy because of the development of new economies like China and India. Nevertheless, global factors are of great importance. When the coronavirus interrupted manufacturing in China in early 2020, this had a knock-on effect for nearly all multinational companies who relied on Chinese manufacturing of parts.

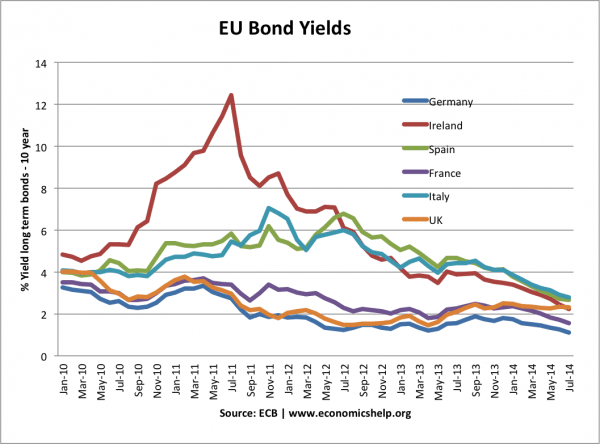

6. Government Debt Crisis

If markets fear government debt is unsustainable or likely to face liquidity shortages, bonds will be sold. This will tend to push up interest rates on bond yields. This increases government debt interest payments and puts pressure on the government to cut spending and reduce the budget deficit. This can cause a negative spiral of lower growth and lower tax receipts. ( sovereign debt crisis )

7. Black swan events

Black swan events are unexpected events, which can destabilise the economy. In theory, they have a very low probability, but throughout history, they occur at an unexpected moment. For example, the outbreak of an infectious virus can cause a fall in travel and economic activity. A major terrorist attack or natural disaster can also cause a fall in economic growth.

The 2020 coronavirus is a good example of how a black swan event can cause major instability. The virus led to a sharp fall in travel and quarantines imposed across the world. This disrupts usual economic activity. The virus also causes great uncertainty because the effects are unknown. It led to a major fall in shares, investment and the price of oil.

8. Erratic leadership

If political leaders are erratic, it can cause instability. For example, President Trump initiated a trade war with China, which caused a decline in global trade.

Supply-side Causes of Economic Instability

1. Price of Oil

An increase in the price of oil can cause economic instability, especially if it is a sudden increase like in the 1970s. higher oil prices increase the costs of firms and cause the AS curve to shift to the left. This causes both inflation and lower growth.

However, it is worth noting that although the oil price is now nearing nearly $100 a barrel, it is not having a huge effect. The impact on economies like the UK is less than it was in the 1970s, partly because the increase in price has been more gradual. Costs of transport are still not a major problem. It would require a much bigger increase to have a really damaging impact.

Note a very rapid fall in oil prices also may cause problems – because it indicates a lack of confidence in the economy.

- Causes of Recessions

- Policies for Dealing with Economic Shocks

- How does the stock market affect the economy?

7 thoughts on “Causes of Economic Instability”

I’ m economic student in MA and resaerch acout economic instability. Thank you for sending paper and comment to me.

wen de we say a country is at a middle in come , what is de effect and why?

I’m economist student also I was involved economic issues in the last two decades particularly in my country where life and people lack of economic policy and work without reason their business, only for profit oriented by import materials and buy in local market, and the civilsociety remain punish endure for this market. inflation is common in this era of globalization since it my country and people blindly trade everything they ought to have profitmaking

the second thing I guest for life is why, and how I can advocate economic issues that relate rest state where everything remian balance price, inflation, deflation, recession, greation of wealth, etc in economic term and also sustianable enviromental freind based policy with equal distribution of income

- Pingback: Global Economics Unit 4 | Economics Blog

What are the effects of economic instability

How to solve the instability in growth?

Comments are closed.

Home — Essay Samples — Economics — Economic Inequality — Poverty and Economic Inequality

Poverty and Economic Inequality

- Categories: Economic Inequality

About this sample

Words: 618 |

Published: Jan 31, 2024

Words: 618 | Page: 1 | 4 min read

Table of contents

Definition and causes of poverty, economic inequality and its effects, government policies and interventions, global perspectives on poverty and economic inequality, solutions to poverty and economic inequality.

- World Bank. (2021). Poverty Overview. https://www.worldbank.org/en/topic/poverty/overview

Cite this Essay

To export a reference to this article please select a referencing style below:

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Prof. Kifaru

Verified writer

- Expert in: Economics

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 631 words

3 pages / 1217 words

8 pages / 3678 words

2 pages / 864 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Economic Inequality

Journalism plays a crucial role in informing the public, shaping opinions, and holding those in power accountable. This essay will explore the definition and importance of journalism, its history and evolution, ethical [...]

The debate over raising the minimum wage has been a hot topic in recent years, with proponents arguing that it will help lift workers out of poverty and stimulate the economy, while opponents claim that it will lead to job [...]

In modern society, the distinction between the ownership class and working class has become increasingly apparent. The ownership class, consisting of individuals who own means of production, businesses, and capital, holds a [...]

Economic inequality is an existed phenomenon in economy, which belongs to the gap between the rich and the poor. Like dividing a cake, every piece of cake which is held by people is not on average, so the inequality is happened [...]

This film happens in 2008. During that time, the world had a big economy. In 2011, the Wall Street has a big revolution and demonstration. Breaking the serious gap between the rich and the poor in the US society. The film [...]

You and your friends are playing the game of who can build the most houses in a set amount of time. The rules are simple: Everyone starts out with the same amount of given money. With that given money you can buy supplies to [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Download Free PDF

An Economic Impact of Political Instability: An Evidence from Pakistan

Article history Received: April 04, 2021 Revised: April 22, 2021 Accepted: April 26, 2021 The economy of Pakistan has been badly damaged by the political instability in the country. Despite its enormous economic resources, Pakistan’s economy remained under dark shadows during most of its historical discourse. The economic indicators describe a significant relationship between politics and the economy of Pakistan. The following study, by reviewing previous studies, concludes that there is a negative relationship between political instability and economic growth in Pakistan from 2000 to 2019. Political instability flourished corruption and reduced the economic growth of the country. Moreover, a weak political system and government institutions could not resist the political tension in the country. The study finally concludes that political instability reduces economic growth in the country and economic growth reinforces political stability in the country.

Related papers

Procedia - Social and Behavioral Sciences, 2016

In case of Pakistan, only economic variables are observed as causes to high economic volatility while political variables are completely ignored. Although, it is apparent that the development pattern in Pakistan is highly volatile during the years of political instability that spans almost over the half history of the country. By taking the sample of 1971 to 2008 and using simple OLS technique, we observe how far political instability hampers the economic development of Pakistan. For the political instability measurement, ignoring all traditional measures of political instability, we construct political instability index by using seven different variables for Pakistan by employing Principal Component Technique; while for economic development measurement frequently economic development variables are used. Through analysis, the negative relationship is found between political instability and economic development in Pakistan.

The purpose of this paper is to empirically determine the effects of political instability in Pakistan within compared with India and China. We discussed GDP per capita and their impact on economic growth. By using the standard deviation and co- variance on a sample of 3 countries, and 5-year periods from 1988 to 2014, this study demonstrates that a significant negative relationship exists between political instability and economic growth we find that higher degrees of political instability are associated with lower growth rates of GDP Per capita. While democracy may have a small negative effect.

The objective of this paper was to investigate the relationship between economic growth and political instability. For this purpose, we selected three variables such as political instability, inflation rate and public debt to measure their impact on Gross Domestic Product (GDP). We used panel data and analyzed it through SPSS software to draw the results. We applied Multiple Regression, ANOVA and Correlation techniques for analysis of data. Our results show that there is a negative correlation between public debt and economic growth. Similarly, there is also a negative correlation between public debt and political instability. Our study suggests that Pakistan must reduce level of public debt and political instability and inflation in order to achieve high level of economic growth.

The political instability is condition for the nation building and nation building is process compulsory for the development of a nation. In most of developing countries the governments are not stable. A new government comes into the power overnight; either through coup data or army takes over. The new government introduces a new system of rules for the operation of business which cause frustration and anger among the people. Political instability now becomes a serious problem especially in developing countries. It is creating enormous difficulties and delaying the development of these countries. Political stability plays an important role in keeping society united and in maintaining legitimacy within the state. It is an essential for the economic development, social integration, and supremacy of law in a state. The stability of political system has direct effects on the procedures of nation and state building. These both require stable political systems for their growth and successful. The development of nation and state without firm and organized system of politics is not possible. So Political instability can be defined at least three ways, first approach is as, the propensity for regime or government change, second is to focus on the incidence of political disorder or violence in a society, such as killings, third approach focuses on economic growth affect by instability. PAKISTAN has spent 34 out of its 68 years, or half its life, in internal political instability as regime instability, political emergencies and constitutional deadlocks. Long-term instability in Pakistan has been significantly higher than in East Asia and post-Partition India. Lack of mature leadership, confrontation between the main organs of the state, poor relations between the center and the provinces, extensive corruption, distrust among the politicians, strong bureaucracy and crisis of governance are the immediate threats to democracy in Pakistan The political instability is directly affected economic growth. How does it affect economic growth and why this is important in developing countries like Pakistan is discussed in brief below? When there is lack of political instability in the county, it directly effects the economic growth. It closes off sources of internal and external investments. The eternal investors does not invest in the countries where there is civil war coups, army take over etc. is either small or zero. The lack of interest by the foreign investors for foreign direct investment, and giving Pakistan access to the productive markets are making economy low and more likely to rely on foreign aid. The improper use of aid on the huge disasters like earth quake in 2005 and on the wake of flood in 2010 has lost the trust of donors to support Pakistan sufficiently even in most difficult times. So that investment remains shy the Growth will remain the dream which leads the high unemployment and poverty. Political instability also limits internal investment. The wealthy classes in under developed countries have enough income to replacement. They can invest their saving in profitable projects. Generally they avoid investing

Journal of Research in Administrative Sciences

This study analyzed the impact of political instability on financial development of Pakistan. OLS regression is used for the estimation of data. Time series data is used for the study. 40 years are included in the time series from 1972 to 2011. The variable of interest is political instability controlling the effects of trade openness, legal protection and GDP/capita. The regression results showed that political instability has negative significant impact on financial development of Pakistan. Trade openness is positive but insignificant with financial development. Legal protection and GDP/capita showed positive and significant impact on the financial development of Pakistan.

The purpose of the study is to determine the impact of political instability on economic growth. For this purpose, we measured political instability by means of three proxies: terrorism, govt. type and election year whereas economic growth is determined with GDP annual growth rate. We used data from 1988 to 2016 and applied ARCH model as our dependent variable (economic growth) is subject to heteroscedasticy and ARCH effect. The results showed that political instability measured with terrorism and election year has negative effect on economic growth. However, govt. type is also found to be negative though insignificant. The study adds to the literature of Pakistan and is helpful for policymakers and investors

This research paper investigates the impact of politics on Pakistan's economy. Using a combination of quantitative and qualitative methods, the study explores how political instability, corruption, and government policies have affected the country's economic growth and development. The research finds that political instability and corruption have been significant barriers to economic progress in Pakistan, leading to reduced foreign investment, weak institutions, and a lack of confidence in the government. Additionally, government policies such as tax and trade policies have had both positive and negative impacts on the economy, depending on their implementation and effectiveness. The study concludes with recommendations for policymakers to improve political stability, reduce corruption, and implement effective policies to promote sustainable economic growth in Pakistan.

HAL (Le Centre pour la Communication Scientifique Directe), 2022

Advertising China - issue of JOMEC Journal, 2019

Međunarodna multidisciplinarna konferencija - Kulturne i kreativne industrije & baština III, 2024

Strategic Culture Foundation, 2020

Socialism and Democracy, 2022

A. Vrolijk & J. Hogendijk (eds.), O ye Gentlemen. Arabic Studies on Science and Literary Culture. The Corpus Bunianum. Leiden/Boston: Brill, 2007, pp. 183-199

International Journal of All Research Education and Scientific Methods (IJARESM), 2021

Diotima's:A Journal of New Readings (Issue on Popular Culture), 2019

Revista Brasilera de Derecho Procesal Penal (RBDPP), 2024

Journal of Artificial Societies and …, 2005

politikadergisi.com

Pharmaceutics, 2021

Osmanlı araştırmaları, 2018

Journal of Muscle Research and Cell Motility, 2003

A engenharia de produção na contemporaneidade 4, 2018

Age and Ageing, 2008

Gazeta Krakowska , 2023

Related topics

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

IMAGES

VIDEO

COMMENTS

Economic instability is the frequent change in the economy caused by factors like fluctuations in the stock market, black swan events, and interest rate changes.

Political instability is regarded by economists as a serious malaise harmful to economic performance. Political instability is likely to shorten policymakers’ horizons leading to sub …

Economic instability involves a shock to the usual workings of the economy. Instability tends to reduce confidence and lead to lower investment, lower spending, lower …

Jan A. Kregel is one of the most important post-Keynesian economists alive. These essays deal with topics ranging from financial crisis in developing countries ...

In addition, economic inequality continues to widen within and between countries, leading to social unrest and economic instability. This essay aims to explore the …

Economic marginalization and destitution could lead to social unrest, political instability, a breakdown of democracy, or war. In a sense, our collective efforts to fight the crisis …

We study the impact of political instability on economic growth, income distribution and poverty. The estimates are obtained by applying Heteroscedasticity consistent …

The objective of this paper was to investigate the relationship between economic growth and political instability. For this purpose, we selected three variables such as political instability, inflation rate and public debt to measure their …

Economic instability occurs when the factors that influence an economy are out of balance. Unstable economies are often characterized by inflation , which is a decrease in the value...